The flipside of low interest rates is a bunch of investors reluctant to part with sought-after securities.

by Tracy Alloway

Bloomberg.com

You can’t always get what you want.

You can’t always get what you want.

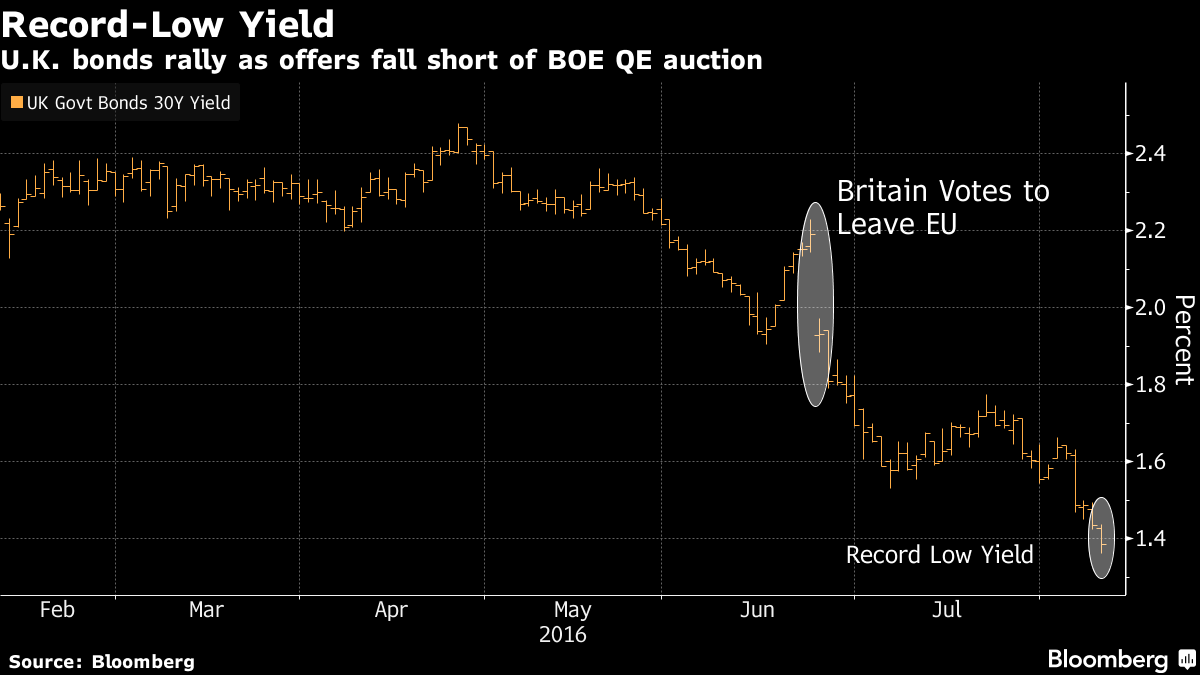

On Tuesday, the Bank of England didn’t manage to buy all the gilts it wanted at a reverse auction — the first such shortfall since it began its bond-buying program back in 2009. The ‘uncovered auction’ happened as investors proved reluctant to part with their holdings of longer-dated U.K. government bonds and could create a headache for policy makers seeking to offset the economic impact of the Brexit referendum by lowering borrowing costs.

The central bank snafu sparked a lively discussion over whether the BOE is reaching Japan-like technical limits in its sovereign-bond purchases or simply suffering from a temporary summertime trading lull.