from Stefan Molyneux

El-Erian: This is How Toxic Politics Can Lead to an Economic Crisis

Populist movements, like Donald Trump’s, are founded upon incoherent strategies

by Mohamed A. El-Erian

Market Watch

NEW YORK (Project Syndicate) — The relationship between politics and economics is changing.

NEW YORK (Project Syndicate) — The relationship between politics and economics is changing.

Advanced-country politicians are locked in bizarre, often toxic, conflicts, instead of acting on a growing economic consensus about how to escape a protracted period of low and unequal growth. This trend must be reversed, before it structurally cripples the advanced world and sweeps up the emerging economies, too.

Obviously, political infighting is nothing new. But, until recently, the expectation was that if professional economists achieved a technocratic consensus on a given policy approach, political leaders would listen. Even when more radical political parties attempted to push a different agenda, powerful forces — whether moral suasion from G7 governments, private capital markets, or the conditionality attached to International Monetary Fund and World Bank lending — would almost always ensure that the consensus approach eventually won the day.

A Few Questions for Sharps Pixley CEO Ross Norman and Other Bullion Bankers

by Chris Powell

GATA.org

Dear Friend of GATA and Gold:

Ross Norman, CEO of London bullion dealer Sharps Pixley, yesterday disputed the 2013 study by a professor at the University of Western Australia that concluded that prices in the twice-daily London gold fixings were manipulated, a study publicized this week by the Sydney-based newspaper The Australian:

http://www.gata.org/node/16835

Norman wrote that the study had not discovered market manipulation at all but only that gold trading volume in London increases around the fixings because of the greater liquidity at those times:

http://news.sharpspixley.com/article/london-fixings-the-case-is-laid-bar…

Norman concluded: “It is no surprise that U.S. courts have seized upon the academic report, prompting a flurry of lawsuits to be filed in what is clearly looking like a pre-ordained desire for a guilty verdict in search of evidence to support it.”

Jack Chan: This Past Week in Gold and Silver

by Jack Chan

The Gold Report

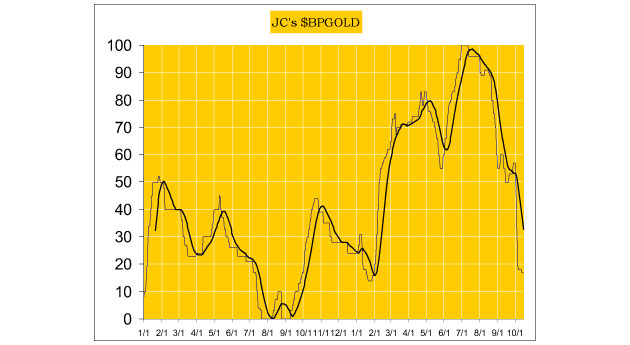

Technical analyst Jack Chan charts the latest moves in gold and silver markets, noting COT data is showing signs of a bottom.

[…] Our proprietary cycle indicator is down.

[…] Our proprietary cycle indicator is down.

[…] The gold sector is on a short-term sell signal as the buy signal has failed. Short-term signals can last for days and weeks, and are more suitable for traders.

The Quarterly Wall St. Lie

by Adam English

Outsider Club

We’re neck deep in an already rocky October, and that can only mean one thing for the stock market: It is time to hype and spin everything, once again.

We’re neck deep in an already rocky October, and that can only mean one thing for the stock market: It is time to hype and spin everything, once again.

With less than three months left in the year, the clock is running out to meet targets and make companies look as healthy as possible.

Earnings season is ramping up, ladies and gentlemen, and that means companies are about to self-congratulate themselves once again.

And, as always, the time has come to do everything possible to sculpt easy sound bites for the talking heads and market cheerleaders to play along, glossing over reality and explaining why everyone should buy everything, forever.

China’s Stunning Move to Dominate the World and the Real Reason Why China is Buying So Much Gold

from King World News

With many investors worried about the economic turmoil that has engulfed the globe, here is a look at China’s stunning move to dominate the world and the real reason why China is buying so much gold.

With many investors worried about the economic turmoil that has engulfed the globe, here is a look at China’s stunning move to dominate the world and the real reason why China is buying so much gold.

China Quietly Increasing Its Global Dominance

Stephen Leeb: “In a fairly lackluster week for the markets, the only news that seemed to arouse any response was China trade data. The headline numbers reported that, contrary to expectations, both Chinese exports and imports had declined in September compared to year-earlier levels, with exports dropping by more than 10 percent in dollar terms. Stock and commodity markets in the West fell in response, believing the numbers signified Chinese weakness that would hurt global growth…

Deeper and Deeper in the Hole: Treasury Receipts Up 1%, Spending Up 5%

by Mike ‘Mish’ Shedlock

Mish Talk

For the first time since 2009, US Deficit Spending On the Rise.

Importantly, receipts are up only 1%, but government spending is up 5%.

The deficit does not count “off budget” items like Social Security and student debt, but let’s take a look at what they do count.

The U.S. budget deficit as a share of the economy widened for the first time in seven years, marking a turning point in the nation’s fiscal outlook as an aging population boosts government spending and debt.

Spending exceeded revenue by $587.4 billion in the 12 months to Sept. 30, compared with a $439.1 billion deficit in fiscal 2015, the Treasury Department said Friday in a report released in Washington. That was in line with a Congressional Budget Office estimate on Oct. 7 for a shortfall of $588 billion. As a share of gross domestic product, the shortfall rose to 3.2 percent from 2.5 percent a year earlier, the first such increase since 2009, government figures show.

“The slowdown in tax collections suggests some cooling in labor market activity,” said Gennadiy Goldberg, a strategist at TD Securities LLC in New York. He sees the higher budget deficits implying more borrowing needs by Treasury.

The Treasury said receipts in fiscal 2016 totaled $3.27 trillion, or 17.8 percent of GDP, while spending totaled $3.85 trillion, or 20.9 percent of GDP. Receipts rose $18 billion from fiscal 2015, while outlays jumped $166 billion, the figures showed. The department cited higher spending on Social Security, Medicare, Medicaid and interest on government debt.

For September, which is the final month in the fiscal calendar, the government reported a $33.4 billion surplus. That was lower than the $90.9 billion surplus a year earlier, in part due to calendar adjustments, according to the Treasury.

Receipts Up 1 Percent

Slowing receipts in the face of all this alleged hiring suggests the alleged hiring is way overstated. This is yet another sign that failure to weed out duplicate social security numbers results in double-counting employment.

Taxpayers, Pull out Your Wallet, Cost Estimates for Biggest Nuclear Energy Boondoggle Exploded Again

by Wolf Richter

Wolf Street

How the Nuclear Energy Lobby Eats up Global Taxpayer Billions

The well-funded lobbyists of the powerful nuclear energy industry are tirelessly working over governments around the world. Occasionally, there are minor setbacks, such as Fukushima or the current multi-billion-dollar scandal around the decommissioning costs of California’s San Onofre nuclear power plant, that threaten to expose just how horridly expensive nuclear power really is for taxpayers, ratepayers, and other stakeholders, from conception of the plant to final decommissioning and proper disposal of nuclear waste and contaminated materials – none of which has yet been accomplished and paid for.

But here’s the mega project that was first conceived in 1985, is still far from completion, and has now thrown back the date of first power generation to 2035, if it can ever be accomplished, and there are grave doubts it can.

Statistician Warn Of “Systemic Mainstream Misinformation” In Poll Data

from Zero Hedge

Submitted by Salil Mehta via Statistical Ideas blog,

Antagonism isn’t perpetual

If you recently glanced at the polls and the election markets, then you would be forgiven to believe that a landslide election is looming. It’s likely not, and the spreads have the potential to revert in surprising ways between now and Election Day. The drumbeat of negative news against Donald Trump may not cause further damage. We’ve discussed numerously, starting on October 11 and October 12, that Hillary Clinton’s runaway spread would revert (here, here, here, here).

Of course that’s a stand taken against a popular headwind, but also an opportunity to make money on an election bet that is mispriced. For example, when we wrote the reversion article, the betfair ask that Mr. Trump’s popular vote could remain in the 40’s% was only priced at 1:6 odds. Nate Silver’s 538 site also reflected this, as shown below. But we -and other academic statisticians- knew that this was faux election probability, and advised thousands to remain vigilant against planned mainstream misinformation.

Experts Said Arctic Sea Ice Would Melt Entirely by September 2016 – They Were Wrong

by Sarah Knapton, Science Editor

Telegraph.co.uk

Dire predictions that the Arctic would be devoid of sea ice by September this year have proven to be unfounded after latest satellite images showed there is far more now than in 2012.

Dire predictions that the Arctic would be devoid of sea ice by September this year have proven to be unfounded after latest satellite images showed there is far more now than in 2012.

Scientists such as Prof Peter Wadhams, of Cambridge University, and Prof Wieslaw Maslowski, of the Naval Postgraduate School in Monterey, California, have regularly forecast the loss of ice by 2016, which has been widely reported by the BBC and other media outlets.

Prof Wadhams, a leading expert on Arctic sea ice loss, has recently published a book entitled A Farewell To Ice in which he repeats the assertion that the polar region would free of ice in the middle of this decade.

Ending a Taking Economy and Creating a Giving Economy (Part 2)

by Charles Hugh Smith

Of Two Minds

Here is Part 2 of the guest essay by Zeus Y.

There no longer seems to be a rational alignment between economic cost and value. This means questioning so-called conventional wisdom and critically considering whether or not to own property or even to go to college.

Here are some examples:

• In my own life, I owned a Florida vacant lot that would normally (and did actually significantly appreciate) in value, but the property was taxed so much in just a few years to pay for a municipal road that the taxes ate up the entire value of the property and I had to unload it just to stop the bleeding.

Lesson: Get rid of property that cost more in maintenance and taxes than they are worth. Don’t let sentimental attachment prevent you from liberating yourself of economic burdens, whether it is real estate property or old furniture in a paid storage facility.

• College tuition is twelve times more expensive over the last generation and college debt has skyrocketed, yet the wages of college grads have actually gone down over the last fifteen years.

The CERTAIN Destruction Of Our Nation

by Karl Denninger

Market-Ticker.org

Go back and read this Ticker, and the link in it on the actual budget deficit we ran last year (no, it’s not the nice number you see at the top of the MTS.)

The budget deficit was in fact $1.4 trillion — not the claimed $587 billion (which is bad enough, incidentally.)

Last year the Federal Government spent $1,417 billion dollars out of $3,854 billion, or 37% of every dollar it spent, on Medicare and Medicaid. This was a 9.3% increase over last year’s expenditure of $1,296,731 (million), all-in.

But inside this figure are even-more damning numbers.

Payments to the health care trust funds were up 13.4% (!)

GDPNow Forecast Dips to 1.9%, Nowcast Rises Slightly to 2.3%

by Mike ‘Mish’ Shedlock

Mish Talk

It was not at all obvious how today’s allegedly “solid” retail sales report would affect third quarter GDP estimates. As I have pointed out before, good reports do not necessarily translate that way. It all depends on what the models expected.

The FRBNY Nowcast expected a weaker retail sales report boosting its GDP estimate slightly.

However, the Atlanta Fed GDPNow Model expected a better retail report and its GDP forecast ticked lower.

GDPNow Latest Forecast: 1.9 Percent — October 14, 2016

Interest Rates and the Marshmallow Test

by Ronald-Peter Stöferle

Mises.org

The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics. ~ Thomas Sowell

The Marshmallow Test is probably the most famous experiment testing people’s patience, which is reflected in the concept of time preference in economics. Psychologist Walter Mischel tested the “delay of gratification” by offering a desired object — such as a Marshmallow — to a child. The examiner told the child that he was about to leave, and that the child would receive a second Marshmallow if it did not eat the first one before the examiner returned. The examiner returned after 15 minutes, but in most cases the temptation had proved too strong. In a variety of versions of the experiment, children’s waiting time amounted to approximately six to ten minutes (with wide dispersion in evidence).

“Originary” Interest Rates Stem from Human Desires

Why is this experiment relevant to us? We obtain economic gratification if we rein in our impatience with respect to consumption. Interest is the most important gauge for this — it is essentially equivalent to the second marshmallow in the experiment. Interest is the return for time, the return for people who decide to wait although they would actually prefer to get everything immediately. Eugen Böhm-Bawerk recognized that interest is not the “price” of money. Rather, interest is the return for the exchange of “money available today against money available tomorrow.” One could also refer to it as the “price of impatience.”

Understanding Islam

by Martin Armstrong

Armstrong Economics

QUESTION: Mr. Armstrong; Why do Islamic extremists hate us so much?

QUESTION: Mr. Armstrong; Why do Islamic extremists hate us so much?

ANSWER: I have asked why is Russia our enemy when they are no longer communist, but nobody can answer that question. The response is usually, “They are Russian.” There is this same residual issue between Islam and Christianity in many circles that people cannot explain. The Turks effectively conquered Constantinople in 1453 and created the Ottoman Empire. Through different rulers, the objectives changed over the centuries. Sometimes the object was isolation and at other times it was conquest mode. This is true of the United States. The objectives change with administrations. Therefore, you cannot really label a people one way or the other.

The attempt to conquer Europe and the failure to take Vienna, which was was the seat of the Holy Roman Empire, in 1683 left a instinctive flavor in the mouths of Western leaders and forever made the Ottoman empire the enemy until they wiped it out in World War I.

Scenes from the Apocalypse – Mass Immigration Ruins the Streets of France

from Zero Hedge

The Paris you know or remember from adverts or brochures no longer exists. While no part of Paris looks like the romantic Cliches in Hollywood movies, some districts now resemble post-apocalyptic scenes of a dystopian thriller. This footage, taken with a hidden camera by an anonymous Frenchman in the Avenue de Flandres, 19th Arrondissement, near the Stalingrad Metro Station in Paris as well as areas in close proximity, shows the devastating effects of uncontrolled illegal mass immigration of young African males into Europe.

If it weren’t for the somewhat working infrastructure, the scene might as well have been the setting of movie shooting – or a slum in Mogadishu. The streets are littered in garbage, the sidewalks are blocked with trash, junk and mattresses, thousands of African men claim the streets as their own – they sleep and live in tents like homeless people.

Busted: Trump Sex Allegations Full of Holes

Evidence points to political motivation behind claims

by Kit Daniels

Info Wars

Details surrounding the sexual assault allegations against Donald Trump are raising doubts that the claims are credible.

Accuser Jessica Leeds claimed Trump molested her in the first-class section of a Braniff 707 flying from Dallas to New York in 1979, but Braniff didn’t use 707s on that route.

A Braniff flight table shows that the airline only operated 727s between the two cities, which is expected: the 727 was developed for domestic flights.

The Investment Legends Are All Warning, Few Are Listening

by Graham Summers

Gold Seek

More and more insiders are warning of a potential systemic event.

More and more insiders are warning of a potential systemic event.

The first sign of real trouble concerned a number of investment legends choosing to close shop and return investors’ capital.

The first real titan to bow out was Stanley Druckenmiller. Druckenmiller maintained average annual gains of nearly 30% for 30 years. He is arguably one of if not the greatest investor of the last three decades.

In 2010, he chose to close shop, foregoing billions in management fees.

Druckenmiller was not alone. In 2011, investment legend Carl Icahn closed his hedge fund to outside investors. Again, here was an investment legend who could lock in billions in investment management fees choosing to close up shop.

He has since stated he is “extremely worried” about stocks.

The list continues.

Weekend Edition: Why Gold Stocks Perform Better Than Gold

by E.B. Tucker

Casey Research

Editor’s note: Today we have a special gold essay to share from Casey Report editor E.B. Tucker. As E.B. explains, gold stocks move in extreme cycles…and they’re currently preparing for the next boom.

And this boom may be the biggest we’ve seen in our lifetimes…

————————–

By E.B. Tucker, editor, The Casey Report

You can make 5x, 10x, or even 27x more money in gold stocks than in gold bullion.

And the best part is that you don’t have to buy options, use debt, or perform any complicated trading strategies either.

And it only involves a little more risk than buying gold bullion. But the potential upside is massive…

Billionaire Eric Sprott’s Business Partner Warns the Global Monetary System is Breathing Its Last Breaths

from King World News

Today billionaire Eric Sprott’s business partner warned that the global monetary system is breathing its last breaths.

Today billionaire Eric Sprott’s business partner warned that the global monetary system is breathing its last breaths.

Eric King: “John, people will email King World News and ask, ‘What about a guy like John Embry? Where does he have his money? Does John have his money in the sector or not?’ Of course we are pretty good friends and so I know you are pretty much all in on this stuff. Your single largest holding is Wesdome Gold. I know you have a ton of these high-quality companies in your portfolio but how many shares of Wesdome Gold do you own?”

John Embry: “I own around 4.5 million shares and the stock is trading at $2.48 Canadian.”