by John Rubino

Dollar Collapse

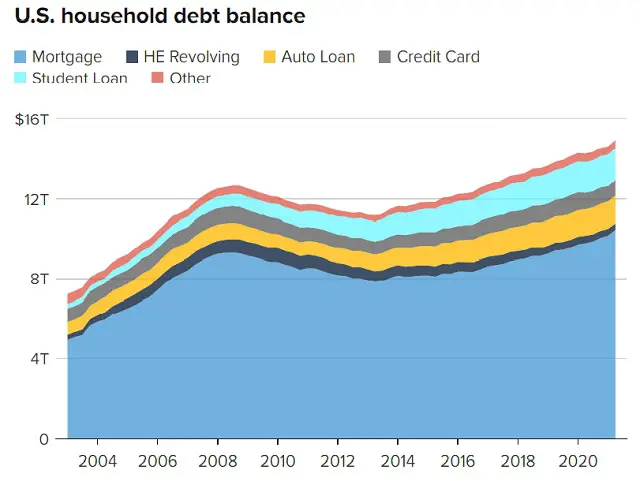

This week, US household debt jumped by the most in 14 years to a new all-time record. The last time it did something like this was in 2007, just as the housing mania was cresting and the Great Recession was looming.

This week, US household debt jumped by the most in 14 years to a new all-time record. The last time it did something like this was in 2007, just as the housing mania was cresting and the Great Recession was looming.

The biggest part of the recent gain was from mortgages (it’s official, we’re in housing bubble 2.0). But credit cards and auto loans are rocking too.

[…] So you’d think we’d have discovered all the ways that the unsophisticated can borrow too much money. But no, it turns out that the world is so in need of new credit sources that it’s resurrecting the layaway plan, which pre-financialization Americans used to buy things they couldn’t immediately afford. Amazingly, this old-as-the-hills “buy now pay later” concept is being hailed as an innovation, and the companies “pioneering” it are attracting Silicon Valley-level capital. Consider: