by Steve St. Angelo

SRSRocco Report

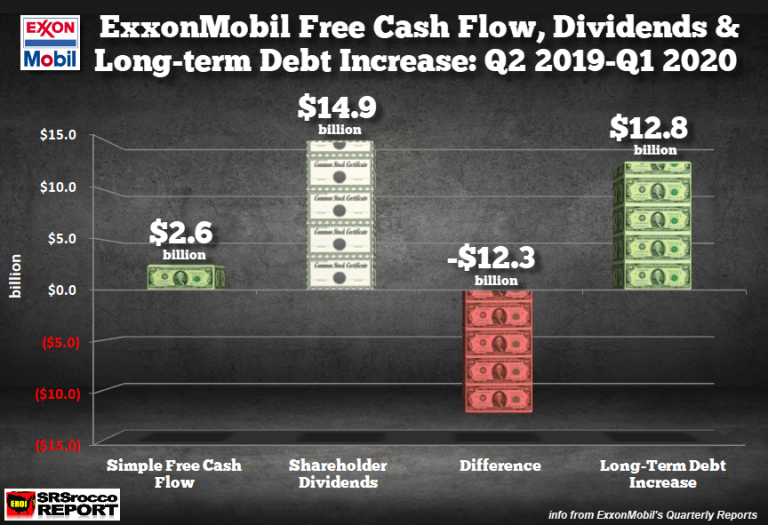

The global contagion that negatively impacted the oil industry couldn’t have come at a worse time for ExxonMobil. After the company increased its long term debt by $12 billion over the last year, ExxonMobil may have to borrow even more money to continue paying dividends and capital expenditures (CAPEX).

The global contagion that negatively impacted the oil industry couldn’t have come at a worse time for ExxonMobil. After the company increased its long term debt by $12 billion over the last year, ExxonMobil may have to borrow even more money to continue paying dividends and capital expenditures (CAPEX).

The reason ExxonMobil was forced to borrow $12 billion between the second quarter of 2019 and the first quarter of 2020 had to do with the nasty negative free cash flow the company accumulated. I explained this in the chart below, which I posted in my article, THE END OF A U.S. OIL GIANT: ExxonMobil’s Days Are Numbered: