by Greg Robb

Market Watch

The Federal Reserve is back in the game. That’s the simple message from the surprisingly strong June jobs report, economists said.

The Federal Reserve is back in the game. That’s the simple message from the surprisingly strong June jobs report, economists said.

“The report does increase modestly Fed tightening odds in coming months, but not to an extreme extent,” said Dean Maki, chief economist for Point72 Asset Management.

“This report should ease some of the fears weighing on some FOMC members that May could reflect the start of a sustained slowdown,” Maki said.

The economy added 287,000 new jobs in June, much stronger than expected and up from a paltry 11,000 jobs added in May.

Turning Inward

Turning Inward

Peter Schiff, Chairman of SchiffGold.com and the host discuss the current silver market eruption, as predicted two weeks earlier on the show. At the end of 2015, for the first time hedge funds were net short the silver market, setting the stage for the perfect price squeeze. Precious metals shares are only beginning what could be a remarkable multi-year advance, as investors wake up to the opportunity; shares are just now starting to reflect their intrinsic value and as the underlying PMs bullion prices advance, the relative affect on the shares could prove explosive. Peter Schiff is “pounding the table” on merits of silver. His forecast includes a meteoric climb to $50 silver, where investment demand / tight supply conditions force the market to eclipse the record zenith on the heels of peak-silver (declining mine output), as well as rising industrial demand, sending AG north of $100-$200+. The legendary investor suggests that investors not dwell on $20 silver, but to be wise enough to procure some for the long-term.

Peter Schiff, Chairman of SchiffGold.com and the host discuss the current silver market eruption, as predicted two weeks earlier on the show. At the end of 2015, for the first time hedge funds were net short the silver market, setting the stage for the perfect price squeeze. Precious metals shares are only beginning what could be a remarkable multi-year advance, as investors wake up to the opportunity; shares are just now starting to reflect their intrinsic value and as the underlying PMs bullion prices advance, the relative affect on the shares could prove explosive. Peter Schiff is “pounding the table” on merits of silver. His forecast includes a meteoric climb to $50 silver, where investment demand / tight supply conditions force the market to eclipse the record zenith on the heels of peak-silver (declining mine output), as well as rising industrial demand, sending AG north of $100-$200+. The legendary investor suggests that investors not dwell on $20 silver, but to be wise enough to procure some for the long-term. The global political/economic state feels precarious for a good reason: it is precarious.

The global political/economic state feels precarious for a good reason: it is precarious. At least 11 police officers were shot — four fatally — by snipers in downtown Dallas, Texas, on Thursday night following a peaceful march protesting recent police shootings of black men.

At least 11 police officers were shot — four fatally — by snipers in downtown Dallas, Texas, on Thursday night following a peaceful march protesting recent police shootings of black men. Consumer confidence plunges the most since 1994.

Consumer confidence plunges the most since 1994. Shocking new video has emerged showing California police shooting dead a 19-year-old man as he lay on the ground.

Shocking new video has emerged showing California police shooting dead a 19-year-old man as he lay on the ground. The E-Mini S&P tout sent out Wednesday night predicted Wall Street’s week would end with two days of asphyxiating tedium. After Thursday’s trance-inducing dirge, we’re down to one more likely day of tedium. Tempting as it is to buy the VIX, which in the last seven days has fallen by half to a recent low of 14.33, it’s still a sucker’s bet. If you had held call options on the Volatility Index for the last hundred days, you’d have experienced exhilaration, pleasure and profit on perhaps four of them. The dog days of summer are here, Trump vs. Clinton is what passes for news, and we had better get used to it.

The E-Mini S&P tout sent out Wednesday night predicted Wall Street’s week would end with two days of asphyxiating tedium. After Thursday’s trance-inducing dirge, we’re down to one more likely day of tedium. Tempting as it is to buy the VIX, which in the last seven days has fallen by half to a recent low of 14.33, it’s still a sucker’s bet. If you had held call options on the Volatility Index for the last hundred days, you’d have experienced exhilaration, pleasure and profit on perhaps four of them. The dog days of summer are here, Trump vs. Clinton is what passes for news, and we had better get used to it.

Sir John Chilcot, a member of the British establishment and also a member of the Butler Inquiry, the responsibility of which was to determine if the so-called “intelligence” used as the excuse for the US/UK invasion of Saddam Hussein’s Iraq was “fixed” to justify the invasion, has, after seven years of delay, finally issued its report.

Sir John Chilcot, a member of the British establishment and also a member of the Butler Inquiry, the responsibility of which was to determine if the so-called “intelligence” used as the excuse for the US/UK invasion of Saddam Hussein’s Iraq was “fixed” to justify the invasion, has, after seven years of delay, finally issued its report. For months before the Brexit referendum on June 23rd, entire industries were hard at work attempting to predict how the UK electorate would vote.

For months before the Brexit referendum on June 23rd, entire industries were hard at work attempting to predict how the UK electorate would vote. The last year has been a scary time to be an investor. In 2015, the slowdown in China’s economy caused undue apprehension to investors and contributed to a nausea-inducing rollercoaster ride which began last July and has continued until now.

The last year has been a scary time to be an investor. In 2015, the slowdown in China’s economy caused undue apprehension to investors and contributed to a nausea-inducing rollercoaster ride which began last July and has continued until now. Gold’s top forecaster, who in February abandoned her bearish outlook to correctly call bullion’s surge, sees more gains in store before prices taper off by year-end.

Gold’s top forecaster, who in February abandoned her bearish outlook to correctly call bullion’s surge, sees more gains in store before prices taper off by year-end. […] Let’s see if the Non-Farm Payrolls Report tomorrow gives the Fed enough of a recovery fig-leaf to start talking about rate increases, and sufficient nudge for the market takers to shove the price of the precious metals around to catch any of the over-leveraged specs leaning in the wrong direction.

[…] Let’s see if the Non-Farm Payrolls Report tomorrow gives the Fed enough of a recovery fig-leaf to start talking about rate increases, and sufficient nudge for the market takers to shove the price of the precious metals around to catch any of the over-leveraged specs leaning in the wrong direction. We’ve warned that bankrupt governments will be eyeing the multi-trillions of dollars in “un-taxed” retirement funds when they get desperate enough.

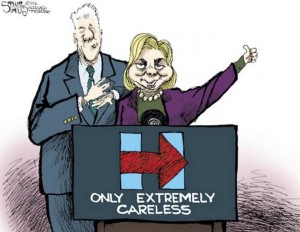

We’ve warned that bankrupt governments will be eyeing the multi-trillions of dollars in “un-taxed” retirement funds when they get desperate enough. Does Hillary Clinton possess the integrity and honesty to be president of the United States? Or are those quaint and irrelevant considerations in electing a head of state in 21st-century America?

Does Hillary Clinton possess the integrity and honesty to be president of the United States? Or are those quaint and irrelevant considerations in electing a head of state in 21st-century America?