by Jeffrey P. Snider

Alhambra Partners

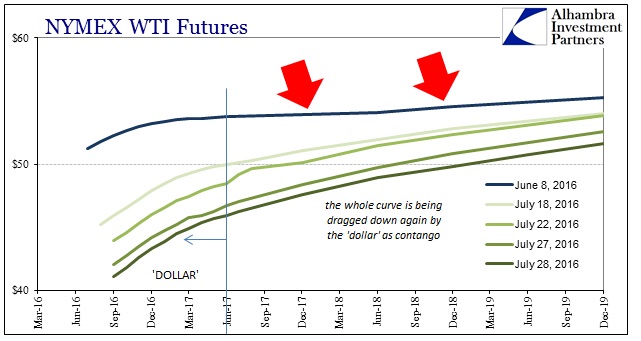

Oil prices are like an unfolding train wreck, as it is nearly impossible to look away now. Day after day, not only are spot prices down but the entire WTI curve is now moving lower in almost perfect unison. Prices have dropped six days in a row, more than $4, and at just above $41 seems a much different world than $51 on June 8.

[…] Yet, despite the persistent funding pressure indicated here, CNY actually moved sharply higher today without any support whatsoever from JPY (and by implication Japanese banks and their “dollar” flow). It further proposes what I suggested a few days ago, that the PBOC is once more interfering (“selling UST’s” or “selling dollars”) in the exchange rate and very likely because global funding is once more a serious concern.