by Jack Farchy and Mark Burton

Yahoo! Finance

(Bloomberg) — What happens when the London Metal Exchange runs out of metal? That’s the question the exchange is urgently trying to address for its flagship copper contract, which sets the global price for one of the world’s most important commodities.

(Bloomberg) — What happens when the London Metal Exchange runs out of metal? That’s the question the exchange is urgently trying to address for its flagship copper contract, which sets the global price for one of the world’s most important commodities.

[…] The problem stems from the LME’s physical nature: anyone holding a contract to expiry becomes the owner of a package of metal in an LME warehouse. On the other hand, anyone who has sold one must deliver the metal when the contract expires.

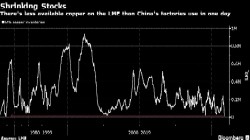

But with available copper inventories at LME warehouses falling below 20,000 tons — less than China’s factories consume in one day — traders are grappling with the possibility that there simply won’t be metal available to deliver.