Fury Gold Mines (Ticker: FURY) CEO Michael Timmins and SVP of Exploration Mike Henrichsen explain the significance of the recently announced 6.04m hit of 11.56 g/t gold step-out hole at the Eau Claire deposit located in the Eeyou Istchee Territory in the James Bay region of Quebec. CEO Mike Timmins stated “Our first set of drill results confirm the potential of this underexplored area of the deposit and supports our overall goal of increasing scale and defining more gold at Eau Claire”…“We are very pleased with the productivity and pace of the program and are excited to continue drilling out the lower areas of the deposit, as well as the down-plunge extension.”

Click Here to Listen to the Audio

Sign up (on the right side) for the free weekly newsletter.

TRANSCRIPT:

Bill Powers: Thank you for tuning into Mining Stock Education. I’m your host, Bill Powers and in today’s show, we are going to be getting an update from Fury Gold Mines. Joining me today is Michael Henrichsen. He is a structural geologist and leads the Fury technical team, as well as the president and CEO, Mike Timmins. Gentlemen welcome to the show. Mike, you put out some excellent results recently at your Eau Claire project that show the expansion potential here, please walk us through these results, and what is the significance?

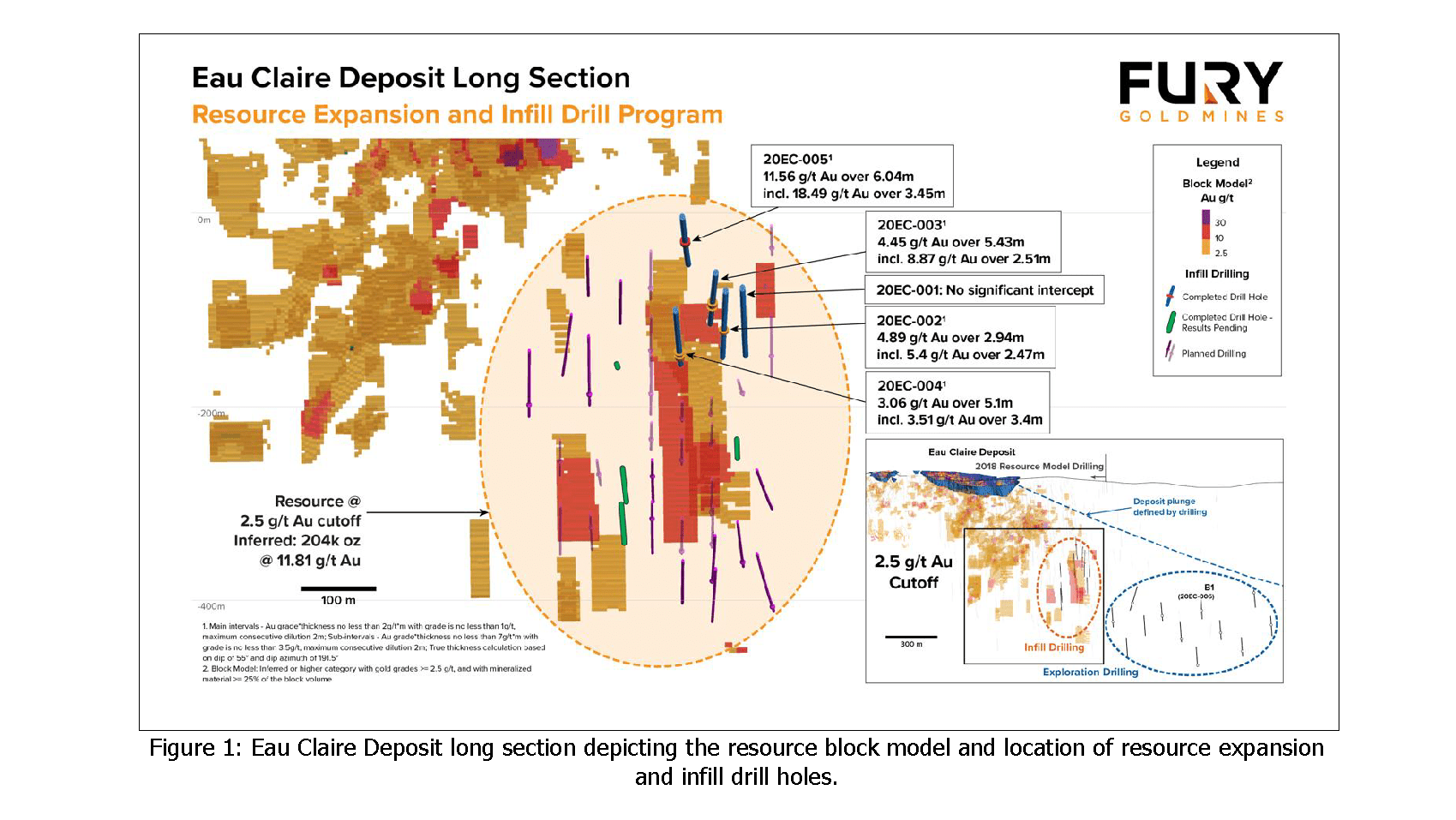

Mike Timmins: Thank you, Bill. And thank you for having us. You’re right, we recently put out some news on the first five holes of the deposit drilling at our Eau Claire project in the James Bay region of Quebec. And as Mike is obviously going to share with us further in the interview, this isn’t your typical infill program. And what we’re focused on is adding ounces around the current resource by drilling adjacent to the mining blocks that Eastmain had in the PEA and/or stitching together some of these outlier blocks in the lowest Eastern margin of the resource.

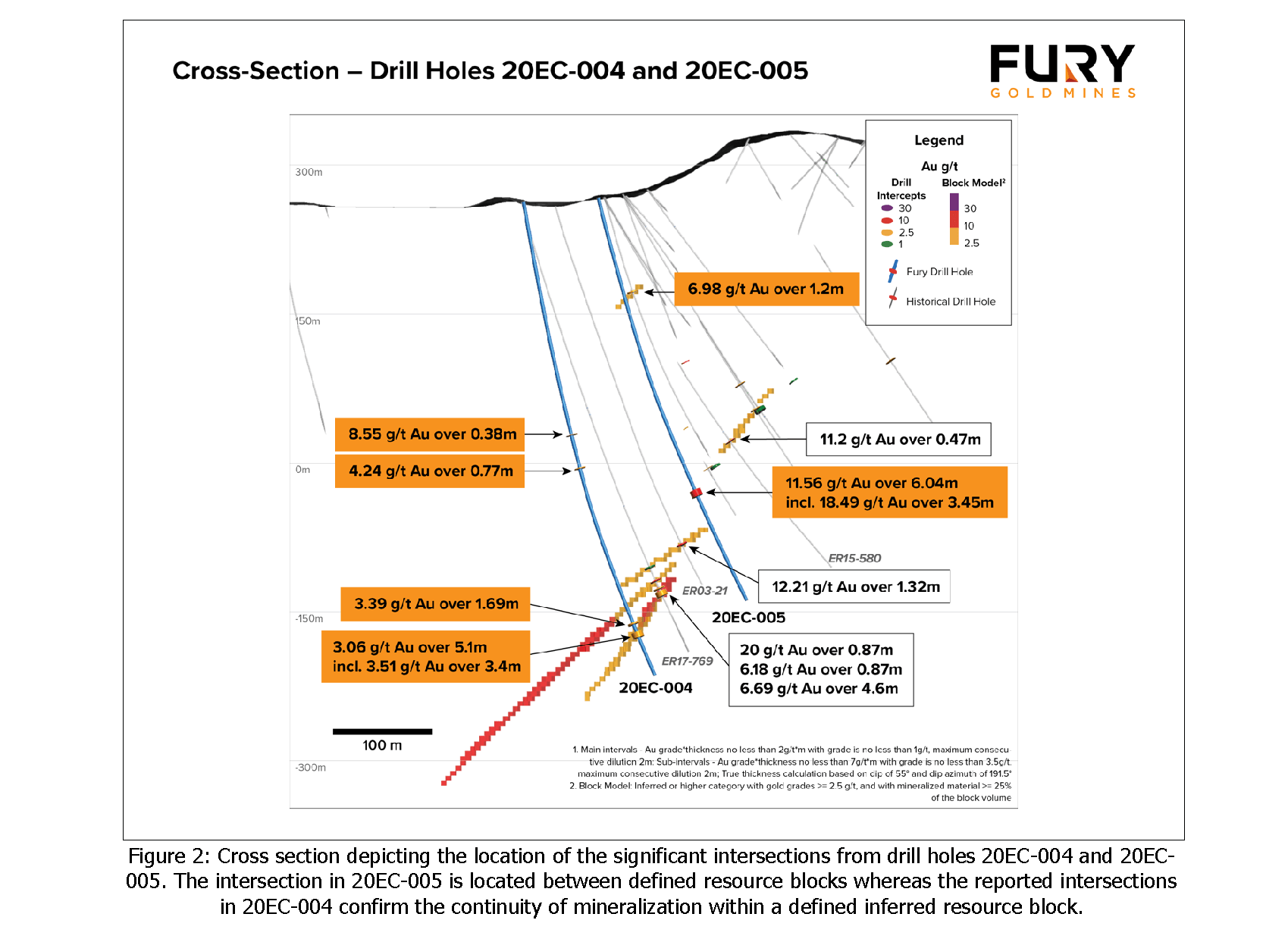

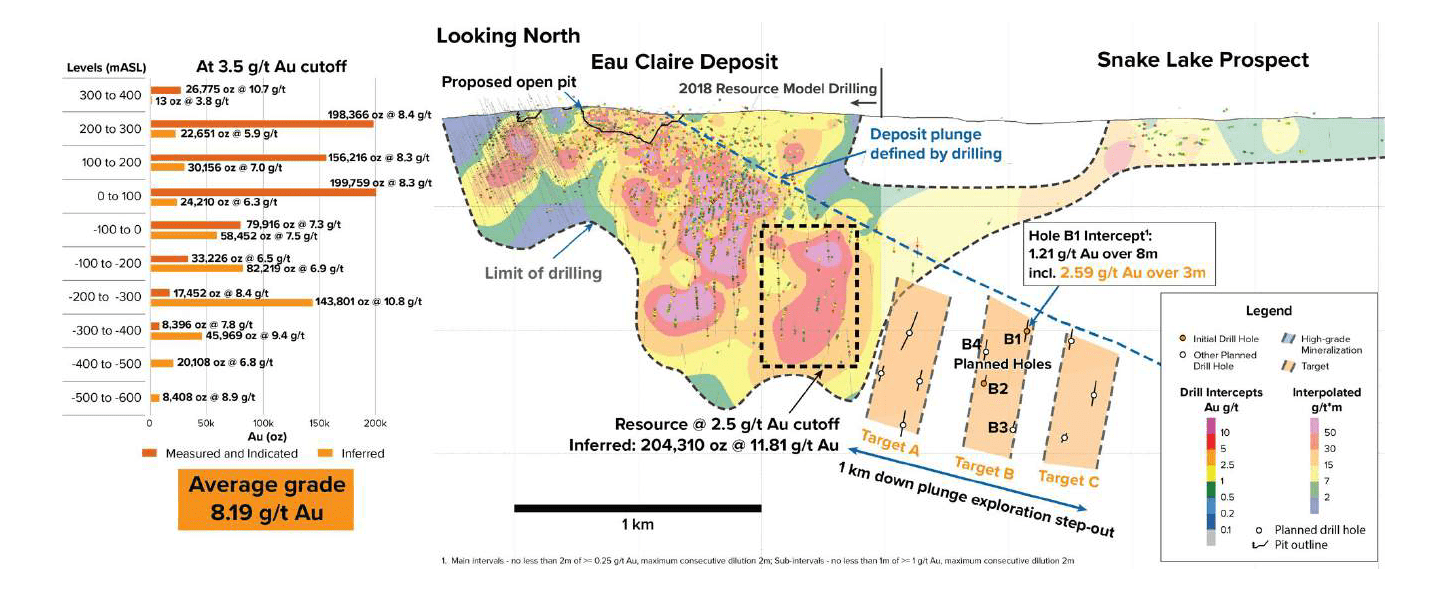

The highlight is obviously the six meters of 11 and a half grams per ton gold, outside of the known resource. Personally, I take that result, and then I put it together with the B1 step-out hole that we hit structure at, 660 meters away from the deposit down-plunge. We put that news out a couple of weeks ago. To us that demonstrates and confirms the high quality of the deposit that we have at Eau Claire and it really goes a long way to support the goal of increasing the scale of the potential mining situation here, back to your point.

Bill Powers: Michael Henrichsen, are there any surprises here with these results or are these in line with your expectations?

Michael Henrichson: No. I think obviously we were happy with the widths of six meters of 11 and a half, that was nice to see for sure. But obviously it’s behaving very well. And what I say by behaving, gold deposits can be very erratic. For us, we came in, we drilled these five holes, we increased the overall footprint of the resource because we were drilling outside of those resource blocks. And ultimately when you go back and you look at 270,000 meters through a deposit, you can statistically say what it should be doing. And it did precisely that if not a little bit better.

So we know we’re in a good part of the deposit. We know that it’s going to behave very well. Even when we did do one infill hole, we had saw a good continuity of mineralization. So our confidence levels are growing, but more importantly, our confidence levels in the actual resource expanding are growing. And we just expect to continue to do this over the next several months.

Bill Powers: And how do these results affect the future expansion drilling that you had planned? Are you just going to go as you planned or are you re-interpreting that as a result of this?

Michael Henrichsen: Yeah, certainly re-interpreting, I think that’s fair to say. Ultimately when you start hitting good gold grades outside of your known resource, you want to keep doing that, right? And so we’ve adjusted our plan to basically not drill within any defined resource blocks, just drill outside of them, get this biggest footprint as possible on the deposit as soon as we can.

And also when you look at that down plunge extension as well that Mike was talking about, our confidence levels, now that we’re drilling nice holes right on the fringe of the resource, sure looks good to continue down plunge immediately, right? So we’re rejigging things in our minds, but from a technical perspective, we’re very happy with what we’re seeing right now.

Bill Powers: When would we expect an updated resource as a result of the ongoing program? About 18 months from now or what are we looking at?

Michael Henrichsen: I think ultimately when you put out a new resource you want to really kind of understand the dimensions of what you’re dealing with. And because we’re in this sort of zone of growth and exploration, it really depends on what the drill bit does. For instance, if a kilometer away all of a sudden we’re stepping and we’re hitting, that’s going to mean a lot of drilling for us to do and that’s a good problem to have obviously, but that would obviously probably delay your updated resource a bit. That’s a problem I hope that we have. Ultimately when we put a new resource out, we want to really be showing, “Hey, this thing is going to get much bigger.” So, hard to put a timeline on it. It’s drill-result dependent. But Mike, comments from your side?

Mike Timmins: I would echo that. I was going to say, it’s going to take two or three campaigns and that will be results-dependent. So I’m thinking end of next year at the earliest, likely the following year.

Bill Powers: And then on the heels of that, perhaps new economic studies if the goal is still production in 2025?

Mike Timmins: Yeah, that’s a good question too. The first technical update from us, the big milestone for Eau Claire will be an updated resource. And again, that’ll be results-dependent in how we decide to scale that. And then very shortly after that, so within a few quarters after that we would look to put out a PFS, yes. So the idea is to really unpackage the 2018 PEA into its modules and move those along at the same time that we’re doing this drilling.

We have our goal internally of what we want for Eau Claire. And so if we just move ahead technically with the environmental, a lot of the project development stuff, the geo-tech, and some of the metallurgical work that we want to do, we can have that larger scenario in mind. And it’s actually the same kind of work. You just do a little bit more of it, when you do it you take a small nuanced approach to getting all that work done. And so we’re going to do that anyway in the background, so that by the time we surface with the new technical report, we’ll be well on our way to delivering the next technical report for Eau Claire. I don’t like telling people that we’re fast tracking things because when guys in the mining space say they are fast-tracking, that means they’re not doing something. But I think if you can do as many work streams as you can in parallel, that’s a good thing for the project and a good thing for investors, because you’ll always be coming out with the next thing.

Bill Powers: And the next thing would be drill results, right? Is that what we should expect?

Mike Timmins: Yeah. So we have four additional infill holes as well as three step-out holes from our panel B step out in the lab. We just completed the first hole of A panel of our step out, so that’s kind of a 200 meter deposit offset down plunge, and we’re currently drilling hole A2 and C1. And the C panel that Mike alluded to is a good 800 to a thousand meter step-out panel, which is exciting, or it can be terrifying, it depends on who you ask. But we’re a mature enough group to be able to shoulder those expectations and that little elevated technical risk in order to really demonstrate and capture value for shareholders.

I think we can expect more drill results to be released kind of mid to late March timeframe after which we anticipate news, I would say from Eau Claire, coming fairly consistently for the next several months to Mike’s point, which will in our view transition very nicely into announcements and results coming out of Homestake and Committee Bay.

Bill Powers: Michael Henrichsen, Is there anything more you want to say about the potential here?

Michael Henrichsen: Well, I think what our investors can expect from us is they can expect resource growth because that’s looking very good to us based on our initial press release here, but you also can expect us to take those bold swings and try and get that game changer going. And that’s what kind of sets us maybe apart a little bit, we’re willing to take those risks as Mike said. But we’ve got a great project and that allows the technical group to say, “Hey, let’s go for it. We see that as potential.” And I think that’s something I want to convey to everybody. We do have a great project and that allows our technical group to be a little bit more aggressive, to see what ultimately Eau Claire will become, but we’re very happy with the start we’ve had.

Bill Powers: Mike Timmins, final question for you. How is the market perceiving Fury? And what more, if you could choose one thing, would you want the market to understand?

Mike Timmins: I think in the market needs to understand the positioning and really what we’ve done here. We’ve assembled the right people with the right assets, I think in the right time of the market. We’re expecting gold to do well over the next three, five, seven year timeframe and we’re putting together a focus team and a focused work plan on high-grade gold assets in Canada. And I think that moving ahead and certainly if gold is your thing you want to be well positioned.

So we think our shareholders are well positioned, it’s trading much better in the last month or so than it has been in the first few months because a lot of the emotion now has gone out of the stock, and people are really looking at what are the ingredients here? What’s the game plan? Quality of management and quality of their plan moving forward. So I think that’s the most important thing that I think potential shareholders should be looking at when they do their A/B comparisons.