by Mark O’Byrne

GoldCore

The fight over the future of the global gold market, London’s 300 year old role in the market and the LBMA’s role in determining price makes Bloomberg’s lead article today and we contribute. The article begins:

The fight over the future of the global gold market, London’s 300 year old role in the market and the LBMA’s role in determining price makes Bloomberg’s lead article today and we contribute. The article begins:

“There’s a competition brewing to figure out how the world’s largest gold-trading hub can get bigger and better.”

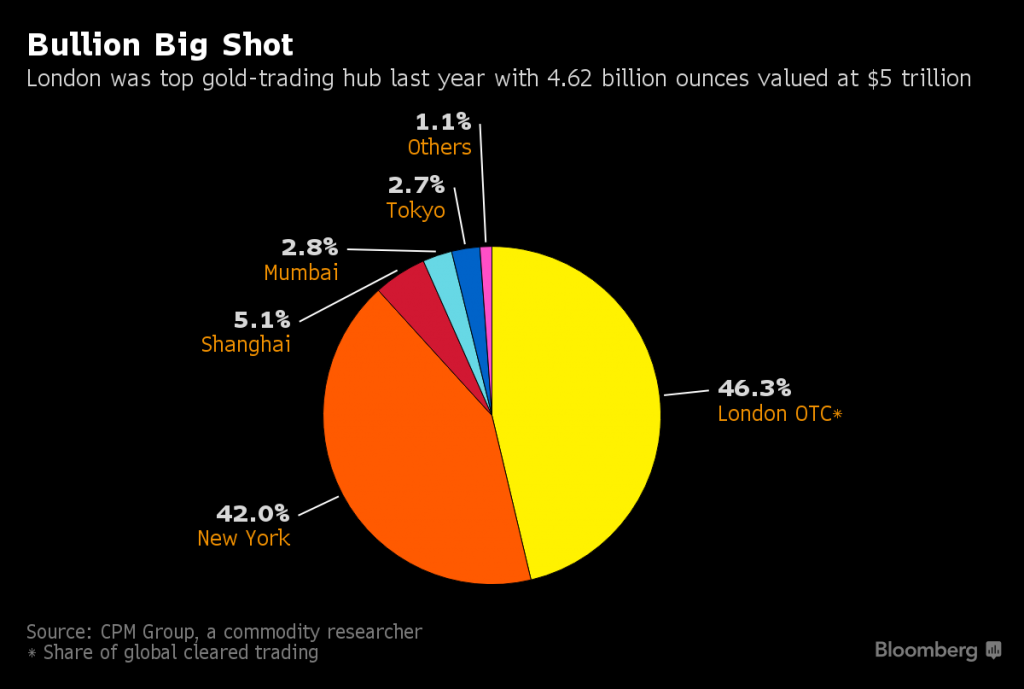

[…] “Much of the $5 trillion in transactions cleared every year in London is done by telephone or in electronic chat rooms and are the same kind of one-on-one deals that gave birth to the marketplace three centuries ago. But traders and bankers say the system may not provide enough transparency to satisfy regulators or attract new business at a time when more gold is being bought and sold in New York and Shanghai.”