And it’s getting worse by the day

by Justin Raimondo

AntiWar

We are sitting atop a volcano that could erupt at any moment. Indeed, the only question is not whether it will explode, but when – and where. For this impending seismic event has multiple pathways to the surface, spread across no less than three continents.

We are sitting atop a volcano that could erupt at any moment. Indeed, the only question is not whether it will explode, but when – and where. For this impending seismic event has multiple pathways to the surface, spread across no less than three continents.

Europe – The long peace that has prevailed in Europe is coming to an end. Ukraine is a battlefield between East and West, where a proxy war between a US-backed regime and an insurgent movement that seeks separation from Kiev is tearing the country apart – and threatens to involve both the Western powers and the Kremlin.

It’s been decades since we’ve seen a buying opportunity this good in gold stocks…

It’s been decades since we’ve seen a buying opportunity this good in gold stocks… Basic economics has proven that when the supply of something dwindles, absent an offsetting drop in demand the price should rise. When translating these fundamental terms to the labor market especially of the past few years, the supply means “slack” or the available pool of workers not yet working; demand has been, we are told repeatedly, very robust; therefore the price of labor, the hourly wage rate, should be rising and rapidly so if only to match the rhetoric (“best jobs market in decades”).

Basic economics has proven that when the supply of something dwindles, absent an offsetting drop in demand the price should rise. When translating these fundamental terms to the labor market especially of the past few years, the supply means “slack” or the available pool of workers not yet working; demand has been, we are told repeatedly, very robust; therefore the price of labor, the hourly wage rate, should be rising and rapidly so if only to match the rhetoric (“best jobs market in decades”). As boring as the week has been, we need to guard against being lulled into complacency.

As boring as the week has been, we need to guard against being lulled into complacency.

[…] Gold and silver were rallying early, breaching 1350 and moving higher, on a weaker dollar and a ‘risk off’ reaction to the latest round of buying of financial paper.

[…] Gold and silver were rallying early, breaching 1350 and moving higher, on a weaker dollar and a ‘risk off’ reaction to the latest round of buying of financial paper. This year the World Social Forum is being held in Montreal, regrouping committed social activists, anti-war collectives and prominent intellectuals.

This year the World Social Forum is being held in Montreal, regrouping committed social activists, anti-war collectives and prominent intellectuals.

Swiss investor Marc Faber is known for his pessimistic view of stock markets, and says the S&P 500 index could soon lose more than half of its value.

Swiss investor Marc Faber is known for his pessimistic view of stock markets, and says the S&P 500 index could soon lose more than half of its value. Gold is set to benefit from a “perfect storm” of dwindling investment alternatives and greater investor risk, according to the August report of the World Gold Council (WGC).

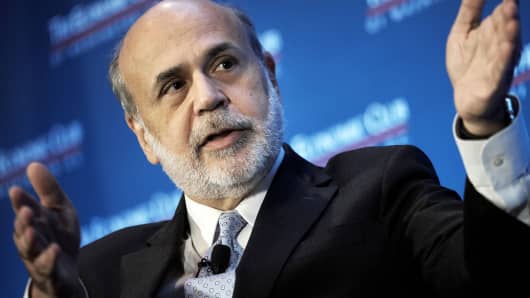

Gold is set to benefit from a “perfect storm” of dwindling investment alternatives and greater investor risk, according to the August report of the World Gold Council (WGC). Ben Bernanke thinks his former colleagues at the Federal Reserve will be reluctant to raise interest rates anytime soon.

Ben Bernanke thinks his former colleagues at the Federal Reserve will be reluctant to raise interest rates anytime soon. The second-quarter surge in home prices made San Jose, Calif., the first city where the price of a typical home eclipses $1 million, underscoring growing affordability concerns.

The second-quarter surge in home prices made San Jose, Calif., the first city where the price of a typical home eclipses $1 million, underscoring growing affordability concerns. With continued uncertainty in key global markets, a top analyst says that the price of gold is now set to soar to 71% within 2 years! […]

With continued uncertainty in key global markets, a top analyst says that the price of gold is now set to soar to 71% within 2 years! […] Gold:1344.30 UP $5.30

Gold:1344.30 UP $5.30

Actual and expected inflation are diverging.

Actual and expected inflation are diverging. Long ago in the Land of the Free, if you wanted to start a saloon, you rented a space and started serving booze.

Long ago in the Land of the Free, if you wanted to start a saloon, you rented a space and started serving booze. Michael Bloomberg served three terms as the Mayor of New York City from January 2002 to January 2014. The last term was made possible by the Mayor spending an estimated $60-$90 million of his own money repealing the two-term limits – an act that outraged many New Yorkers.

Michael Bloomberg served three terms as the Mayor of New York City from January 2002 to January 2014. The last term was made possible by the Mayor spending an estimated $60-$90 million of his own money repealing the two-term limits – an act that outraged many New Yorkers. Trump is attractive precisely because the Establishment fears and loathes him because 1) they didn’t pick him and 2) he might upset the neoconservative Empire that the Establishment elites view as their global entitlement.

Trump is attractive precisely because the Establishment fears and loathes him because 1) they didn’t pick him and 2) he might upset the neoconservative Empire that the Establishment elites view as their global entitlement. The world’s next energy revolution is probably no more than five or ten years away. Cutting-edge research into cheap and clean forms of electricity storage is moving so fast that we may never again need to build 20th Century power plants in this country, let alone a nuclear white elephant such as Hinkley Point.

The world’s next energy revolution is probably no more than five or ten years away. Cutting-edge research into cheap and clean forms of electricity storage is moving so fast that we may never again need to build 20th Century power plants in this country, let alone a nuclear white elephant such as Hinkley Point.

On November1, 2006, Alexander Litvinenko suddenly fell ill and was hospitalized.

On November1, 2006, Alexander Litvinenko suddenly fell ill and was hospitalized. I just heard the rawest kind of propaganda from former presstitute David Satter, who hangs out at the right-wing Hudson Institute and pretends to be an expert on Russia and Putin. On August 10 Satter told NPR’s audience that Washington’s hope to bring peace to Syria would fail unless Washington understood that the Russian government had no humanitarian feelings and did not care about the loss of human life. What Washington needs to do, said Satter, was to make sure that Putin and his henchmen understood that they would be held accountable as war criminals.

I just heard the rawest kind of propaganda from former presstitute David Satter, who hangs out at the right-wing Hudson Institute and pretends to be an expert on Russia and Putin. On August 10 Satter told NPR’s audience that Washington’s hope to bring peace to Syria would fail unless Washington understood that the Russian government had no humanitarian feelings and did not care about the loss of human life. What Washington needs to do, said Satter, was to make sure that Putin and his henchmen understood that they would be held accountable as war criminals.