by Wolf Richter

Wolf Street

Some of the same characters that played leading roles last time.

Some of the same characters that played leading roles last time.

The value of the US housing market has ballooned to $26 trillion. In many markets, prices exceed even the peak or the prior bubble that blew up so spectacularly. This construct is weighed down by $14 trillion in mortgage debt, or about 76% of US GDP. Of that, $10 trillion is owed on one- to four-family residences. The numbers are big – and they matter.

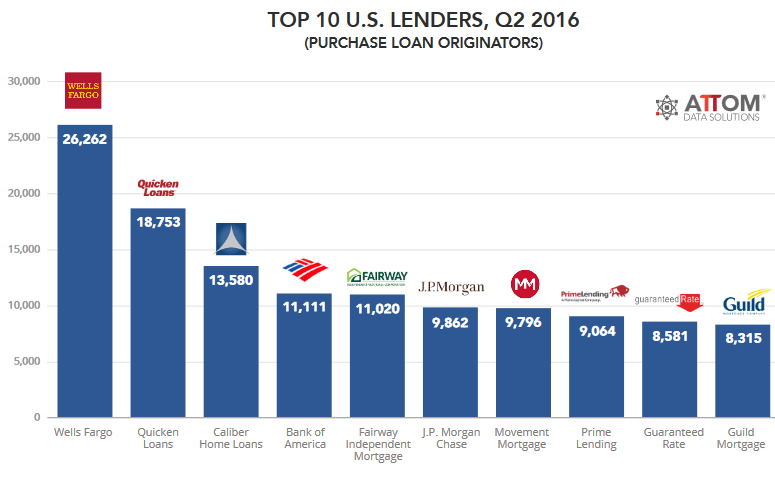

But who’s doing the lending? More and more: nonbanks, evocatively called “shadow banks.” They have now overtaken commercial banks “to grab a record slice” of government-guaranteed mortgages, Attom Data Solutions reported in its housing report.