from RonPaulLibertyReport

Suck It, Wall Street

In a blowout comedy for the ages, finance pirates take it up the clacker

by Matt Taibbi

Hate Inc.

In the fall of 2008, America’s wealthiest companies were in a pickle. Short-selling hedge funds, smelling blood as the global economy cratered, loaded up with bets against finance stocks, pouring downward pressure on teetering, hyper-leveraged firms like Morgan Stanley and Citigroup. The free-market purists at the banks begged the government to stop the music, and when the S.E.C. complied with a ban on financial short sales, conventional wisdom let out a cheer.

“This will absolutely make a difference,” economist Peter Cardillo told CNN. “Now, if there is any good news, shorts will have to cover.”

At the time, poor beleaguered banks were victims, while hedge funds betting them down as the economy circled the drain were seen as antisocial monsters. “They are like looters after a hurricane,” seethed Andrew Cuomo, then-Attorney General of New York State, who “promised to intensify investigations into short selling abuses.” Senator John McCain, in the home stretch of his eventual landslide loss to Barack Obama, added that S.E.C. chairman Christopher Cox had “betrayed the public’s trust” by allowing “speculators and hedge funds” to “turn our markets into a casino.”

Americans Abandoning Free Speech Better Brace for the Consequences

Government will happily suppress misinformation in favor of misinformation of its own.

by J.D. Tuccille

Reason.com

In the panicked aftermath of the 9/11 terrorist attacks, the powers-that-be dusted off wish lists of surveillance-state powers and began monitoring and tracking us in ways that affect our lives two decades later. The political turbulence of recent years, culminating in the Capitol riot on January 6, may similarly liberate the political class to do its worst—this time with free speech as the target. The effort will likely again enjoy support from members of the public eager to surrender their freedom.

In the panicked aftermath of the 9/11 terrorist attacks, the powers-that-be dusted off wish lists of surveillance-state powers and began monitoring and tracking us in ways that affect our lives two decades later. The political turbulence of recent years, culminating in the Capitol riot on January 6, may similarly liberate the political class to do its worst—this time with free speech as the target. The effort will likely again enjoy support from members of the public eager to surrender their freedom.

“We need to shut down the influencers who radicalize people and set them on the path toward violence and sedition,” argued columnist Max Boot in The Washington Post. His solution? Carriers should drop Fox News and other conservative cable news outlets if they don’t stop spreading “misinformation.” Boot also believes that “Biden needs to reinvigorate the FCC” to impose British-style controls over the news—never mind that the Federal Communications Commission (FCC) doesn’t have the authority to regulate cable outlets that it has over broadcasters that use public airwaves.

Laws? Only for You. Bend Over.

by Karl Denninger

Market-Ticker.org

The snicker factor of a bunch of hedge fund and other Wall Street folks screaming about GameStop (GME) and others is astoundingly funny.

Let’s start with the law: It is illegal to “manipulate” a stock or other security — that is, it is unlawful to express an intent to sell or buy for any other reason than to actually sell or buy, and it is also illegal to intentionally mislead others about your reasons for doing so.

This is why “spoofing” (although almost-never prosecuted) is against the law. “Spoofing” is the practice of laying in a bid or offer you have no intention of being filled on for the express reason of making other people think you want to sell or buy something, when in fact you want to do the opposite. They attempt to follow your claimed “expression of intent” only to find your offer or bid has disappeared, the price moves and they come in on the other side. It sounds like picking up pennies in front of a steamroller and it is, but it can be very profitable especially if your connection to the exchange is fast enough that the risk of getting filled is extremely low in that you can cancel your order before anyone can hit it.

Get Ready for Your Covid Anal Swab

by Simon Black

Sovereign Man

Are you ready for this week’s absurdity? Here’s our Friday roll-up of the most ridiculous stories from around the world that are threats to your liberty, risks to your prosperity… and on occasion, inspiring poetic justice.

Are you ready for this week’s absurdity? Here’s our Friday roll-up of the most ridiculous stories from around the world that are threats to your liberty, risks to your prosperity… and on occasion, inspiring poetic justice.

China Pushes New Trend: Anal Swab COVID Tests

In the earliest days of the pandemic, China locked down the citizens of Wuhan, going so far as to weld some people in their homes in an attempt to control the spread of COVID.

Little did we know at the time that China’s aggressive authoritarian policies would become the norm across the world.

Now China has taken the depths of their penetration to a whole new level… because now the regime has started to use anal swabs, inserted about two inches into the anus, to test for COVID.

Update on Fed’s QE: The Crybabies on Wall Street, which Clamored for More, Are Disappointed

by Wolf Richter

Wolf Street

And five SPVs expired, including the one that bought corporate bonds and bond ETFs.

And five SPVs expired, including the one that bought corporate bonds and bond ETFs.

The Fed has now put on ice five of its SPVs (Special Purpose Vehicles) which had been designed back in March to bail out the bond market. It unwound its repo positions last June. Its foreign central bank liquidity swaps are now down to near-nothing except with the Swiss National Bank, which seems to have a need for dollars. The Fed has been adding to its pile of Treasury securities at the rate spelled out in its FOMC statements, thereby monetizing part of the US government debt. And it has been adding to its pile of Mortgage Backed Securities (MBS).

Now Reddit Investors Are Talking About Targeting Silver, and That Could Change Everything

by Michael Snyder

The Economic Collapse Blog

For decades, the big fish on Wall Street have been able to do virtually anything that they want, but now the small fish are fighting back and it has been a beautiful thing to watch. Finally it is payback time, and the losses have been absolutely staggering. In fact, Reuters is reporting that short sellers have lost more than 70 BILLION dollars so far this year. But nobody should be crying for the short sellers. As Charles Payne pointed out during an epic rant on Fox Business, the short sellers have ruthlessly crushed countless businesses over the years, and they did so without showing any mercy whatsoever.

For decades, the big fish on Wall Street have been able to do virtually anything that they want, but now the small fish are fighting back and it has been a beautiful thing to watch. Finally it is payback time, and the losses have been absolutely staggering. In fact, Reuters is reporting that short sellers have lost more than 70 BILLION dollars so far this year. But nobody should be crying for the short sellers. As Charles Payne pointed out during an epic rant on Fox Business, the short sellers have ruthlessly crushed countless businesses over the years, and they did so without showing any mercy whatsoever.

So now the big hedge funds want mercy themselves?

It’s not likely to happen.

Comex Silver and Reddit

by Craig Hemke

TF Metals Report

The Reddit-driven fun continues today with no end in sight as of this moment. Can our new friends continue this momentum into next week and, if they do, what might be some targets to watch?

The Reddit-driven fun continues today with no end in sight as of this moment. Can our new friends continue this momentum into next week and, if they do, what might be some targets to watch?

More on that in a minute. First, let’s just take stock of where we are as I type. Comex gold is up 1.3% but, more importantly, Comex silver is up 5.4% and pushing toward $28. The shares are rolling again, too, with some of the most heavily-shorted like First Majestic jumping higher again.

And this is awesome! Again, though I’m not sure much can be done to harm The Banks through buying at the Comex level, there certainly exists the possibility that enough of a move in price could spark some additional momentum…which would lead to some additional pain for The Banks…which could lead to some additional momentum…which might lead to some Bank short covering…which could lead to some additional momentum….and if this continues long enough, we might do some real damage.

Stock Wars! The People Rise Up Against Wall Street

Reddit turns the tables on the big hedge funds

by Adam Taggart

Chris Martenson’s Peak Prosperity

An epic David-vs-Goliath battle has erupted on Wall Street.

An epic David-vs-Goliath battle has erupted on Wall Street.

And it may just change the future of investing, helping to tilt the playing field away from the huge unfair advantage the banking cartel has enjoyed for decades.

In case you’ve been sleeping under a rock for the past week: millions of individual investors have banded together using Reddit chat boards, Twitter and other forms of social media to wage concentrated attacks against large hedge funds who were recklessly (and possibly illegally) over-shorting the stocks of weak companies.

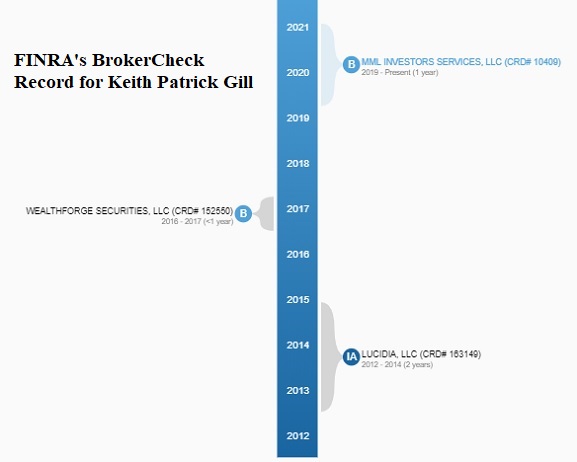

GameStop: Will the Real Keith Gill Please Stand Up

by Pam Martens

Wall Street on Parade

The Wall Street Journal has an article up naming Keith Gill as the fellow that started the GameStop mania at WallStreetBets. The article says that Gill “until recently worked in marketing for Massachusetts Mutual Life Insurance Co.”

The Wall Street Journal has an article up naming Keith Gill as the fellow that started the GameStop mania at WallStreetBets. The article says that Gill “until recently worked in marketing for Massachusetts Mutual Life Insurance Co.”

According to FINRA’s BrokerCheck, a Keith Patrick Gill, employed at a subsidiary of Massachusetts Mutual, MML Investor Services, has held trading licenses since 2012 and got his Series 7 stock trading license in 2016. On November 1, 2016, FINRA shows that Gill received his Series 24 Principal’s license, making him eligible to supervise other licensed brokers. FINRA also shows that Gill has worked for three trading houses since 2012.

Could there be two Keith Gills working for MassMutual? Yes there could. But it would certainly behoove the Wall Street Journal reporters to revisit their reporting.

If the guy who started the GameStop mania has passed a multitude of trading exams showing his knowledge of exactly what constitutes market manipulation, this is a whole new ballgame.

What Will Reddit Do with Silver?

by Keith Weiner

Silver Seek

The hot story this week is the incredible run up in the stock price of GameStop. A week ago, this was a $40 stock, with the company losing well over $4 a share. That’s not surprising for a retail store operator in the world of lockdowns. What is surprising is what happened this week.

The hot story this week is the incredible run up in the stock price of GameStop. A week ago, this was a $40 stock, with the company losing well over $4 a share. That’s not surprising for a retail store operator in the world of lockdowns. What is surprising is what happened this week.

The share price ran up to almost $500.

To understand why, let’s take a step back and look at the context.

What Caused GameStop to Run Up?

The stock is heavily shorted, including by hedge funds—probably because the prospects for money-losing retailers are bleak. Then a group on Reddit, Wall Street Bets, promoted the idea of buying the stock because the short interest was greater than the total number of shares (they assumed that this means illegal naked shorting—not necessarily.)

“The Squad” Rejects Expansion of Domestic Terrorism Powers Aimed at Trump Supporters

by Alice Salles

Mises.org

It’s not just Trump supporters outraged by the newly proposed domestic terrorism laws targeting them. None of “the Squad,” including Rep. Alexandra Ocasio-Cortez and other avowed leftists, are tagging along with many of their Democratic colleagues.

It’s not just Trump supporters outraged by the newly proposed domestic terrorism laws targeting them. None of “the Squad,” including Rep. Alexandra Ocasio-Cortez and other avowed leftists, are tagging along with many of their Democratic colleagues.

The events of January 6, or how the “attack on the Capitol” was covered in the media, stirred up a frenzy among Democrats and their supporters to deploy some retaliation against not only the so-called domestic terrorists of that fateful day but also many of their fellow Trump supporters.

President Joe Biden ordered investigations from three intelligence agencies into “domestic violent extremism,” while in Congress, there are moves to establish new offices in the FBI, Department of Homeland Security, and Department of Justice to pursue ill-defined public enemies.

Despite the heightened partisan tensions in recent weeks and months, some progressive Democrats are drawing the line at expanding the police state’s powers over political dissidents.

Going Down the Bitcoin Rabbit Hole

by David Kranzler

Investment Research Dynamics

“There was euphoria in stocks and cryptos late in 2017, but now we are seeing much more retail participation. There was a lot of optimism even 6 months ago, but now the worst stocks (penny stocks) are leading the way instead of FAAMNG. This is a sign we are in the final stages of the bubble. Investors in money losing hype stocks and cryptocurrencies will have nothing to hold onto when the momentum shifts.” – Alex Pitti, “The Warning Sign That Correctly Called The Last Bitcoin Crash Is Back,” Seeking Alpha

In going down the Bitcoin rabbit-hole and digging even deeper into the inner-workings of the Bitcoin market, I discovered that some of the offshore Bitcoin trading platforms have enabled Bitcoin buyers/traders to employ up 100x leverage. The offshore platforms do not accept dollars. There’s an intermediate cryptocurrency which is considered a “stablecoin” called Tether issued by Tether Ltd. U.S. Bitcoin buyers using the offshore platforms to trade Bitcoin have to exchange dollars for Tethers or other stablecoins. Supposedly a Tether is fixed at $1. Tethers are then used to purchase Bitcoins on margin.

You Will Own Nothing and Satan Klaus Will Be Happy… and How GameStop Traders Fight Back

by Jeff Berwick

Dollar Vigilante

Bend over btchs. You anal schwab is ready.

Bend over btchs. You anal schwab is ready.

Well, I suppose you still have a choice. (If you’re outside China)

Do you want to be Schwabbed in your brain or your butt?

[…] That is the question…

You’ll own nothing and be happy

Remember when the WEF said “You will own nothing and you’ll be happy?”

The ways in which you’ll own nothing are spectacularly abundant and include giving up your:

Privacy for the Greater Good

Dignity for the Greater Good

Human Connection & Values for the Greater Good

Immune System & Good Health for the Greater Good

Elon Musk Adds ‘#Bitcoin’ to His Twitter Bio, Bitcoin Surges By 20%

by Ian Haworth

Daily Wire

In an already turbulent and volatile week for the financial markets, with the shorted stock prices of companies like GameStop surging, eyes returned to the world of Bitcoin after Elon Musk added “#bitcoin” to his Twitter bio.

In an already turbulent and volatile week for the financial markets, with the shorted stock prices of companies like GameStop surging, eyes returned to the world of Bitcoin after Elon Musk added “#bitcoin” to his Twitter bio.

After the CEO of SpaceX and Tesla, Inc., added the hashtag early on Friday morning, Bitcoin prices skyrocketed by as much as 20%, climbing suddenly in the early hours of the morning. According to cryptocurrency site CoinDesk, Bitcoin prices rose $5,000 in an hour to $37,299, increasing further to $37,653 by 8.00 a.m. ET.

Someone Edited a Maxine Waters Quote About Trump Staffers So That it Applied to Cuomo Staffers, and New York Democrats Are Outraged

by Jordan Lancaster

DailyCaller.com

A Twitter user edited a quote from Democratic California Rep. Maxine Waters originally directed at Trump staffers to make it appear it was targeted at New York Governor Andrew Cuomo’s staff, and Democrats were outraged.

A Twitter user edited a quote from Democratic California Rep. Maxine Waters originally directed at Trump staffers to make it appear it was targeted at New York Governor Andrew Cuomo’s staff, and Democrats were outraged.

At a 2018 rally, Waters encouraged her supporters to harass officials in the Trump administration over Trump’s immigration policies.

“Let’s make sure we show up wherever we have to show up,” she said at the California rally. “And if you see anybody from that Cabinet in a restaurant, in a department store, at a gasoline station, you get out and you create a crowd. And you push back on them. And you tell them they’re not welcome anymore, anywhere.”