by Pam Martens and Russ Martens

Wall Street on Parade

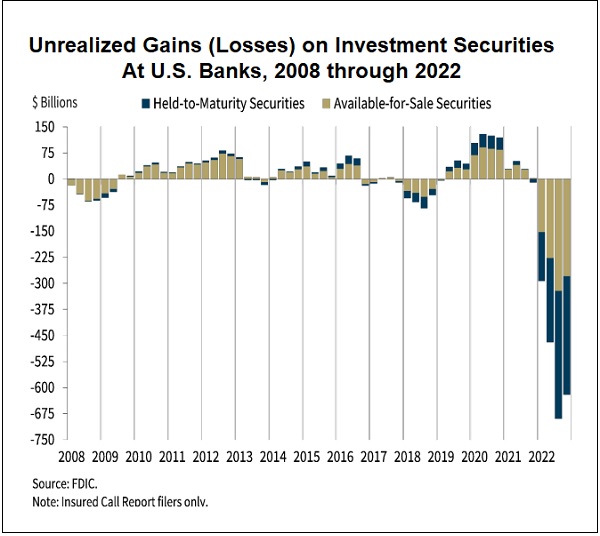

Wall Street mega banks, as well as others, are moving vast amounts of their debt securities from one accounting category to another accounting category in order to stretch out unrealized losses over the life of the instrument. As the FDIC chart above indicates, as of December 31, 2022 unrealized losses on investment securities at U.S. banks stood at more than $600 billion.

Wall Street mega banks, as well as others, are moving vast amounts of their debt securities from one accounting category to another accounting category in order to stretch out unrealized losses over the life of the instrument. As the FDIC chart above indicates, as of December 31, 2022 unrealized losses on investment securities at U.S. banks stood at more than $600 billion.

According to JPMorgan Chase’s 10-K (Annual Report) filings with the Securities and Exchange Commission, over the past three years it has moved a total of $347 billion (yes, “billion” with a “b”) of investment securities from the accounting category called “Available-for-Sale” (AFS) to the accounting category called “Held-to-Maturity” (HTM).