from The Creating Wealth Show

When the United States stopped backing dollars with gold in 1968, the nature of money changed, becoming the fiat currency system that has now put the world into an unprecedented recession. Jason Hartman is joined by returning guest, Richard Duncan, to talk about how we are in danger of a global Great Depression and how we can stop it. Richard’s previous book talked about the inevitable collapse of the dollar, and his new book discusses “a new theoretical construct, The Quantity Theory of Credit, that is the key to understanding not only the developments that led to the crisis, but also to understanding how events will play out in the years ahead.” Richard explains how the expansion of credit eventually implodes and the dangers of the contraction of credit. Richard Duncan is the author of three books on the global economic crisis. The Dollar Crisis: Causes, Consequences, Cures (John Wiley & Sons, 2003, updated 2005), predicted the current global economic disaster with extraordinary accuracy. It was an international bestseller. His second book was The Corruption of Capitalism: A strategy to rebalance the global economy and restore sustainable growth. It was published by CLSA Books in December 2009. His latest book is The New Depression: The Breakdown of the Paper Money Economy (John Wiley & Sons, 2012). Since beginning his career as an equities analyst in Hong Kong in 1986, Richard has served as global head of investment strategy at ABN AMRO Asset Management in London, worked as a financial sector specialist for the World Bank in Washington D.C., and headed equity research departments for James Capel Securities and Salomon Brothers in Bangkok. He also worked as a consultant for the IMF in Thailand during the Asia Crisis. He is now chief economist at Blackhorse Asset Management in Singapore.

When the United States stopped backing dollars with gold in 1968, the nature of money changed, becoming the fiat currency system that has now put the world into an unprecedented recession. Jason Hartman is joined by returning guest, Richard Duncan, to talk about how we are in danger of a global Great Depression and how we can stop it. Richard’s previous book talked about the inevitable collapse of the dollar, and his new book discusses “a new theoretical construct, The Quantity Theory of Credit, that is the key to understanding not only the developments that led to the crisis, but also to understanding how events will play out in the years ahead.” Richard explains how the expansion of credit eventually implodes and the dangers of the contraction of credit. Richard Duncan is the author of three books on the global economic crisis. The Dollar Crisis: Causes, Consequences, Cures (John Wiley & Sons, 2003, updated 2005), predicted the current global economic disaster with extraordinary accuracy. It was an international bestseller. His second book was The Corruption of Capitalism: A strategy to rebalance the global economy and restore sustainable growth. It was published by CLSA Books in December 2009. His latest book is The New Depression: The Breakdown of the Paper Money Economy (John Wiley & Sons, 2012). Since beginning his career as an equities analyst in Hong Kong in 1986, Richard has served as global head of investment strategy at ABN AMRO Asset Management in London, worked as a financial sector specialist for the World Bank in Washington D.C., and headed equity research departments for James Capel Securities and Salomon Brothers in Bangkok. He also worked as a consultant for the IMF in Thailand during the Asia Crisis. He is now chief economist at Blackhorse Asset Management in Singapore.

Just go to JasonHartman.com and get started now!

Click Here to Listen to the Audio

Sign up (on the right side) for the instant free Financial Survival Toolkit and free weekly newsletter.

The banksters, by manipulating the price of gold and artificially creating a bear market, have created what will likely turn out to be one of the greatest opportunities ever seen. I’ve maintained all along this was their goal. To create the most destructive bear market in history, which would then generate the largest bull market the world has ever seen.

The banksters, by manipulating the price of gold and artificially creating a bear market, have created what will likely turn out to be one of the greatest opportunities ever seen. I’ve maintained all along this was their goal. To create the most destructive bear market in history, which would then generate the largest bull market the world has ever seen.

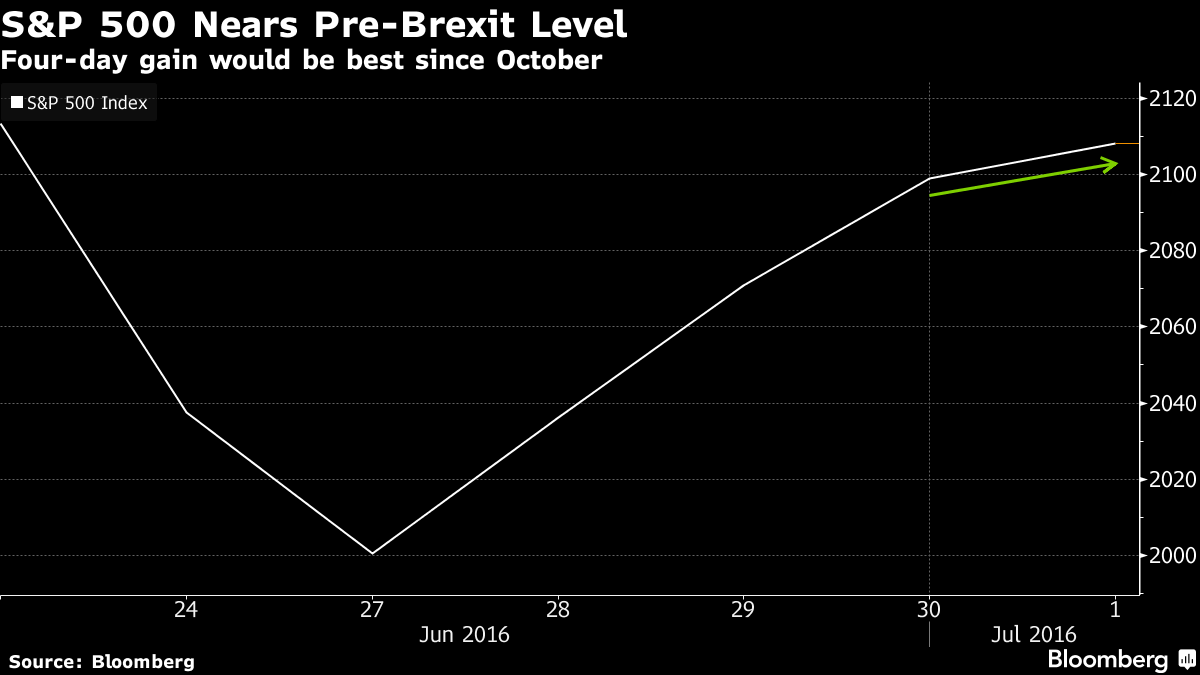

U.S. stocks capped the biggest four-day rally in nine months, as bonds rose worldwide on speculation central banks will act to limit the fallout from the U.K.’s vote to leave the European Union.

U.S. stocks capped the biggest four-day rally in nine months, as bonds rose worldwide on speculation central banks will act to limit the fallout from the U.K.’s vote to leave the European Union.

Benefiting hedge funds and banks that had front-run the fund.

Benefiting hedge funds and banks that had front-run the fund. The establishment REMAIN camp peddled the same story for the UK housing market all year, one of a collapse, crash or worse! As operation fear each month ramped up the threats of that which awaited a post Brexit Britain. The house prices crash fear mongering even emanated direct from George Osborne himself who warned: “If we leave the European Union there will be an immediate economic shock that will hit financial markets… That affects the value of people’s homes and the Treasury analysis shows that there would be a hit to the value of people’s homes by at least 10 per cent and up to 18 per cent.”

The establishment REMAIN camp peddled the same story for the UK housing market all year, one of a collapse, crash or worse! As operation fear each month ramped up the threats of that which awaited a post Brexit Britain. The house prices crash fear mongering even emanated direct from George Osborne himself who warned: “If we leave the European Union there will be an immediate economic shock that will hit financial markets… That affects the value of people’s homes and the Treasury analysis shows that there would be a hit to the value of people’s homes by at least 10 per cent and up to 18 per cent.” Editor’s note: Yesterday, Casey Research founder Doug Casey described the powerful force that’s ruining the country: the “Deep State.”

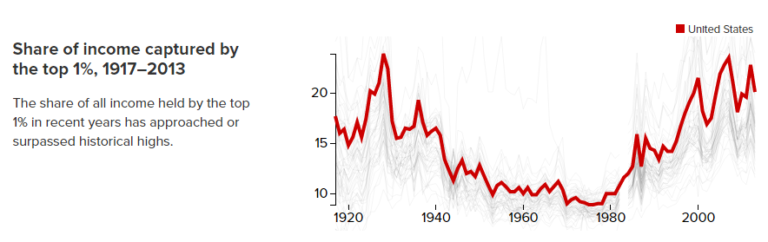

Editor’s note: Yesterday, Casey Research founder Doug Casey described the powerful force that’s ruining the country: the “Deep State.” Part of the challenge with distorted income distributions is that it hollows out the middle class. The middle class in the United States is now a minority. We have more people making higher incomes and more people making way less and this group is growing much faster. Our economy has taken a bimodal distribution with extremes on both sides. We have a record number of people on food stamps but also a record number of higher income households. The only problem is that the low range of the ladder is growing much faster than that at the top. For every person that makes it into the upper income brackets you have three that fall out of the middle class and into the low income wage trap. Part of the political anger we are seeing in the US and other parts of Europe is that the elites are simply ignoring the needs of the masses. In many cases this purposeful ignorance is because their wealth is built on keeping many stuck on a perpetual hamster wheel where productivity gains only go to a small section of society.

Part of the challenge with distorted income distributions is that it hollows out the middle class. The middle class in the United States is now a minority. We have more people making higher incomes and more people making way less and this group is growing much faster. Our economy has taken a bimodal distribution with extremes on both sides. We have a record number of people on food stamps but also a record number of higher income households. The only problem is that the low range of the ladder is growing much faster than that at the top. For every person that makes it into the upper income brackets you have three that fall out of the middle class and into the low income wage trap. Part of the political anger we are seeing in the US and other parts of Europe is that the elites are simply ignoring the needs of the masses. In many cases this purposeful ignorance is because their wealth is built on keeping many stuck on a perpetual hamster wheel where productivity gains only go to a small section of society.

“These people think they are God. They think they can do anything they want.”

“These people think they are God. They think they can do anything they want.”

On the heel of an absolutely wild trading week, China is about to shock the world and the global markets.

On the heel of an absolutely wild trading week, China is about to shock the world and the global markets. I’m sure by now you’ve heard all about the Brexit drama.

I’m sure by now you’ve heard all about the Brexit drama.

This episode starts out with an introduction on buy downs and then finishes up with a live recording of Jason’s session on SWOT aka Strengths, Weaknesses, Opportunities, and Threats, as they apply to the most historically proven asset class in the world. Jason explains why the imperfection and fragmentation of the U.S. real estate market make it a beneficial investment vehicle and why it outperforms Wall Street and stocks every single time.

This episode starts out with an introduction on buy downs and then finishes up with a live recording of Jason’s session on SWOT aka Strengths, Weaknesses, Opportunities, and Threats, as they apply to the most historically proven asset class in the world. Jason explains why the imperfection and fragmentation of the U.S. real estate market make it a beneficial investment vehicle and why it outperforms Wall Street and stocks every single time. On Monday, June 20, 2016, I stood in the London Eye Ferris wheel. I was just across the Thames from the UK Houses of Parliament, standing with a film crew to record an urgent warning. I said that the Brexit vote, coming just three days later on June 23, could produce a financial earthquake.

On Monday, June 20, 2016, I stood in the London Eye Ferris wheel. I was just across the Thames from the UK Houses of Parliament, standing with a film crew to record an urgent warning. I said that the Brexit vote, coming just three days later on June 23, could produce a financial earthquake. What makes a city great? With the UK now facing an uncertain future outside the European Union, it is a question that will become increasingly pertinent as the government attempts to negotiate a new trade deal that enables it to remain in the single market and continue to be one of the world’s economic powerhouses.

What makes a city great? With the UK now facing an uncertain future outside the European Union, it is a question that will become increasingly pertinent as the government attempts to negotiate a new trade deal that enables it to remain in the single market and continue to be one of the world’s economic powerhouses. In the late 12th century while the rest of Europe was choking on feudalism, Venice was rapidly becoming the most advanced power on the continent.

In the late 12th century while the rest of Europe was choking on feudalism, Venice was rapidly becoming the most advanced power on the continent. On Thursday, our pal Jim Willie stopped by for another holiday weekend podcast. Making it even more special was conducting this program in our A2A format where our Vault subscribers got to ask the majority of the questions. The result is 90 minutes of compelling audio that you’re definitely going to want to hear.

On Thursday, our pal Jim Willie stopped by for another holiday weekend podcast. Making it even more special was conducting this program in our A2A format where our Vault subscribers got to ask the majority of the questions. The result is 90 minutes of compelling audio that you’re definitely going to want to hear.