from Zero Hedge

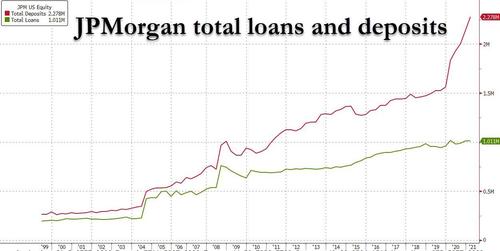

There was a remarkable disclosure in the latest JPMorgan earnings report: the largest US bank – an entity that historically has best been known for making loans to the broader population – reported that in Q1 its total deposits rose by a whopping 24% Y/Y and up 6% from Q4, to $2.278 trillion, while the total amount of loans issued by the bank was virtually flat sequentially at $1.011 trillion, and down 4% from a year ago.

In other words, for the first time in its history, JPM had 100% more deposits than loans, or inversely, the ratio of loans to deposits dropped below 50% for the third quarter in a row after plunging in the aftermath of the covid pandemic: