by Hubert Moolman

Silver Seek

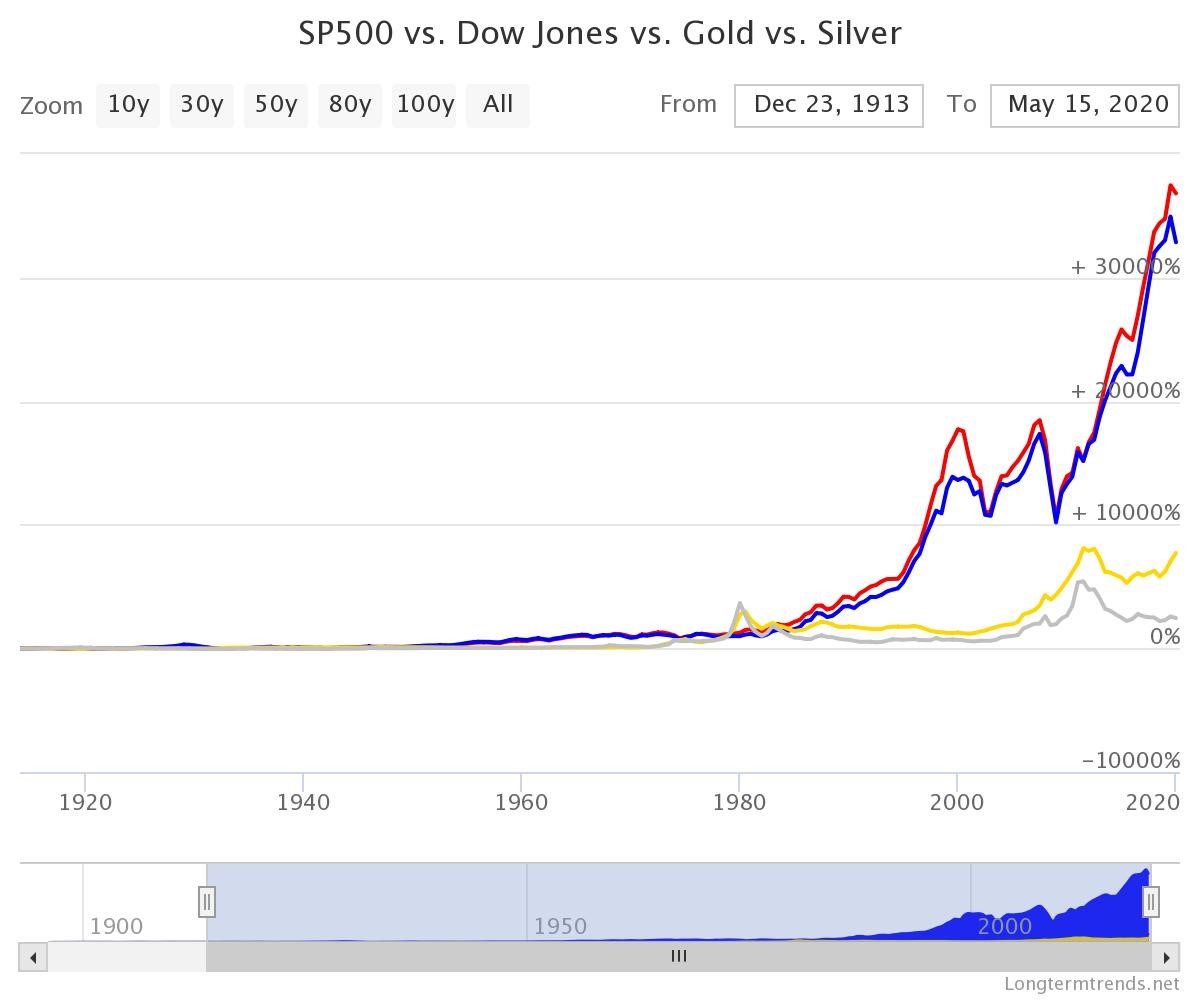

Since the creation of the Federal Reserve in 1913, the stock market has outperformed Gold and Silver significantly. Here is a great chart (from longtermtrends.net) that proves this:

Since the creation of the Federal Reserve in 1913, the stock market has outperformed Gold and Silver significantly. Here is a great chart (from longtermtrends.net) that proves this:

[…] The S&P 500 is in red, the Dow in blue and Gold and Silver in their native colours. The outperformance is huge. Through the debt-based monetary system, the Fed facilitates the extension of credit which disproportionately benefits assets like general stocks and bonds.

During each credit cycle, Silver and Gold prices mostly loses relative value to assets like general stocks and commodities. In other words, inflating the currency supply (inflation) does not benefit Gold and Silver relative to most other significant assets like stocks (the chart above is really the proof of this).