by Gordon T. Long

Gold Seek

A FALLING MARKET CANNOT BE ALLOWED – at any cost!

A FALLING MARKET CANNOT BE ALLOWED – at any cost!

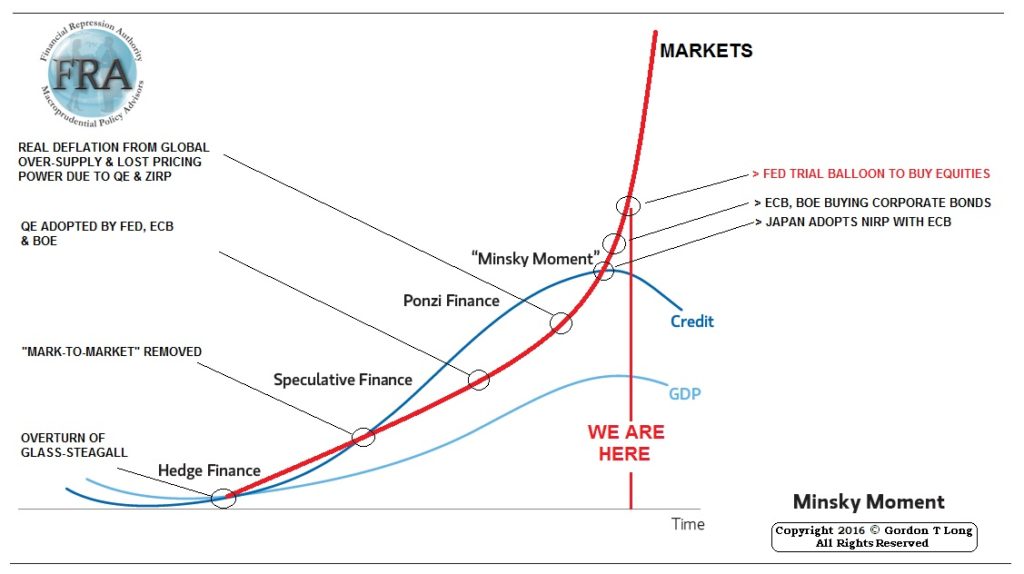

The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment , excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for a major correction. A correction because of the high degree of market correlation that likely would be instantaneously contagious across all global financial markets.

Any correction more than 10% must be stopped. As a result of the level of instability, even a 10% corrective consolidation could get quickly out of control, so any correction becomes a major risk. What the central bankers are acutely aware of is: