American Households Now Carry $1.34 Trillion in Auto Loans on an Asset That Depreciates While Covid-19 Creates Demand Destruction.

from My Budget 360

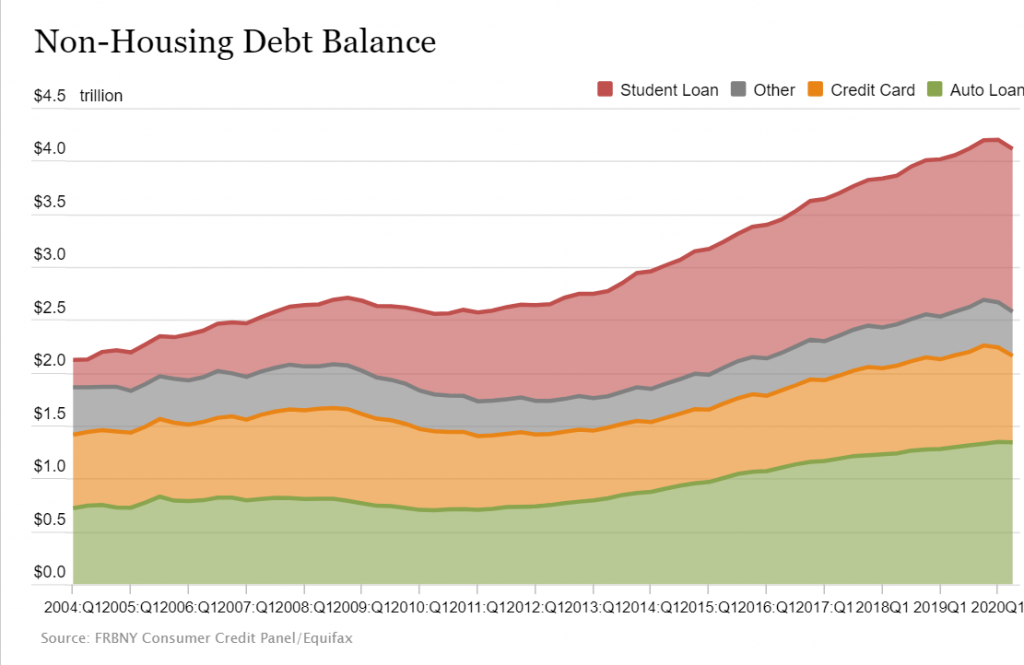

America is literally driving itself into debt. US households now carry a stunning $1.34 trillion in automotive debt. What is troubling about this is the amount of driving taking place has plunged courtesy of Covid-19 and much of our economy is built around driving. People take the morning and evening commute, and this was seen as simply normal – but now with many working from home, that may not be the case. Also, the notion of buying cars (a depreciating asset) every few years is just a bad financial move. The buying would not be so bad but the level of debt being taken on to finance a car purchase is. Not too long ago a three- or four-year term on an auto loan was standard. Now we have loans of six to seven years! You also have billions of dollars going to subprime borrowers and in this climate, a large number of Americans are financially on the edge. Where do we go from here when it comes to auto debt?

America is literally driving itself into debt. US households now carry a stunning $1.34 trillion in automotive debt. What is troubling about this is the amount of driving taking place has plunged courtesy of Covid-19 and much of our economy is built around driving. People take the morning and evening commute, and this was seen as simply normal – but now with many working from home, that may not be the case. Also, the notion of buying cars (a depreciating asset) every few years is just a bad financial move. The buying would not be so bad but the level of debt being taken on to finance a car purchase is. Not too long ago a three- or four-year term on an auto loan was standard. Now we have loans of six to seven years! You also have billions of dollars going to subprime borrowers and in this climate, a large number of Americans are financially on the edge. Where do we go from here when it comes to auto debt?