by Ben Marlow

Telegraph.co.uk

What makes a city great? With the UK now facing an uncertain future outside the European Union, it is a question that will become increasingly pertinent as the government attempts to negotiate a new trade deal that enables it to remain in the single market and continue to be one of the world’s economic powerhouses.

What makes a city great? With the UK now facing an uncertain future outside the European Union, it is a question that will become increasingly pertinent as the government attempts to negotiate a new trade deal that enables it to remain in the single market and continue to be one of the world’s economic powerhouses.

Amid such huge uncertainty, companies that have large UK operations, some built over many decades, are now being forced to consider moving some of their workers to other parts of the bloc.

The large majority of those will be based in London, which has long been the number one commercial, financial and business centre of Europe, dwarfing its rivals when it comes to luring the world’s top companies; 40pc of the biggest companies from across the globe have chosen the capital for their European bases, and 60pc of the big companies from outside Europe have chosen to locate their continental headquarters in the city.

In the late 12th century while the rest of Europe was choking on feudalism, Venice was rapidly becoming the most advanced power on the continent.

In the late 12th century while the rest of Europe was choking on feudalism, Venice was rapidly becoming the most advanced power on the continent. On Thursday, our pal Jim Willie stopped by for another holiday weekend podcast. Making it even more special was conducting this program in our A2A format where our Vault subscribers got to ask the majority of the questions. The result is 90 minutes of compelling audio that you’re definitely going to want to hear.

On Thursday, our pal Jim Willie stopped by for another holiday weekend podcast. Making it even more special was conducting this program in our A2A format where our Vault subscribers got to ask the majority of the questions. The result is 90 minutes of compelling audio that you’re definitely going to want to hear. If you ever wanted to get a look inside the mind of Kyle Bass, founder and CIO of Hayman Capital Management, here is your chance. In a wide-ranging discussion with Grant Williams, author of Things that Make You Go Hmm and co-founder of Real Vision TV, he shared his thoughts on position-sizing, China, the appeal of holding gold, central banking, interest rates – and much, much more.

If you ever wanted to get a look inside the mind of Kyle Bass, founder and CIO of Hayman Capital Management, here is your chance. In a wide-ranging discussion with Grant Williams, author of Things that Make You Go Hmm and co-founder of Real Vision TV, he shared his thoughts on position-sizing, China, the appeal of holding gold, central banking, interest rates – and much, much more.

Bill Clinton might have been diddling something in Arizona the other day but I can assure you it was not a golf ball.

Bill Clinton might have been diddling something in Arizona the other day but I can assure you it was not a golf ball. “There’s just doesn’t seem to be many blacksmith jobs these days.”

“There’s just doesn’t seem to be many blacksmith jobs these days.” Hillary Clinton gave a “voluntary interview” to the FBI on Saturday regarding her email arrangements while she was secretary of state, her campaign said. “Secretary Clinton gave a voluntary interview this morning about her email arrangements while she was Secretary,” spokesman Nick Merrill said in a release. “She is pleased to have had the opportunity to assist the Department of Justice in bringing this review to a conclusion. Out of respect for the investigative process, she will not comment further on her interview.” According to the AP and other news outlets, the interview lasted about 3 1/2 hours and was held at FBI headquarters.

Hillary Clinton gave a “voluntary interview” to the FBI on Saturday regarding her email arrangements while she was secretary of state, her campaign said. “Secretary Clinton gave a voluntary interview this morning about her email arrangements while she was Secretary,” spokesman Nick Merrill said in a release. “She is pleased to have had the opportunity to assist the Department of Justice in bringing this review to a conclusion. Out of respect for the investigative process, she will not comment further on her interview.” According to the AP and other news outlets, the interview lasted about 3 1/2 hours and was held at FBI headquarters. Happy Independence Day weekend from everyone at the Mises Institute. It’s fitting that in the week leading up to our American celebration of secession that we have been able to applaud Britain for their own separation from a legislative body that Angel Merkel was forced to admit is about political control, and not free trade. The more the bureaucrats in Brussels try to make the UK pay for Brexit, the more they justify British independence.

Happy Independence Day weekend from everyone at the Mises Institute. It’s fitting that in the week leading up to our American celebration of secession that we have been able to applaud Britain for their own separation from a legislative body that Angel Merkel was forced to admit is about political control, and not free trade. The more the bureaucrats in Brussels try to make the UK pay for Brexit, the more they justify British independence. From the Archve:

From the Archve:

Sliding Into Absurdity

Sliding Into Absurdity The US stock markets have rallied back sharply after one of their biggest falls in history last week in what we expect will be continued volatility for the foreseeable future. And, near the close on Friday they have pulled back heavily.

The US stock markets have rallied back sharply after one of their biggest falls in history last week in what we expect will be continued volatility for the foreseeable future. And, near the close on Friday they have pulled back heavily. After another wild week of trading in global markets, a legend in the business said gold and silver will soar for at least 2 more years but “scumbag Greenspan” should shut his mouth.

After another wild week of trading in global markets, a legend in the business said gold and silver will soar for at least 2 more years but “scumbag Greenspan” should shut his mouth. Rising global policy uncertainty should lead to lower equity multiples.

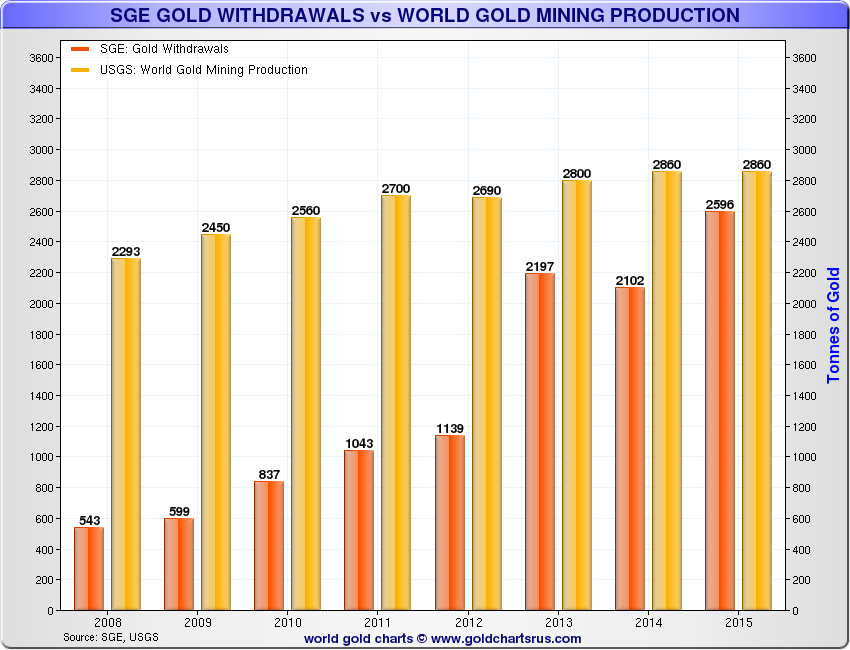

Rising global policy uncertainty should lead to lower equity multiples. In the World Gold Council’s Gold Investor magazine, Jiao Jinpu, Chairman of the Shanghai Gold Exchange, reports that “In its first month, the Shanghai Gold Benchmark Price’s trading volume was 105.91 metric tons of gold kilo bars, corresponding to a turnover of [renminbi] 27.94 billion and an average daily trading volume of 4.81 metric tons. 102.10 metric tons of gold were physically settled, addressing the market’s need for physical gold.”

In the World Gold Council’s Gold Investor magazine, Jiao Jinpu, Chairman of the Shanghai Gold Exchange, reports that “In its first month, the Shanghai Gold Benchmark Price’s trading volume was 105.91 metric tons of gold kilo bars, corresponding to a turnover of [renminbi] 27.94 billion and an average daily trading volume of 4.81 metric tons. 102.10 metric tons of gold were physically settled, addressing the market’s need for physical gold.” One week on from the United Kingdom shocking the world by voting to leave the European Union, one would be not be lacking in predictions of doom and gloom across the political and economic board. As one who voted to leave the nascent European Superstate, the oft (mis)quoted words of Benjamin Franklin came to mind when he suggested that those who trade liberty for security deserve neither.

One week on from the United Kingdom shocking the world by voting to leave the European Union, one would be not be lacking in predictions of doom and gloom across the political and economic board. As one who voted to leave the nascent European Superstate, the oft (mis)quoted words of Benjamin Franklin came to mind when he suggested that those who trade liberty for security deserve neither.