by James Howard Kunstler

Kunstler.com

What were the execs of these mighty companies thinking — these knights of the boardroom, these capitalist geniuses, these moral nonpareils — when they cancelled Atlanta’s turn to host the midsummer All-star Game to “protest” Georgia’s passage of a law that requires voter ID? Surely that they were striking a righteous blow against systemic racism. And then, the rest of the world realized — almost immediately — that Major League Baseball requires online ticket buyers to show ID when they pick up their tickets at any stadium… and that Delta Airlines requires passengers to show ID (duh) before being allowed to fly in one of their airplanes… and that various other corporations snookered into this latest hustle such as Nike, Coca-Cola, and Calvin Klein support forced labor in the Asian nations that manufacture their products.

What were the execs of these mighty companies thinking — these knights of the boardroom, these capitalist geniuses, these moral nonpareils — when they cancelled Atlanta’s turn to host the midsummer All-star Game to “protest” Georgia’s passage of a law that requires voter ID? Surely that they were striking a righteous blow against systemic racism. And then, the rest of the world realized — almost immediately — that Major League Baseball requires online ticket buyers to show ID when they pick up their tickets at any stadium… and that Delta Airlines requires passengers to show ID (duh) before being allowed to fly in one of their airplanes… and that various other corporations snookered into this latest hustle such as Nike, Coca-Cola, and Calvin Klein support forced labor in the Asian nations that manufacture their products.

They’re Woke, you see. The tentacles of Wokery have reached into every last compartment of American life now, more effectively even than the Covid-19 corona virus. Wokeness emerged on the scene in 2014 when the feckless teenager Michael Brown was shot to death by police officer Darren Wilson upon arrest in Ferguson, Missouri, an event that kicked off the Black Lives Matter movement. The moral panic BLM ignited proved to be a spectacularly effective device for repelling the truth of the situation, and many more like it, which was that Michael Brown resisted arrest, fought with, and menaced officer Wilson before getting shot.

Today is the eighty-eighth anniversary of Executive Order 6102, signed by President Franklin Delano Roosevelt, “forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” The order was one of the several disastrous responses to the Great Depression that succeeded in escalating the financial crisis. Later in the year, the US Congress would pass a resolution retroactively supporting the legislation; however, it was the determined autocratic leadership of FDR that made way for these unprecedented measures. It would be a crime for Americans to hold gold for over forty years, until President Gerald Ford reversed the order in 1974.

Today is the eighty-eighth anniversary of Executive Order 6102, signed by President Franklin Delano Roosevelt, “forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States.” The order was one of the several disastrous responses to the Great Depression that succeeded in escalating the financial crisis. Later in the year, the US Congress would pass a resolution retroactively supporting the legislation; however, it was the determined autocratic leadership of FDR that made way for these unprecedented measures. It would be a crime for Americans to hold gold for over forty years, until President Gerald Ford reversed the order in 1974.

Do you feel like we are on the verge of a major tipping point? If so, you are definitely not alone. I felt like the first few months of this year would be a time of relative stability, but now I believe that global events will really start to heat up again in a major way. Interestingly, Saturday was the only day when the calendar will read 4/3/21 for the next 100 years. I don’t know if that means anything or not, but a lot of people on social media were commenting that 4-3-2-1 sounds an awful lot like some sort of a countdown. Perhaps it is just a coincidence that we crossed that date at such a critical time in our history, but without a doubt I do believe that we are rapidly approaching our “point of no return”.

Do you feel like we are on the verge of a major tipping point? If so, you are definitely not alone. I felt like the first few months of this year would be a time of relative stability, but now I believe that global events will really start to heat up again in a major way. Interestingly, Saturday was the only day when the calendar will read 4/3/21 for the next 100 years. I don’t know if that means anything or not, but a lot of people on social media were commenting that 4-3-2-1 sounds an awful lot like some sort of a countdown. Perhaps it is just a coincidence that we crossed that date at such a critical time in our history, but without a doubt I do believe that we are rapidly approaching our “point of no return”. Hawaii is an American gem, a collection of island paradises that one can travel to in a reasonable period of time from most of the US mainland. Hawaii poses no issues with language, currency, or cell phone service. The climate is wonderful, with beaches, palm trees, and sea breezes. Under COVID however, visiting Hawaii is more like checking into prison with myriad rules and procedures, including monitored quarantine and GPS bracelets.

Hawaii is an American gem, a collection of island paradises that one can travel to in a reasonable period of time from most of the US mainland. Hawaii poses no issues with language, currency, or cell phone service. The climate is wonderful, with beaches, palm trees, and sea breezes. Under COVID however, visiting Hawaii is more like checking into prison with myriad rules and procedures, including monitored quarantine and GPS bracelets. California teachers, backed by one of the country’s largest local teachers’ unions, are calling for child care for their own children in order to be able to return to the classroom and resume in-person learning.

California teachers, backed by one of the country’s largest local teachers’ unions, are calling for child care for their own children in order to be able to return to the classroom and resume in-person learning. The entire mindset has changed.

The entire mindset has changed. Facebook fact-checked a woman’s account of serious adverse reactions following the Covid vaccine posted one week before she died.

Facebook fact-checked a woman’s account of serious adverse reactions following the Covid vaccine posted one week before she died. That’s true even for us die-hard silver enthusiasts.

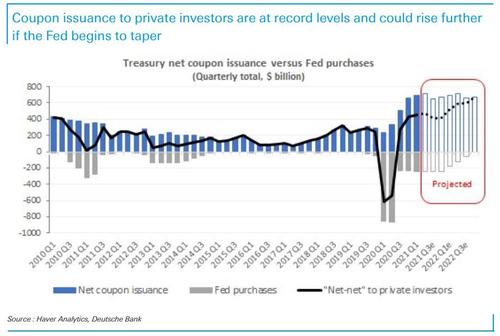

That’s true even for us die-hard silver enthusiasts. Central bankers and their comrades in Washington DC changed course in 2020. The policy shifted from “print money and hand it to Wall Street” to “helicopter money” in the form of direct payments and loans to citizens.

Central bankers and their comrades in Washington DC changed course in 2020. The policy shifted from “print money and hand it to Wall Street” to “helicopter money” in the form of direct payments and loans to citizens. Major League Baseball has reportedly made the decision to host the 2021 All Star Game in Colorado after caving to pressure from the political Left to boycott Georgia after Georgia passed a new election security law, which included having to include a driver’s license number when voting by mail.

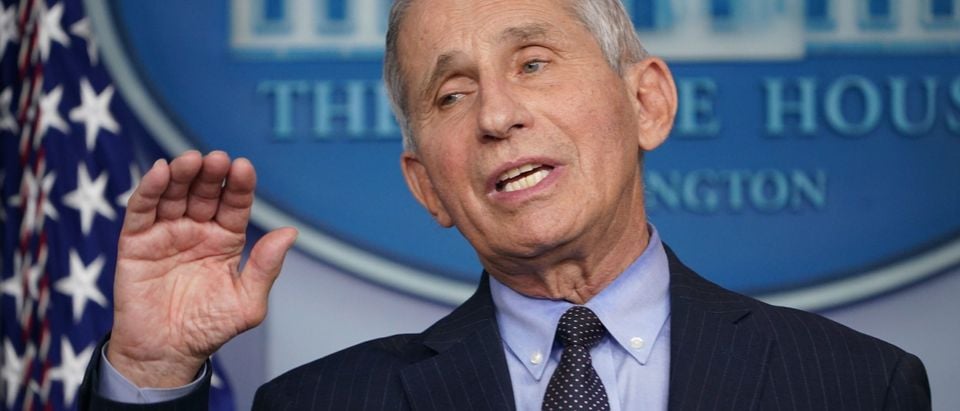

Major League Baseball has reportedly made the decision to host the 2021 All Star Game in Colorado after caving to pressure from the political Left to boycott Georgia after Georgia passed a new election security law, which included having to include a driver’s license number when voting by mail. Republican Rep. Scott Perry of Pennsylvania said it is “very concerning” that the federal infectious disease research organization led by Dr. Anthony Fauci bypassed federal oversight of a grant that funded a lab in Wuhan, China to genetically modify bat-based coronaviruses.

Republican Rep. Scott Perry of Pennsylvania said it is “very concerning” that the federal infectious disease research organization led by Dr. Anthony Fauci bypassed federal oversight of a grant that funded a lab in Wuhan, China to genetically modify bat-based coronaviruses. Two-hundred sixty-one California state prisoners have requested transfers to facilities that house the opposite gender since a new law went into effect on Jan. 1 — and 255 of them have requested to move from a male to a female corrections facility.

Two-hundred sixty-one California state prisoners have requested transfers to facilities that house the opposite gender since a new law went into effect on Jan. 1 — and 255 of them have requested to move from a male to a female corrections facility. From the indispensable Lockdown Sceptics I learned recently of this job ad in Britain:

From the indispensable Lockdown Sceptics I learned recently of this job ad in Britain: