by Daily Bell Staff

The Daily Bell

Gold on Track for Eighth Losing Session U.S. GDP data revision seen bolstering case for interest-rate increase … Gold prices edged lower Friday, on pace for an eighth straight losing session, amid mounting evidence of improving economic growth in the U.S. that would strengthen the case for an interest-rate increase. – Wall Street Journal

Gold went up by 16 percent in the first quarter of 2016 and kept on moving even afterward for a total of 20%.

Investors are nervous about the economy and the first quarter’s results reflected those nerves with a rise in gold.

Since then it’s moved down some 6% as Janet Yellen has counterattacked with vaguely worded suggestions that the Fed might hike rates again.

China’s decision to buy its second gold storage vault in London last week was another step towards total dominance of the market.

China’s decision to buy its second gold storage vault in London last week was another step towards total dominance of the market. We will have the BREXIT report out next week. This is incredibly important for the fate of Europe hangs in the balance. Politicians are only interested in saving their own jobs. They do not care about the people and the markets reflect this arrogance.

We will have the BREXIT report out next week. This is incredibly important for the fate of Europe hangs in the balance. Politicians are only interested in saving their own jobs. They do not care about the people and the markets reflect this arrogance. Debt will get the US into a monumental pickle, or at least Lacy Hunt thinks so.

Debt will get the US into a monumental pickle, or at least Lacy Hunt thinks so. When Erika Cajic woke before dawn one morning in early May and read that wildfires were breaking out in an oil-producing region of Alberta, she sat down on the family room couch with a cup of hot chocolate and her laptop and bought shares of an investment linked to crude.

When Erika Cajic woke before dawn one morning in early May and read that wildfires were breaking out in an oil-producing region of Alberta, she sat down on the family room couch with a cup of hot chocolate and her laptop and bought shares of an investment linked to crude. Federal Reserve Chairwoman Janet Yellen on Friday said an interest-rate rise may coming in a matter of “months,” as she expected the economy, and importantly, the jobs market, to continue to get better.

Federal Reserve Chairwoman Janet Yellen on Friday said an interest-rate rise may coming in a matter of “months,” as she expected the economy, and importantly, the jobs market, to continue to get better.

In a Santelli Exchange interview exclusive to CNBC Pro subscribers, economist Douglas Holtz-Eakin discusses the potential danger posed to the U.S. housing market from the government’s handling of Fannie Mae and Freddie Mac after the financial crisis.

In a Santelli Exchange interview exclusive to CNBC Pro subscribers, economist Douglas Holtz-Eakin discusses the potential danger posed to the U.S. housing market from the government’s handling of Fannie Mae and Freddie Mac after the financial crisis. From time to time over the last thirty years, after I have talked or written about some new restriction on human liberty in the economic field, some new attack on private enterprise, I have been asked in person or received a letter asking, “What can I do” — to fight the inflationist or socialist trend? Other writers or lecturers, I find, are often asked the same question.

From time to time over the last thirty years, after I have talked or written about some new restriction on human liberty in the economic field, some new attack on private enterprise, I have been asked in person or received a letter asking, “What can I do” — to fight the inflationist or socialist trend? Other writers or lecturers, I find, are often asked the same question. Editor’s note: Today, in place of our daily market commentary, we’re sharing a recent essay that’s been extremely popular with our Casey Report and International Man readers.

Editor’s note: Today, in place of our daily market commentary, we’re sharing a recent essay that’s been extremely popular with our Casey Report and International Man readers. Except for its western hemisphere lap-dogs and chattel, the U.S. “defense” strategy has been the implementation of a highly “offensive” (in both senses of the word here) policy of military and economic antagonism. What unfolding of events in Syria and Venezuela are just two examples.

Except for its western hemisphere lap-dogs and chattel, the U.S. “defense” strategy has been the implementation of a highly “offensive” (in both senses of the word here) policy of military and economic antagonism. What unfolding of events in Syria and Venezuela are just two examples. The smaller gold-mining and exploration stocks have enjoyed an amazing year, soaring with gold’s new bull market. Many have more than doubled since mid-January, and some have more than tripled at best in that short span. Are such spectacular gains fundamentally-justified, or merely the result of ephemeral sentiment that could vanish anytime? The gold juniors’ recently-reported Q1’16 results offer great insights.

The smaller gold-mining and exploration stocks have enjoyed an amazing year, soaring with gold’s new bull market. Many have more than doubled since mid-January, and some have more than tripled at best in that short span. Are such spectacular gains fundamentally-justified, or merely the result of ephemeral sentiment that could vanish anytime? The gold juniors’ recently-reported Q1’16 results offer great insights.

There will be a long holiday weekend in the US for Memorial Day, a day in which we remember all those who have served, and especially those who have given that ‘last full measure of devotion.’

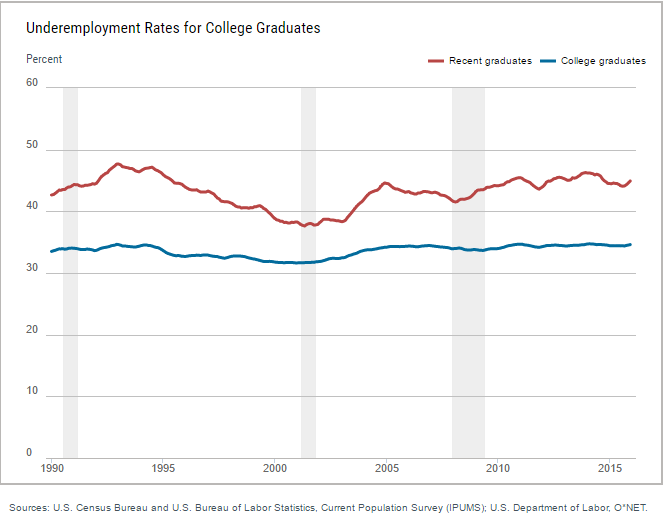

There will be a long holiday weekend in the US for Memorial Day, a day in which we remember all those who have served, and especially those who have given that ‘last full measure of devotion.’ We don’t send our young into the wilderness for a vision quest as a rite of passage. There are few things in modern society that signify a transition into adulthood. Going to college is one of them. And in debt addicted America, it is no surprise that for many, college debt is the first debt they will take on. Getting a college education is supposed to give someone a well rounded view of the world and a potential skill set. Some argue that college is not about vocational training. That to some degree is true but when students are going into $50,000 or $100,000 of student debt, then what is this modern day life quest really teaching and why is the price tag so incredibly high? As college graduation season comes into full bloom, many are left with the prospect of having no job lined up. It is also startling to see how many recent college graduates are working in jobs that really don’t require a college degree (so clearly the vocational piece doesn’t matter here).

We don’t send our young into the wilderness for a vision quest as a rite of passage. There are few things in modern society that signify a transition into adulthood. Going to college is one of them. And in debt addicted America, it is no surprise that for many, college debt is the first debt they will take on. Getting a college education is supposed to give someone a well rounded view of the world and a potential skill set. Some argue that college is not about vocational training. That to some degree is true but when students are going into $50,000 or $100,000 of student debt, then what is this modern day life quest really teaching and why is the price tag so incredibly high? As college graduation season comes into full bloom, many are left with the prospect of having no job lined up. It is also startling to see how many recent college graduates are working in jobs that really don’t require a college degree (so clearly the vocational piece doesn’t matter here).

It’s no secret. Our government has a debt problem … a $19.2 trillion debt problem.

It’s no secret. Our government has a debt problem … a $19.2 trillion debt problem. He’s won prestigious global awards for his contributions to humanity.

He’s won prestigious global awards for his contributions to humanity.