from WallStForMainSt

Klobuchar on Trump Pardons: ‘He’s Literally Burning Down the House of Justice as He Walks Out the Door’

by Trent Baker

Breitbart.com

During a Wednesday appearance on CNN’s “New Day,” Sen. Amy Klobuchar (D-MN) sounded off on President Donald Trump’s recent round of pardons.

During a Wednesday appearance on CNN’s “New Day,” Sen. Amy Klobuchar (D-MN) sounded off on President Donald Trump’s recent round of pardons.

According to Klobuchar, Trump is “literally burning down the house of justice as he walks out the door” by pardoning people mostly related to him and “his own political interests.” She called Trump’s pardons “a travesty.”

“Well, 88% of them — a study was done — of his pardons are somehow related to Donald Trump’s interests or to his own political interests,” Klobuchar said of Trump’s pardons. “So, when you look at them, even though they all seem different, as you point out, about murderers, about money laundering, about a Congress using campaign funds to send his pet rabbit on a trip — true fact — when you look through all of them, what ties them together is corruption. It is corruption. And so, when you think of the pardon power, that is supposed to be about forgiveness and mercy.”

Singapore’s Covid Experience and Overestimated Death Rates

by Ethan Yang

The American Institute for Economic Research

On December 14, 2020 Singapore’s Ministry of Health communicated a summary of the steps it took to contain a raging Covid-19 breakout in its migrant worker living facilities. The report itself claimed that the city-state had over 320,000 migrant workers living in cramped dormitories and around 47% or a little over 152,000 contracted Covid-19. This number includes individuals either confirmed with a PCR test, which tests for traces of the virus and is commonly employed as a nasal swab or a serology test, which tests for Covid-19 antibodies. A serology test can detect those who have been exposed in the past and have since recovered or never developed symptoms at all.

On December 14, 2020 Singapore’s Ministry of Health communicated a summary of the steps it took to contain a raging Covid-19 breakout in its migrant worker living facilities. The report itself claimed that the city-state had over 320,000 migrant workers living in cramped dormitories and around 47% or a little over 152,000 contracted Covid-19. This number includes individuals either confirmed with a PCR test, which tests for traces of the virus and is commonly employed as a nasal swab or a serology test, which tests for Covid-19 antibodies. A serology test can detect those who have been exposed in the past and have since recovered or never developed symptoms at all.

In Singapore, migrant workers, mostly from other parts of Asia such as India and China, are subject to a number of restrictions on their freedoms and are often seen as second class citizens.

On Truth

by Dr. Paul Craig Roberts

PaulCraigRoberts.org

The Western World’s concept of objective truth was challenged by Karl Marx, who declared truth to be class truth. The capitalists had their truth, and the workers had their truth. The workers’ truth had more validity, because they were oppressed, whereas the capitalists’ truth was self-serving.

The Western World’s concept of objective truth was challenged by Karl Marx, who declared truth to be class truth. The capitalists had their truth, and the workers had their truth. The workers’ truth had more validity, because they were oppressed, whereas the capitalists’ truth was self-serving.

This assault on objective truth did not succeed except on a limited basis for a short time in the Soviet Union where Lysenko damaged Soviet biology and agriculture at the expense of a number of lives.

The assault on objective truth in the 21st century is race based and gender based. The races and genders have their own truths. The truths that have validity are those of the oppressed—people of color, feminists, transgendered, and sexual deviants. The truths without validity are those of the oppressors—white heterosexual males.

Happy 70th! “Shipageddon” and Rise of the Robots

from King World News

As we move through the last few trading days of the year, here is a look at Happy 70th, “Shipageddon,” and rise of the robots.

As we move through the last few trading days of the year, here is a look at Happy 70th, “Shipageddon,” and rise of the robots.

Happy 70th!

December 23 (King World News) – Danielle DiMartino Booth at Quill Intelligence: The legendary Barry Gordon is going on his 70th year in show business. No surprise, the actor/voice actor/singer/talk show host holds the record as the longest-serving president of the Screen Actors Guild (1988-1995). At this time of the year especially, we are reminded of just how tender an age he started his career. Born December 21, 1948 in Brookline, Massachusetts, Gordon debuted at the ripe old age of three, winning second place on Ted Mack’s Amateur Hour. He’d have wait a few years before hitting it big singing lead vocals for Art Mooney and His Orchestra. At six years old, Gordon became the youngest performer ever to hit the Billboard chart. The song, “Nuttin’ for Christmas,” peaked at number six in 1955; after selling more than a million copies, the tune was certified gold…

Inflation Alert with Jordan Roy-Byrne

from Kerry Lutz's Financial Survival Network

Look out above. Jordan Roy-Byrne sees things unfolding later next year. Once Covid has subsided, probably after the vaccine is distributed and herd immunity is achieved, people will start leaving their homes and spending money to make up for lost time. Money will be pouring into the economy. This will be the beginning of inflation, led by increased consumer prices. A look at the trend lines, shows the CPI is already heading higher. There will be a temporary growth pop and we’re seeing copper take off, as a result; it’s currently trading at $3.58. Commodity price inflation is baked in the cake. It’s anticipating growth and inflation, a strange convergence. No matter how you cut it, interesting times are ahead.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Q1 Stock Market Bust Up? with Sam McElroy

from Kerry Lutz's Financial Survival Network

Sam McElroy graduated from Hampton University, magna cum laude, and holds several financial licenses. He says that there’s no alternative to the stock market. Investors are staying in the market because they believe that the market always comes roaring back. They were slammed in March, but now they’re up for the year. The market could continue to advance and this has created complacency. However, a wise investor is always prepared for the inevitable pullbacks that inevitably occur. We could very well see a reversion to the mean. Will it be this year or next? Beware of corrections, but the timing is the tough part. Whenever the market is pushing higher, bears are always portrayed as alarmists. And then in a matter of days they can appear to be prophets. Covid has put a dent global wealth with 200-300 million people unemployed and trillions of wealth lost. Q1 pullback in equities? Or perhaps a consumption boom? Let’s see what happens next.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Rare Opportunity for a World-Class Silver Discovery with Tier One Metals’ Chairman Ivan Bebek

Tier One Metals is a precious metals exploration company that was spun out from Auryn Resources on October 9, 2020. Tier One Metals is currently an unlisted reporting issuer that will be seeking listings in Q1. The Company is focused on creating significant value for shareholders through the exploration and potential discovery of world-class silver, gold and copper deposits in southwest Peru. Tier One is actively planning to complement its existing strong property portfolio through additional precious metal acquisitions in Peru, leveraging off its in-country experienced personnel teams. Tier One Metal’s main focus currently is the 100% owned Curibaya project, which consists of approximately 11,000 hectares and is located approximately 48 km north-northeast of the provincial capital, Tacna, accessible by road.

Tier One Metals is in the process of acquiring drill permits for Curibaya and completing targeting at the project. Initial surface sampling programs at Curibaya have returned numerous high-grade samples of silver, gold and copper over a four-kilometer by four-kilometer alteration system. In this interview Chairman Ivan Bebek provides an update on Tier One Metals’ progress, upcoming developments and overall investment value proposition.

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

Extreme Charts – December 22

by John Rubino

Dollar Collapse

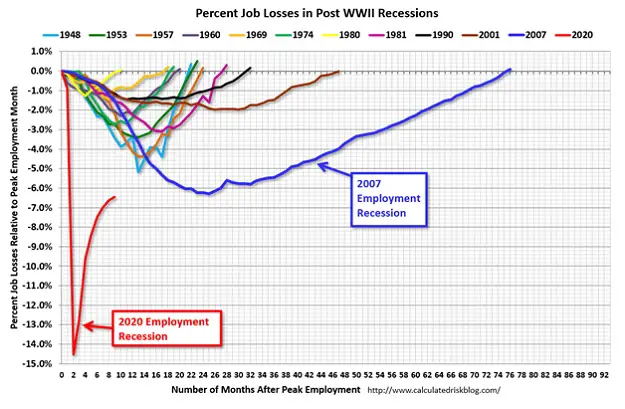

It’s official: This has been the weirdest year in US economic history.

It’s official: This has been the weirdest year in US economic history.

Starting with the shape of the recent recession, even 2007 — an odd one in its own right — looks almost normal when compared with 2020,

[…] Labor force participation and the Federal Reserve’s balance sheet have veered in opposite directions.

[…] The government is spending like crazy while tax receipts stagnate.

[…] Growth of the money supply has gone vertical.

Hospital Workers Turn Down Covid Vaccine: “There’s Too Much Mistrust”

from Zero Hedge

Less than a week after we reported on widespread resistance among healthcare workers in one Chicago hospital, BeckersHospitalReview.com’s Ayla Ellison reports that the virus of vaccine mistrust is spreading…

Many employees at Howard University Hospital in Washington, D.C., have reservations about taking the COVID-19 vaccine, and CEO Anita Jenkins is trying to get workers to follow her lead by getting vaccinated, according to CNN.

The hospital, a major healthcare provider for the Black community, received 725 doses of the Pfizer vaccine Dec. 15 and expects to receive a second shipment this week. As of Dec. 18, only about 600 of the hospital’s 1,900 employees had signed up for the shots, according to Kaiser Health News.

Why I Will Not Accept Joe Biden as President

Unwillingness to accept election result grows out of a level of outrage unlike anything previously experienced

by Newt Gingrich

Washington Times

A smart friend of mine who is a moderate liberal asked why I was not recognizing Joe Biden’s victory.

A smart friend of mine who is a moderate liberal asked why I was not recognizing Joe Biden’s victory.

The friend made the case that Mr. Biden had gotten more votes, and historically we recognize the person with the most votes. Normally, we accept the outcome of elections just as we accept the outcomes of sporting events.

So, my friend asked why was 2020 different?

Having spent more than four years watching the left #Resist President Donald Trump and focus entirely on undoing and undermining the 2016 election, it took me several days to understand the depth of my own feelings.

As I thought about it, I realized my anger and fear were not narrowly focused on votes. My unwillingness to relax and accept that the election grew out of a level of outrage and alienation unlike anything I had experienced in more than 60 years involvement in public affairs.

The Latest Updates from Martin Armstrong – 2020.12.22

by Martin Armstrong

Armstrong Economics

Chairman Report on Election in Georgia Warns of Untrustworthiness

Chairman Report on Election in Georgia Warns of Untrustworthiness

The 2020 Census – Counting Illegal Aliens

Pelosi Gone! AOC is a tissy! Conservative Democrats Just May Spoil the Party

Market Talk – December 22, 2020

Did Biden Get a Real Vaccine or Water?

Nullification Isn’t Just for Democrats, Anymore

by Geoffrey P. Hunt

American Thinker

Since the 2016 election, Democrats have made all kinds of nullification standard fare, but more pernicious than displaying a disagreeable temperament, or contrary opinion; more than First Amendment-protected civil disobedience.

Since the 2016 election, Democrats have made all kinds of nullification standard fare, but more pernicious than displaying a disagreeable temperament, or contrary opinion; more than First Amendment-protected civil disobedience.

Instead, making that which is legitimate, illegitimate; making what is illegitimate, legitimate. Making what is decent, abhorrent; making what is grotesque, glorious—all enjoying approbation from a fawning media.

Any and all tactics, now including election fraud, and covering up bribery of a president to-be, are used unapologetically, with no subterfuge, and with impunity. Truth now is subjective, conditioned on identity and whether it will be canceled by the mob, or approved by the neo-aristocracy.

To “nullify,” derived from the Latin “nullus” meaning none or nothing, is more than just saying “no.” It can be athletic repudiation, loathing, despising – in the vernacular: “Hell, no!”

Americans Are Sick of Arbitrary Covid-19 Restrictions

A year into the pandemic, politicians still have not digested the dangers of careless public health measures.

by Jacob Sullum

Reason.com

“I’m not sure we know what we’re doing,” San Mateo County Health Officer Scott Morrow recently confessed, referring to the myriad puzzling restrictions state and local governments have imposed in the name of fighting COVID-19. Morrow’s doubts are striking, because last spring he joined other San Francisco Bay Area officials in imposing the nation’s first lockdowns, which he still thinks were justified.

“I’m not sure we know what we’re doing,” San Mateo County Health Officer Scott Morrow recently confessed, referring to the myriad puzzling restrictions state and local governments have imposed in the name of fighting COVID-19. Morrow’s doubts are striking, because last spring he joined other San Francisco Bay Area officials in imposing the nation’s first lockdowns, which he still thinks were justified.

Morrow’s remarkable statement, which he posted on his department’s website earlier this month, shows that politicians and bureaucrats are still struggling to justify edicts that are often arbitrary and scientifically dubious. A year into the COVID-19 epidemic, many of them have yet to digest the dangers of carelessly exercising their public health powers.

Although research in other countries has shown that K-12 schools are not an important source of virus transmission, they remain closed in California and many other jurisdictions, largely because of resistance from teachers unions. “The adverse effects for some of our kids will likely last for generations,” Morrow warned.

2020 Finally Draws to a Close

by Craig Hemke

Sprott Money

It has been a long year. Excruciatingly long. But it’s nearly over, so we should take stock of the gains we’ve seen and begin to look ahead to 2021.

It has been a long year. Excruciatingly long. But it’s nearly over, so we should take stock of the gains we’ve seen and begin to look ahead to 2021.

As 2020 began, no one outside of the Chinese Communist Party had heard of a novel new coronavirus that would soon be called Covid-19. The emergence of this virus, and the ensuing pandemic, would be the primary news story and driving force for the global markets in 2020. Expect this to continue in 2021.

However and regardless, as 2020 began, the precious metals were poised to continue their bull markets that began in earnest in November of 2018. The onset of the pandemic only accelerated this bull trend. The continuation of the Covid Crisis in 2021 will add more fuel to the rally, but it won’t be the only rationale for driving precious metals prices even higher.

Tesla Was Added to the SPX – Now What?

by David Kranzler

Investment Research Dynamics

Tesla is emblematic of the fraud and deception that has permeated every nook and cranny of the United States’ economic and political system. It is the poster-child for the biggest stock bubble in history.

Tesla is emblematic of the fraud and deception that has permeated every nook and cranny of the United States’ economic and political system. It is the poster-child for the biggest stock bubble in history.

Well, the SPX index inclusion event is finally over. TSLA shares were quite volatile on Friday. TSLA was up over $30 early in the trading session Friday. In the last hour of trading, TSLA swung from from up $20 to down $20 and ended up closing up $39, as roughly 95 million shares crossed the tape at the close, likely index funds finalizing their rebalancing. The stock closed down $19 in the after-hours trading on Friday.

While it’s impossible to know for sure, my bet is that TSLA will start dropping precipitously in price sometime over the next 3-4 weeks. As of mid-day Tuesday (Dec 21) the shares are down 8.6% from Friday’s close.

For 55 Percent of Americans, 2020 Has Been “a Personal Financial Disaster”

by Michael Snyder

End of the American Dream

One of the big reasons why so many Americans are angry about the size of the “stimulus payments” in the COVID relief bill that Congress just passed is because this year has truly been a “financial disaster” for millions upon millions of people. More Americans than ever before are just barely scraping by from month to month, and $600 is just not going to go very far. In 2020, small businesses have been getting slaughtered by the thousands, millions of Americans are in imminent danger of being evicted from their homes, and more than 70 million new claims for unemployment benefits have been filed since the COVID pandemic first started. The U.S. has plunged into a brutal economic depression, and most of the country is desperately hoping that the federal government will do more to bail them out.

One of the big reasons why so many Americans are angry about the size of the “stimulus payments” in the COVID relief bill that Congress just passed is because this year has truly been a “financial disaster” for millions upon millions of people. More Americans than ever before are just barely scraping by from month to month, and $600 is just not going to go very far. In 2020, small businesses have been getting slaughtered by the thousands, millions of Americans are in imminent danger of being evicted from their homes, and more than 70 million new claims for unemployment benefits have been filed since the COVID pandemic first started. The U.S. has plunged into a brutal economic depression, and most of the country is desperately hoping that the federal government will do more to bail them out.

Of course the truth is that we can’t actually afford another 900 billion dollar “stimulus package” on top of all the other “stimulus packages” that were already passed this year.