$1.71 Trillion in Student Debt and Millennials Continue to Struggle with Debt Overload. What Does it take to Purchase a Home and why Boomer Logic is so off?

[Ed. Note: It’s somewhat amusing how idiot millennials will take on life-crippling amounts of debt to attend the adult-daycare otherwise known as college, and still lack enough introspection to say, “why Boomer Logic is so off” is the headline. Yes, clearly it’s the Boomers who are the idiots in this story… Good luck with your utterly useless degree.]

from My Budget 360

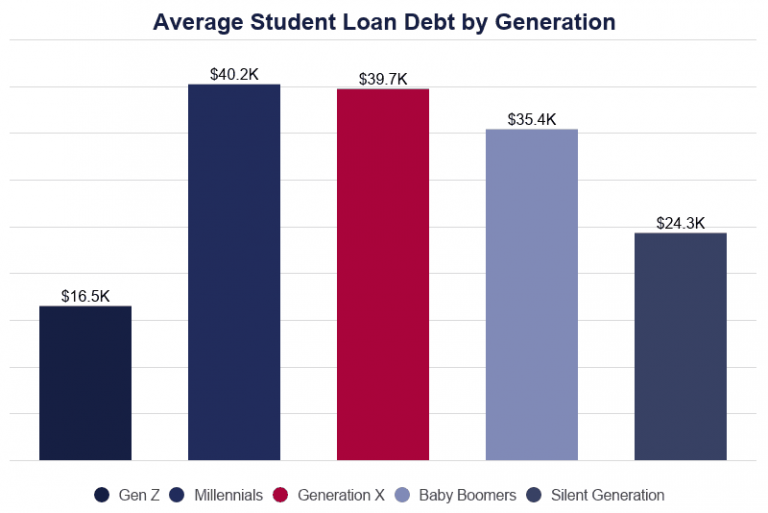

It should come as no surprise that Millennials continue to lead the pack in terms of student loan debt. The average debt carried by a Millennial is over $40,000. According to the US Census per capita income is $34,103 and the amount of student loan debt is deeply troubling since it is higher than one year of working income for a typical American. We hear the constant drum beat from older generations especially baby boomers that Millennials “need to suck it up” and save to purchase a home but that is largely nonsense. Why? Baby boomers in the US grew up at a time when one blue collar income was enough to buy a modest house in most metro areas. Today that is not the case. Minimum wage is $7.25 per hour and most good paying jobs require some form of education. It is important to highlight this because Millennial home buying is falling behind previous generations and each year that goes by creates one more year that wealth is not being built.

It should come as no surprise that Millennials continue to lead the pack in terms of student loan debt. The average debt carried by a Millennial is over $40,000. According to the US Census per capita income is $34,103 and the amount of student loan debt is deeply troubling since it is higher than one year of working income for a typical American. We hear the constant drum beat from older generations especially baby boomers that Millennials “need to suck it up” and save to purchase a home but that is largely nonsense. Why? Baby boomers in the US grew up at a time when one blue collar income was enough to buy a modest house in most metro areas. Today that is not the case. Minimum wage is $7.25 per hour and most good paying jobs require some form of education. It is important to highlight this because Millennial home buying is falling behind previous generations and each year that goes by creates one more year that wealth is not being built.