from The Still Report

Time to Heel

by James Quinn

The Burning Platform

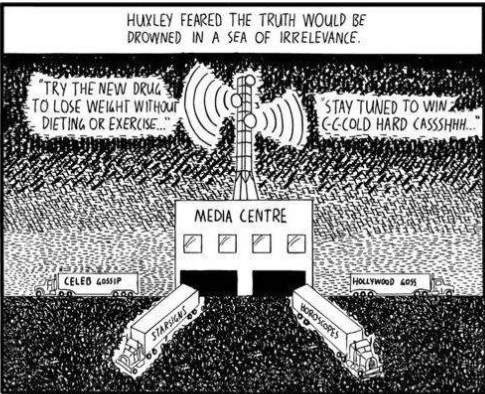

“Whether in actual fact the policy of the boot-on-the-face can go on indefinitely seems doubtful. My own belief is that the ruling oligarchy will find less arduous and wasteful ways of governing and of satisfying its lust for power, and these ways will resemble those which I described in Brave New World. Within the next generation I believe that the world’s rulers will discover that infant conditioning and narco-hypnosis are more efficient, as instruments of government, than clubs and prisons, and that the lust for power can be just as completely satisfied by suggesting people into loving their servitude as by flogging and kicking them into obedience.” – Letter from Aldous Huxley to George Orwell – 1949

Huxley’s vision of the future held sway for the next five decades, as generation after generation underwent government social indoctrination in public schools; medicating those who didn’t conform reduced dissent; incessant propaganda from government-controlled media convinced the masses to consume, obey and feel (no thinking allowed); and learned to love their debt servitude.

The Number of Americans That Are Depressed or Considering Suicide Has Soared Because of the Covid Lockdowns

by Michael Snyder

The Economic Collapse Blog

As we head into winter, health authorities are telling us to stay at home as much as possible and to keep contact with others at a minimum. They are telling us that we must do this for our own good, but the truth is that the mental health of the American people has been absolutely devastated by the various restrictions that have been imposed since the COVID pandemic first began. Coming into this year, suicide was at an all-time record high in the United States and more Americans were on anti-depressants than ever before. Unfortunately, the COVID lockdowns have made things even worse. The following is an excerpt from a study that was released just a few days ago…

As we head into winter, health authorities are telling us to stay at home as much as possible and to keep contact with others at a minimum. They are telling us that we must do this for our own good, but the truth is that the mental health of the American people has been absolutely devastated by the various restrictions that have been imposed since the COVID pandemic first began. Coming into this year, suicide was at an all-time record high in the United States and more Americans were on anti-depressants than ever before. Unfortunately, the COVID lockdowns have made things even worse. The following is an excerpt from a study that was released just a few days ago…

The unfolding of the current coronavirus 2019 (COVID-19) pandemic, the worst global public health crisis in recent history, has caused unprecedented medical, social, and economic upheaval across the globe, and inflicted profound psychological pain on many people. The rapid spread of this highly contagious disease resulted in a host of mental health consequences: feelings of uncertainty, sleep disturbances, anxiety, distress, and depression. The wide adoption of restrictive measures, although helpful in controlling the spread of the virus, inevitably resulted in psychological and financial costs that may have long-term psychological sequelae.

A lot of people will never be the same again after this.

Silver and Those Long Cycles

by Argentus Maximus

TF Metals Report

Every couple of years I refresh the long wave view for precious metals with a big cycle review.

Every couple of years I refresh the long wave view for precious metals with a big cycle review.

It’s been a few years since I updated the big picture of silver cycles, so here are some new views for readers to pore over and accept, or dismiss, or modify, their implications depending on how convincing they look, or fail to look!

So let’s get started:

Is there a thirty year cycle in the price of silver?

We only have one wave back to consider if there is, so number of comparisons with the present day is limited. that’s unfortunate.

Donald the Dragon Slayer

by Frank Miele

Real Clear Politics

The legacy of President Donald Trump will be measured against the diminishment of his enemies.

The legacy of President Donald Trump will be measured against the diminishment of his enemies.

First — even before he was nominated — he broke the corrupt, elitist Republican Party. If you don’t think that is true, just ask yourself when was the last time you took Jeb Bush seriously.

Next, he maimed the corrupt, elitist Democratic Party, which was so fearful that it resorted to dirty tricks that would have made Dick Nixon blush. Crooked Hillary and her gang of globalists invented a plot to “vilify” Trump by linking him to a fake scandal “claiming interference by Russian security services.” Don’t take my word for it. That comes from a contemporaneous memo by Obama-era CIA Director John Brennan, and we don’t have to speculate about whether the plot came to fruition because the nation wasted more than two years and $32 million on a special-counsel probe to look into the fake allegations against Trump. Some taxpayers group really ought to send Hillary a bill.

Everything Will Come Tumbling Down – Rick Ackerman with Greg Hunter

Rick Ackerman – Second Great Depression Starts in 2021

by Greg Hunter

USA Watchdog

Analyst, professional trader and financial writer Rick Ackerman says don’t expect the trillions of dollars of borrowed money given away in government stimulus to save the economy. It will not. Ackerman explains, “For every dollar of debt we create, we only get 33 cents of growth. . . . The stimulus is having less and less of an effect, and because it has less of an effect, it stimulates the stimulators to do even more stimulating, which essentially means more borrowing. So, that’s what’s called a debt trap, and we are very much in it. . . . There is no question you get a shot in the arm on the consumer spending side and also with asset inflation with the real estate market and stock market. Don’t kid yourself, you are not creating sustainable growth to pay off that borrowing. We are not going to grow our way out of this.”

Analyst, professional trader and financial writer Rick Ackerman says don’t expect the trillions of dollars of borrowed money given away in government stimulus to save the economy. It will not. Ackerman explains, “For every dollar of debt we create, we only get 33 cents of growth. . . . The stimulus is having less and less of an effect, and because it has less of an effect, it stimulates the stimulators to do even more stimulating, which essentially means more borrowing. So, that’s what’s called a debt trap, and we are very much in it. . . . There is no question you get a shot in the arm on the consumer spending side and also with asset inflation with the real estate market and stock market. Don’t kid yourself, you are not creating sustainable growth to pay off that borrowing. We are not going to grow our way out of this.”

When Money Dies, 100 Years Later

by Jeff Deist

Mises.org

When Money Dies, Adam Fergusson’s cautionary account of hyperinflation in Weimar-era Germany, is the book Americans desperately need to read today.

When Money Dies, Adam Fergusson’s cautionary account of hyperinflation in Weimar-era Germany, is the book Americans desperately need to read today.

Ours is a nation willfully lacking in knowledge and understanding of money; a cynic might think this lack of apprehension is by design. Money is seldom discussed in schools, popular media, or politics. And almost a century after the stark lessons of 1923 Germany, the West is convinced it can’t happen here. In our overwhelming material abundance, aided by the natural deflationary pressures of markets, we simply have lost our ability to imagine a hyperinflationary scenario. Sure, there have been currency meltdown since the two world wars in places like Yugoslavia and Zimbabwe and Bulgaria and Argentina. Yes, Venezuela and arguably Turkey face currency crises today. But we need not worry about this, because modern central banks—especially the US Fed and the ECB—have tamed inflation through sheer technocratic expertise and a willingness to use extraordinary monetary policy tools. Asset purchases and balance sheet expansion, ultra-low or negative interest rates, and a determination to provide as much “liquidity” as an economy needs are the new normal for central bankers. Thanks to this open embrace of centrally-planned money, former Fed Chair (and likely future Treasury Secretary) Janet Yellen assured us we need not expect another financial crisis in our lifetime.

2020: A Look in Review, and Dark Days Forward

by Karl Denninger

Market-Ticker.org

When I first began writing The Market Ticker I made a practice of doing a “Year in Review” ticker toward the back half of December with a list of predictions for the next year. Part of this, after the first one of course, was scoring myself on the previous year’s predictions.

Predictions for events, market-based, societal or political, with a year timeline are pretty tough. Most years I managed to get somewhere around a third to a half of them, and a couple of times a few more than that. Plenty of people thought this was a terrible record. Frankly, I’ll put that up against Gundlach, Gartman (who for a very long time was the absolute best person to bet against, ever) and a whole host of others, most of whom would be lucky to hit 10%. And while half sounds like random chance it’s not by any stretch of the imagination; these are not bets against professional odds-makers such as a football game where the book does its level best to set the line right at the 50/50 point and if they suck at it they are out of business in a very short period of time.

Market Report: Waiting for Godot…

by Alasdair MacLeod

Gold Money

This week, gold and silver rallied on Monday and Tuesday before drifting lower subsequently and ending up little changed on the week. In morning trade in Europe today, gold traded at $1835, down $3 from last Friday’s close, while on the same timescale silver lost 30 cents at $23.86. Volumes on Comex were low.

This week, gold and silver rallied on Monday and Tuesday before drifting lower subsequently and ending up little changed on the week. In morning trade in Europe today, gold traded at $1835, down $3 from last Friday’s close, while on the same timescale silver lost 30 cents at $23.86. Volumes on Comex were low.

It is as if markets are waiting for something which might not happen, hence the reference to Samuel Becket’s play in our headline. While the covid situation continues to deteriorate, we await a second US stimulus package, and perhaps, for the year-end to pass. The chattering classes talk about inflation watchers selling their gold ETFs for cryptocurrencies. But there is no evidence that that activity goes beyond a few trend-chasing speculators. And even then, bitcoin has fallen from $19375 last Friday to $17752 this morning — hardly a sensible switch.

The fact of the matter is gold is up only 21% in dollars, and in euros and sterling, even less as our next chart shows.

Democrat Congressman ‘Demands’ 126 Republican Members of Congress Not Be Seated for Supporting Trump Lawsuit

by Ryan Saavedra

Daily Wire

Rep. Bill Pascrell (D-NJ) is demanding that 126 House Republicans that supported a lawsuit challenging the 2020 presidential election not be seated during the upcoming congressional term that starts next month.

Rep. Bill Pascrell (D-NJ) is demanding that 126 House Republicans that supported a lawsuit challenging the 2020 presidential election not be seated during the upcoming congressional term that starts next month.

“Stated simply, men and women who would act to tear the United States government apart cannot serve as Members of the Congress,” Pascrell said in a statement. “These lawsuits seeking to obliterate public confidence in our democratic system by invalidating the clear results of the 2020 presidential election undoubtedly attack the text and spirit of the Constitution, which each Member swears to support and defend.”

When Do We Start Coming Out of the Covid-19 Mass Hysteria?

by Michael Fumento

The American Institute for Economic Research

“Men . . . go mad in herds, while they only recover their senses slowly, and one by one.” So wrote Scottish journalist Charles Mackay in his 1841 book Extraordinary Popular Delusions and the Madness of Crowds, which for good reason to this day remains in print.

“Men . . . go mad in herds, while they only recover their senses slowly, and one by one.” So wrote Scottish journalist Charles Mackay in his 1841 book Extraordinary Popular Delusions and the Madness of Crowds, which for good reason to this day remains in print.

The Covid-19 hysteria, scientifically called mass psychogenic illness, that began in March has yet to peak. And if some have it their way it will continue indefinitely, merely going, in medical terminology, from epidemic to endemic. That is, it will never fully go away no matter what. We apparently finally have some medicines that work with countless more being tested, doctors have gotten better at applying treatments, vaccines are being administered in what is by far record time, and yet the media and public health community onslaught shows absolutely no sign of abating.

We have heard White House Covid-19 task force member Dr. Deborah Birx claim “This is not just the worst public health event. This is the worst event that this country will face, not just from a public health side.” Oy!

Frauds: The Election, Media, Congressional Democrats, and the FBI

by Clarice Feldman

American Thinker

The first of this week’s two biggest stories was Friday evening’s action by the Supreme Court refusing to hear the lawsuit brought by Texas and other states respecting the evident fraud in the balloting in Wisconsin, Pennsylvania, Georgia, and Michigan. I expressed my views on this yesterday here: ‘A Republic, If You Can Keep It’ | The Pipeline

The first of this week’s two biggest stories was Friday evening’s action by the Supreme Court refusing to hear the lawsuit brought by Texas and other states respecting the evident fraud in the balloting in Wisconsin, Pennsylvania, Georgia, and Michigan. I expressed my views on this yesterday here: ‘A Republic, If You Can Keep It’ | The Pipeline

In short, I believe if the Court had decided to take it, it would not have decided who won these states. Instead, had it decided that the electors from those states were chosen illegally, it would have remanded the complaints to the legislatures of these states, which have the responsibility to fashion a remedy. In any event, had they decided to throw out the electoral votes of those states, Biden would still have one more electoral vote than President Trump, as the majority is determined by the number of electoral votes actually cast.

Judge Orders California Sheriff to Reduce Inmate Population by 50% Due to Covid-19 Threat

by Penka Arsova

LaCorte News

A judge has ordered the sheriff of Orange County, California, to slash the number of incarcerated people by 50% to protect those more vulnerable to coronavirus infections.

A judge has ordered the sheriff of Orange County, California, to slash the number of incarcerated people by 50% to protect those more vulnerable to coronavirus infections.

The ruling: Superior Court Judge Peter Wilson ruled that Orange County Sheriff Don Barnes violated the constitutional right of individuals in custody who are considered to be at a higher risk of contracting COVID-19 and developing severe symptoms due to medical and age-related reasons. Wilson said that the sheriff showed “deliberate indifference” to the threat that the virus poses to the immunocompromised and older adults.

“The uncontested facts found here include that conditions in the jail do not permit proper social distancing, there is no mandatory testing of staff or asymptomatic detainees after intake, and no strictly enforced policy of requiring masks for all staff interaction with inmates,” Judge Wilson wrote, the Los Angeles Times reported.

Treasury Still Holding $340 Billion in CARES Act Funding – Just $114 Billion Has Been Handed Over to the Fed

However, according to the Fed’s December 10th H.4.1 report, almost 9 months after the CARES Act became law, Treasury has handed off to the Fed only $114 billion of the authorized $454 billion total.

by Dave Allen for Discount Gold & Silver

The International Forecaster

Under the historic, bipartisan CARES Act, passed by Congress and signed into law in late March, the plan was for the Treasury Department to allocate $454 billion of taxpayer funds to the Federal Reserve.

Under the historic, bipartisan CARES Act, passed by Congress and signed into law in late March, the plan was for the Treasury Department to allocate $454 billion of taxpayer funds to the Federal Reserve.

The Fed, in turn, was to leverage that money by 10 times, or roughly $4.54 trillion, to preserve the economy – particularly by keeping workers on the payroll and businesses surviving until the pandemic was brought under control.

Fed Chair Jerome Powell explained the plan like this: “We’re required to get full security for our loans so that we don’t lose money.

“So, the Treasury puts up money as we estimate what the losses might be…Effectively $1 of loss absorption of backstop from Treasury is enough to support $10 of loans.”

However, according to the Fed’s December 10th H.4.1 report, almost 9 months after the CARES Act became law, Treasury has handed off to the Fed only $114 billion of the authorized $454 billion total.

Fauci: Take the Vaccine, or Wear the Submission Muzzle Forever

by Mac Slavo

SHTF Plan

Dr. Anthony Fauci has now said that unless Americans are willing to take the rushed coronavirus vaccine with “significant” side effects, they will be wearing the submission muzzle forever. Even if enough submit to the vaccine, Fauci wants us masked for at least 6 more months.

The masks will never go away until people wake up to what they really are: a symbol of submission to the controllers. Fauci declared that face masks are here to stay unless enough Americans get the coronavirus vaccination, and even then it will take at least six months before the masks can be left behind, according to a report by ZeroHedge.

Speaking to Chris Cuomo, Fauci was asked if the masks could come off, to which he replied “Well, the answer is not unless you get the overwhelming majority of the country vaccinated and protected and get that umbrella of what we call herd immunity.”

This Time the Shoeshine Boy is a Player

by Rick Ackerman

RickAckerman.com

Here was a reassuring headline last week from Forbes online: Airbnb’s Higher Valuation Is Reasonable. What a relief! We can always count on the financial news media to provide a list of reasons why a stock is not overvalued no matter what its price. The trouble is, the story appeared before ABNB went public last Thursday. The IPO had been pegged at $56-$60 per share, amounting to a valuation of around $35 billion. However, when the stock actually began to trade, it opened at $146 and rose in minutes to $165. That’s a valuation of more than $100 billion – not bad for a business that has been drowning in red ink since the pandemic hit last spring and which even before then was challenged to bring any revenues down to the bottom line. “The new valuation,” continued Forbes, referring to the $60/share benchmark, “changes nothing about the firm’s business but increases the execution risk of management achieving the expectations baked into the stock.”

Here was a reassuring headline last week from Forbes online: Airbnb’s Higher Valuation Is Reasonable. What a relief! We can always count on the financial news media to provide a list of reasons why a stock is not overvalued no matter what its price. The trouble is, the story appeared before ABNB went public last Thursday. The IPO had been pegged at $56-$60 per share, amounting to a valuation of around $35 billion. However, when the stock actually began to trade, it opened at $146 and rose in minutes to $165. That’s a valuation of more than $100 billion – not bad for a business that has been drowning in red ink since the pandemic hit last spring and which even before then was challenged to bring any revenues down to the bottom line. “The new valuation,” continued Forbes, referring to the $60/share benchmark, “changes nothing about the firm’s business but increases the execution risk of management achieving the expectations baked into the stock.”

The Deracination of the Western World

by Dr. Paul Craig Roberts

PaulCraigRoberts.org

The Western World has entered a Dark Age from which it is unlikely to emerge intact. In Europe nations once based on distinct ethnicity have opened their borders to mass immigration of unassimilable peoples, thus destroying their internal unity. These same nations have also abandoned their sovereignty. The US, EU, and Globalism preside over Europe. The main European countries no longer consist of nation states. In France citizens who complain of the marginalization of the French people in their own country are prosecuted. In Germany they are branded Nazis and subjected to legal threats. Germany doesn’t even permit its citizens to express opinions with which Jews disagree. Having just completed a two and a half year prison sentence for Holocaust denial, 92 year old Ursula Haverbeck has been convicted again by German courts for doubting aspects of the Holocaust in a 2018 interview. In Greece a nationalist political party, Golden Dawn, was declared racist, xenophobic, and fascist, charged with running a criminal organization and had its leaders and its members in the Greek government arrested and sentenced to prison. The ethnic base of European countries has been effectively silenced.