by John W. Whitehead

The Rutherford Institute

“There is now the capacity to make tyranny total in America.” – James Bamford

It never fails.

Just as we get a glimmer of hope that maybe, just maybe, there might be a chance of crawling out of this totalitarian cesspool in which we’ve been mired, we get kicked down again.

In the same week that the U.S. Supreme Court unanimously declared that police cannot carry out warrantless home invasions in order to seize guns under the pretext of their “community caretaking” duties, the Biden Administration announced its plans for a “precrime” crime prevention agency.

Talk about taking one step forward and two steps back.

The latest guidelines from the Centers for Disease Control and Prevention (CDC) say fully vaccinated Americans do not need to wear face masks or practice physical distancing except when business policy or government regulation requires them to do so. But “despite the new guidelines,” The New York Times says in a story about the loosening of that city’s COVID-19 restrictions, “many experts still suggest wearing a mask indoors when not eating or drinking. People should maintain social distance when possible. And they should try to choose outdoors over indoors.”

The latest guidelines from the Centers for Disease Control and Prevention (CDC) say fully vaccinated Americans do not need to wear face masks or practice physical distancing except when business policy or government regulation requires them to do so. But “despite the new guidelines,” The New York Times says in a story about the loosening of that city’s COVID-19 restrictions, “many experts still suggest wearing a mask indoors when not eating or drinking. People should maintain social distance when possible. And they should try to choose outdoors over indoors.”

Inveterate liar Liz Cheney is running from one news camera to the next like a chicken with its head cut off. Is she screaming about the Biden regime personally funding Hamas, Hezb’allah, and Iranian terrorists in their war to exterminate Israel? Nope. Is she furious that the White House has intentionally instigated a crisis of epic proportions at the southern border by dismantling President Trump’s effective deterrents and actively aiding and abetting the business operations of drug-traffickers and slavers throughout the United States? Of course not: Ignoring the will of the American people and insisting that they remain victims while criminal enterprises destroy their communities are bipartisan objectives of the One Party State. Is she enraged that “green” fascists have joined forces with Federal Reserve currency-manipulating oligarchs to spike gas prices and send inflation spiraling to the moon? Both parties abandoned Main Street businesses decades ago (and despise President Trump’s “America First” policies), so as long as Wall Street can still make a buck and her lobbyists are sitting pretty, why should she care?

Inveterate liar Liz Cheney is running from one news camera to the next like a chicken with its head cut off. Is she screaming about the Biden regime personally funding Hamas, Hezb’allah, and Iranian terrorists in their war to exterminate Israel? Nope. Is she furious that the White House has intentionally instigated a crisis of epic proportions at the southern border by dismantling President Trump’s effective deterrents and actively aiding and abetting the business operations of drug-traffickers and slavers throughout the United States? Of course not: Ignoring the will of the American people and insisting that they remain victims while criminal enterprises destroy their communities are bipartisan objectives of the One Party State. Is she enraged that “green” fascists have joined forces with Federal Reserve currency-manipulating oligarchs to spike gas prices and send inflation spiraling to the moon? Both parties abandoned Main Street businesses decades ago (and despise President Trump’s “America First” policies), so as long as Wall Street can still make a buck and her lobbyists are sitting pretty, why should she care? With the possible exception of international trade, no topic in economics contains more myths than monetary theory. In the present article I address four popular opinions concerning money that suffer from either ambiguity or outright falsehood.

With the possible exception of international trade, no topic in economics contains more myths than monetary theory. In the present article I address four popular opinions concerning money that suffer from either ambiguity or outright falsehood. Is the party almost over? Volatility has returned to Wall Street in a major way, and certain investors are getting absolutely crushed. On Wednesday, a trillion dollars in paper wealth had been wiped out during the trading session at one point, but those losses were later pared back as cryptocurrencies rallied. On social media, there has been a lot of weeping and wailing due to the huge financial losses that some people have experienced this week. But if you think that these losses are bad, just wait until you see what is coming later.

Is the party almost over? Volatility has returned to Wall Street in a major way, and certain investors are getting absolutely crushed. On Wednesday, a trillion dollars in paper wealth had been wiped out during the trading session at one point, but those losses were later pared back as cryptocurrencies rallied. On social media, there has been a lot of weeping and wailing due to the huge financial losses that some people have experienced this week. But if you think that these losses are bad, just wait until you see what is coming later. They all did it, from Salesforce, Uber, and Twitter on down. It was pure magic, a show produced with enormous hype. Now they’re all trying to get out at the same time.

They all did it, from Salesforce, Uber, and Twitter on down. It was pure magic, a show produced with enormous hype. Now they’re all trying to get out at the same time. Five weeks ago, we wrote that sharply negative real interest rates were going to drive prices higher in the weeks ahead, and so far that forecast is playing out as expected. So what happens next? That’s the subject this week.

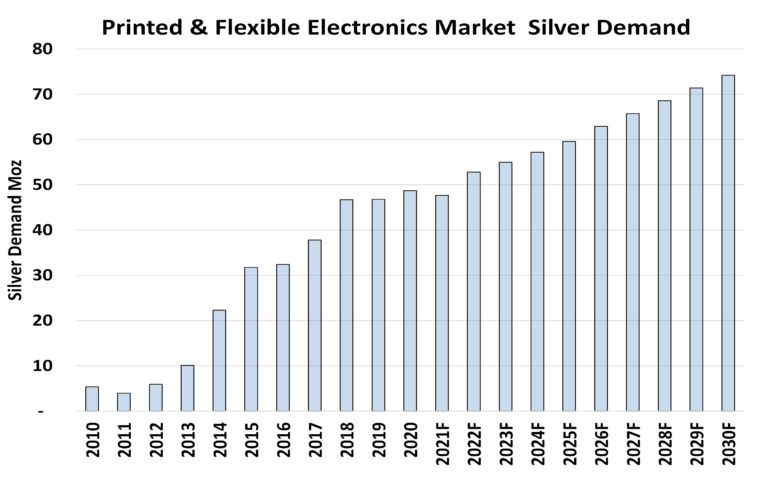

Five weeks ago, we wrote that sharply negative real interest rates were going to drive prices higher in the weeks ahead, and so far that forecast is playing out as expected. So what happens next? That’s the subject this week. (Washington, DC – May 19, 2021) Silver demand for printed and flexible electronics is forecast to increase 54 percent, from 48 million ounces (Moz) in 2021 to 74 Moz in 2030, consuming 615 million ounces for these applications during the 10-year timeframe, as this market continues to mature and expand. Printed and flexible electronics are vital to the evolution of electronic technologies as they are mainstays in a wide range of products, including sensors for temperature, pressure, motion, lighting, moisture/relative humidity, radar, heart rate, and carbon monoxide. Other applications include their use in internet connected devices, medical and wearable electronics, displays for appliances, mobile phones, computers and tablets, medical devices, automotive, and consumer electronics.

(Washington, DC – May 19, 2021) Silver demand for printed and flexible electronics is forecast to increase 54 percent, from 48 million ounces (Moz) in 2021 to 74 Moz in 2030, consuming 615 million ounces for these applications during the 10-year timeframe, as this market continues to mature and expand. Printed and flexible electronics are vital to the evolution of electronic technologies as they are mainstays in a wide range of products, including sensors for temperature, pressure, motion, lighting, moisture/relative humidity, radar, heart rate, and carbon monoxide. Other applications include their use in internet connected devices, medical and wearable electronics, displays for appliances, mobile phones, computers and tablets, medical devices, automotive, and consumer electronics. This week has been truly brutal for the entire cryptocurrency sector, with the prices of major currencies like Bitcoin and Ethereum crashing at least 30%. The overall sector has shed trillions of dollars in value.

This week has been truly brutal for the entire cryptocurrency sector, with the prices of major currencies like Bitcoin and Ethereum crashing at least 30%. The overall sector has shed trillions of dollars in value. In yesterday’s Dispatch, we gave you the old “gold is money” routine.

In yesterday’s Dispatch, we gave you the old “gold is money” routine. The U.S. Capitol Police Department has denied involvement in writing a letter that expressed “disappointment” at recent comments from GOP leaders opposing the creation of a January 6 Commission.

The U.S. Capitol Police Department has denied involvement in writing a letter that expressed “disappointment” at recent comments from GOP leaders opposing the creation of a January 6 Commission. The House of Representatives passed a bill Wednesday that would create a bipartisan, 9/11-style commission into the Jan. 6 Capitol riot, with dozens of Republicans joining Democrats in a rebuke of GOP leadership.

The House of Representatives passed a bill Wednesday that would create a bipartisan, 9/11-style commission into the Jan. 6 Capitol riot, with dozens of Republicans joining Democrats in a rebuke of GOP leadership.