QC Copper and Gold (TSXV:QCCU & OTC listing coming in Nov 2020) CEO Stephen Stewart provides an overview of the company’s under-the-radar Opemiska copper discovery which investors can currently buy at a virtual $0 enterprise value. QC Copper and Gold has a current market cap of about C$10M yet also has current cash and owned securities of about C$10M. Therefore, Stephen explains: “So if you add those two figures together, basically our working capital brings our EV to zero. So that means you’re getting this project for nothing, what I think is perhaps one of the most interesting copper and gold exploration plays in a mature district like Chibougamau, Quebec. You can invest at a virtual zero enterprise value with QC Copper and Gold today.”

Click Here to Listen to the Audio

The Opemiska project is an at-surface copper discovery in Quebec which QC Copper and Gold is about to initiate a 20,000m drill program on to further define and delineate the deposit. Stephen explains: “So back in 2019, we drill tested it. We put 3,500 meters into the ground. It returned 13 holes, over a hundred meters of ore-grade copper right near surface in an open pit. We had 2.5% percent copper over 75 meters. It was my personal favorite hole. My second favorite hole was 1% copper over 160 meters and that’s right at surface, literally that was three meters down in the hole so that means open pit. That all goes to say, we’ve already found this deposit. Now, our next task is delineating it, so systematically drilling it out and proving to the market and to everybody that this is X tons at Y grade with Z strip ratio. That is our objective right now, and we are going to get to that in Q1. We’re just coming out with a 20,000-meter drill campaign that we’ll put on the first made in 43-101 resource…And then, we’ll put economics on it.”

0:00 Introduction

2:10 Genesis of $QCCU and how’d you access your shares?

3:45 OTC listing coming in November 2020

4:05 Bullish copper thesis

7:38 $QCCU has yet to run up like the copper majors

9:05 “We’ve found this deposit…right at surface.”

12:02 “You can invest at a virtual zero enterprise value with QC Copper and Gold today”

14:00 Current treasury and planned 20,000m drill program

15:27 Who will buy this deposit?

19:00 Are you spreading yourself too thin?

21:02 Market-cap one year from now?

21:58 $QCCU owns 44% of Baselode Energy

TRANSCRIPT:

Bill Powers: Welcome back to Mining Stock Education. I’m your host, Bill Powers. Today we have a new company profile interview today and it’s QC Copper and Gold. QC Copper and Gold which is part of the Ore group that is led by Stephen Stewart. The Ore group is a sponsor of Mining Stock Education and we’ve previously profiled two companies within this group, Baselode Energy as well as Orefinders in the past few months, so this is the third company in the group. Stephen Stewart is at the helm of this company as well as being at the helm of Orefinders Resources. So Stephen, welcome back on to Mining Stock Education and thank you for joining me again.

Stephen Stewart: Bill, it’s great to be here. Of course, we’re a proud sponsor, a big fan of your show. I listen to every episode.

Bill: Thank you. Well, let’s start off with the beginning. What is the history of QC Copper and as a manager and CEO of this company, how did you access your shares?

Stephen: Well, as a manager, how did I access my shares? Let’s start there. I bought every single share cash either on the market or in a private placement, zero free shares in this company and the same holds true for every company that I and my group are involved with. So our interests are aligned with shareholders first and foremost, I think that’s critical. How we acquired the Opemiska Project which is QC’s flagship and how QC came to be, it was a spinoff of Orefinders Resources which is another company we spoke about before. That happened in 2018, where we dividended out our shares in what was then a private company and gave a distribution to Orefinders’ shareholder.

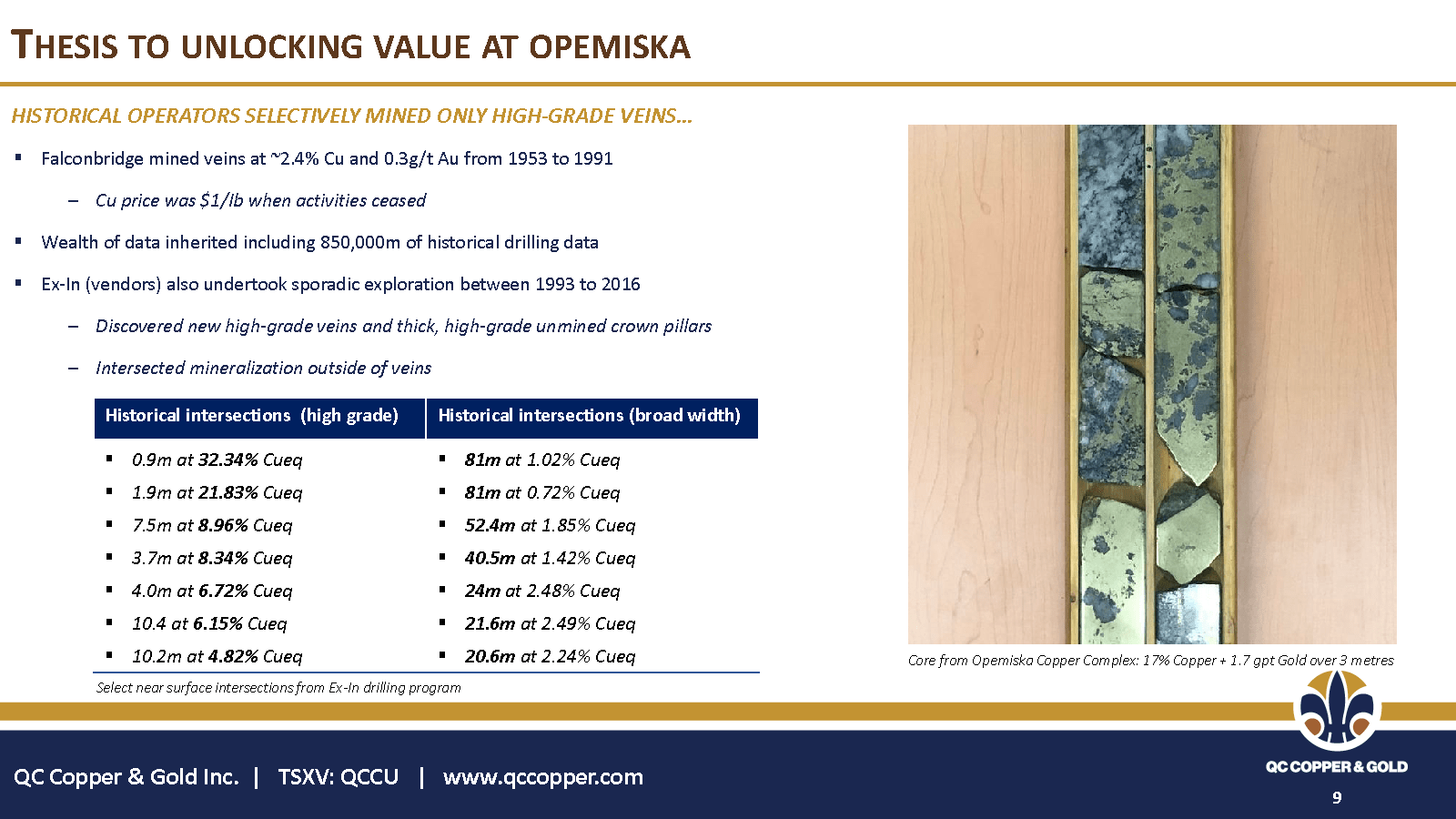

So they got free shares in QC. I’ll note that QC used to be at the time was called PowerOre. It had a different asset but ultimately, we created this brand new listing on the Toronto Venture Exchange as a vehicle to acquire what’s called the Opemiska Copper Mine Complex which is the former producer, former Falconbridge, world-class mine that produced 1.4 billion pounds of copper, nearly a million ounces of gold in the Chibougamau district of Quebec. And so, that is our focus now and we’re ready to go. The time for copper is here.

Bill: Stephen, the listing on the TSXV is QCCU. Website is qccopper.com, for people to find more information. But I see that you don’t really have the OTC listing up and running yet?

Stephen: Not yet. That’s a priority. I think two weeks away, and we will have our full listing to give exposure for US investors of which there are many.

Bill: Okay. When we talked about Orefinders, obviously you are very bullish on gold as am I. So because this is a copper focus junior, let’s hear your bullish thesis for copper please.

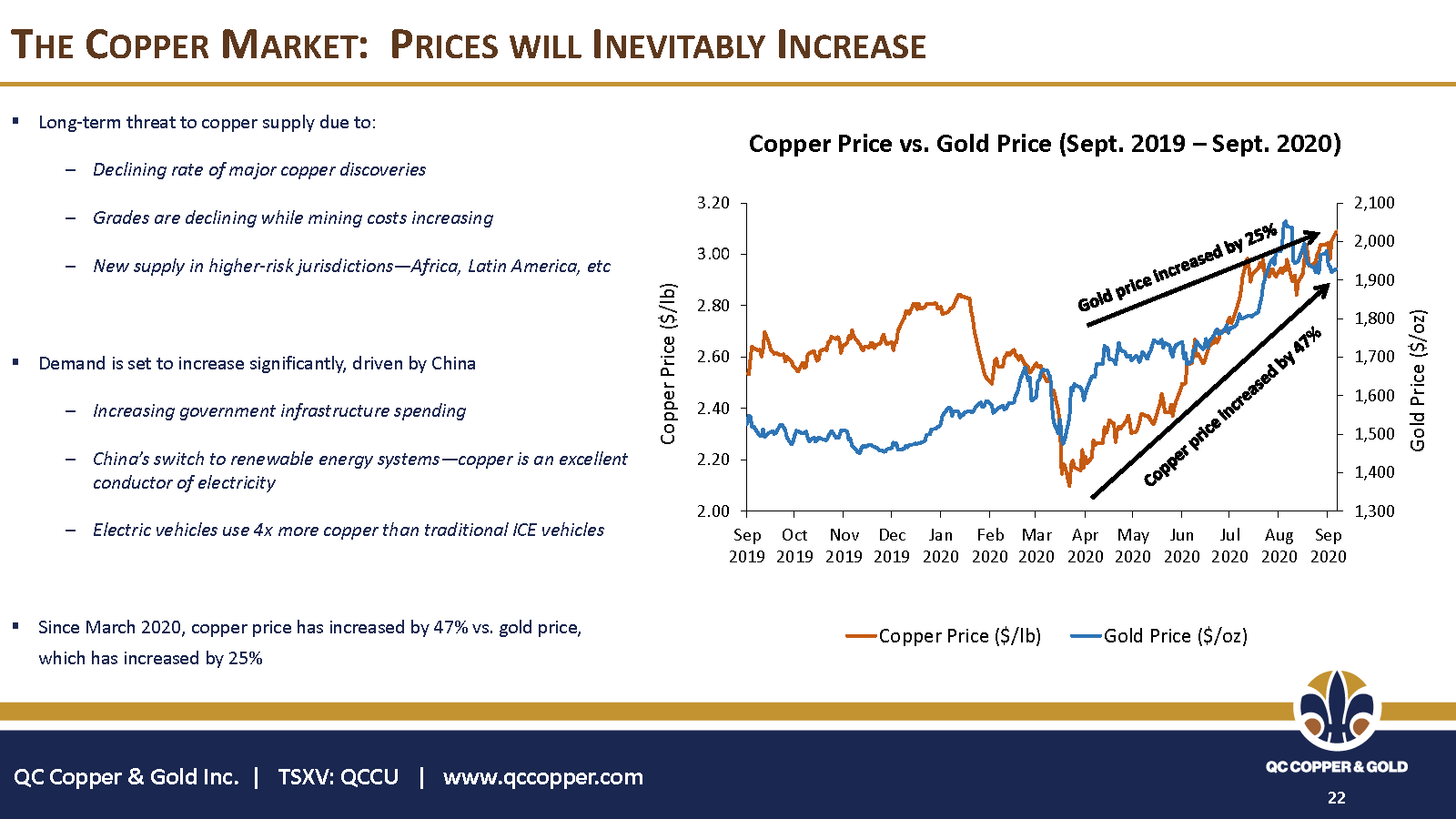

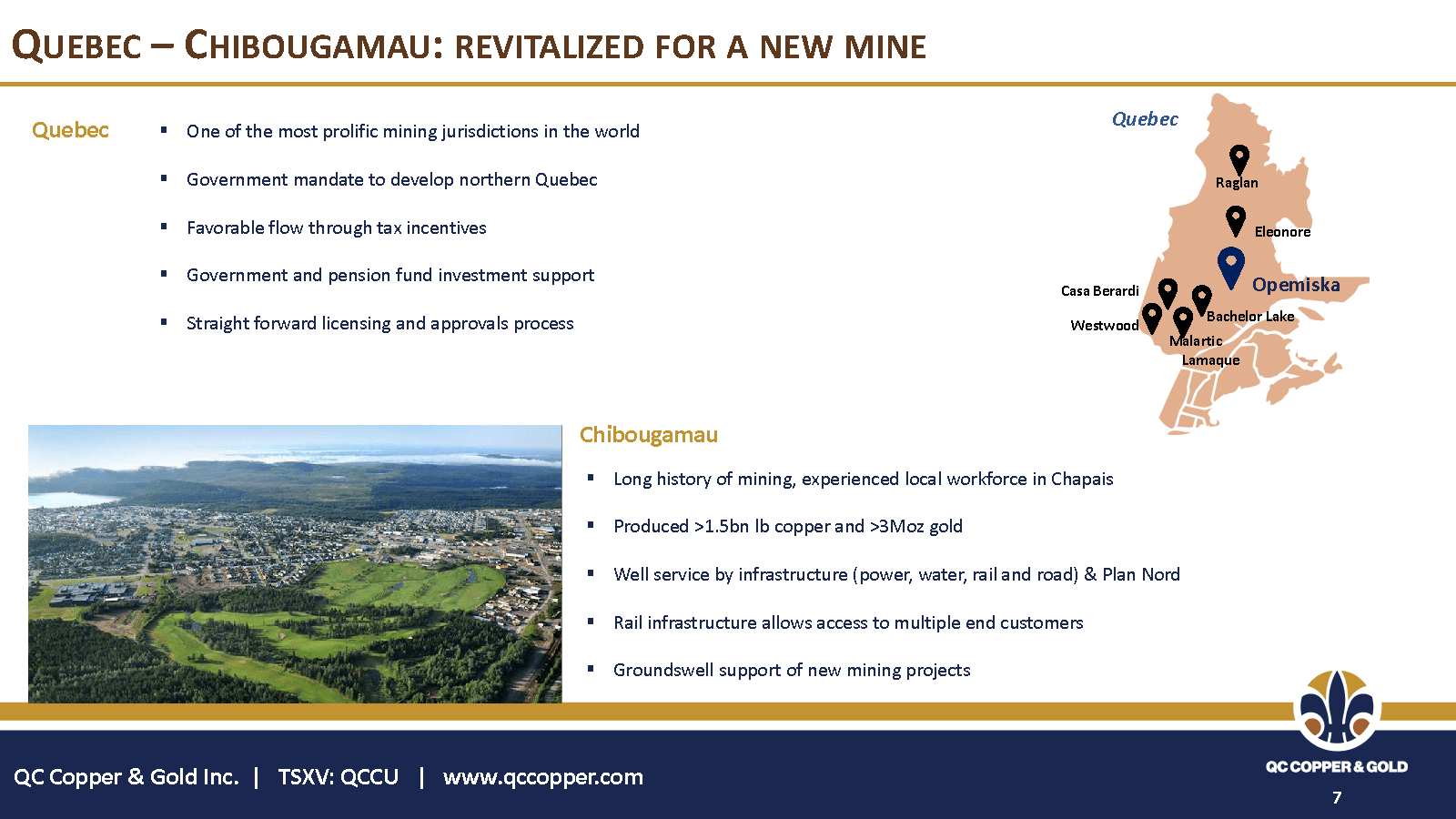

Stephen: Well, certainly. I’ll mention I am a gold guy and this has gold in it, hence their name QC, stands for Quebec, Copper and Gold but it really is a copper rich story. And my thesis about copper is it goes to the macro. Let’s talk about the supply demand aspects. When you look at the supply, where copper has come from historically to this day, the vast majority of it comes from Chile, Escondida, Chuqui, these are 70 year old huge open pits that used to be mining 1.5 grams as recently as 10 years ago, that those grades have been halved. They’re below 0.7 grams. They’re still big deposits but they’re getting so expensive and old to operate. And eventually, they’re going to run out. And so, there’s a real supply issue. There are a few really fantastic new copper deposits coming online but investors will quickly find out those deposits are in really risky jurisdictions.

So there’s this lack of pipeline of quality copper in really good jurisdictions. Of course, we’re in Quebec, which is I think tier-one across the board, the place you want to be. That’s my supply argument for why we want to be in copper. And then of course, you have to consider the demand. Copper is really the most versatile metal there is. It obviously behaves very differently from gold. It’s really an industrial metal. It is the industrial metal. People call it doctor copper because it correlates with the economy. And so, if the economy is doing well, copper is doing well. Now, is the economy going to be doing well in the next 12 to 24 months? Well, I mean there’s a huge unknown with COVID and of course the election going on, but ultimately I think it comes down to infrastructure.

So even if main street isn’t doing well, what I think is going to happen is in order to get us out of this debt quagmire, meaning the massive amount of money printing that’s going on in the United States and across the world. It’s not just the United States, it’s everywhere. In order for us to get out of that and resolve ourselves and get back to productivity, okay? Not just free money, but productivity, we’re going to have to build the infrastructure, the roads, the bridges, the highways, the ports, buildings, you name it, a new deal of sorts. In fact, I think it’s probably going to be called the Marshall Plan Part Two, not to get sort of doom and gloom about it, but I think that the United States and the Americas as a whole really needs to focus on infrastructure and copper is a major, major input for all of these things.

And then of course, we can take it to the next level and amplify the demand expectations from copper for this EV expectation. It doesn’t go into the battery, but what it does, it connects point A from point B. So if it has an on or an off switch, it’s got copper. We really think that copper has a very, very bright future. It has struggled over the past two years, largely because of the trade war. And then COVID took it down to $2/lb. Earlier in March, but it’s rallied and the Chinese are just consuming it voraciously. They can’t get enough of it because they’re in recovery mode. They’re trying to eat the lunch of the West, so to speak, and they’re building and they’re buying as much raw copper as they can. They driven the price up to $3.15 this week.

But what we haven’t seen is the junior exploration companies like QC Copper really react. Okay, so the guys that are producing the copper, they see that extra dollar of margin flow to their bottom line instantly. The Freeport’s of the world have performed great. Look at their stock chart, but there is a lag when it comes to the exploration companies like QC Copper. It takes a while for that benefit to trickle down to us. Really, it’s about interest as we do not produce it, we look for it. But as Freeport gains in momentum and share price people make money, then they start to think about where are they going to replenish their supply? And they start to look up the supply chain and then slowly go look at us.

The exact same setup, so this is what I call the junior exploration lag, it takes anywhere from 6 to 12 months. We saw it with gold, exact same setup happened. It’s already happening with copper. We’re seeing, I mean QC is up not insubstantially over the last few months. Our contemporaries are doing the same thing, but really what you hear is the narrative. I mean, just listen to what people are saying, guys like yourself, people on TV, copper really is coming into the forefront and that just drives sentiment, which is so powerful in this industry.

Bill: You’re an early stage exploration company seeking to discover and develop a copper deposit in Quebec. That’s what the QC stands for. But when I look at a junior, I always try to assess what’s the fundamental valuation relative to the market cap. So can you talk to us about your cash, securities and your known resource relative to your current market cap?

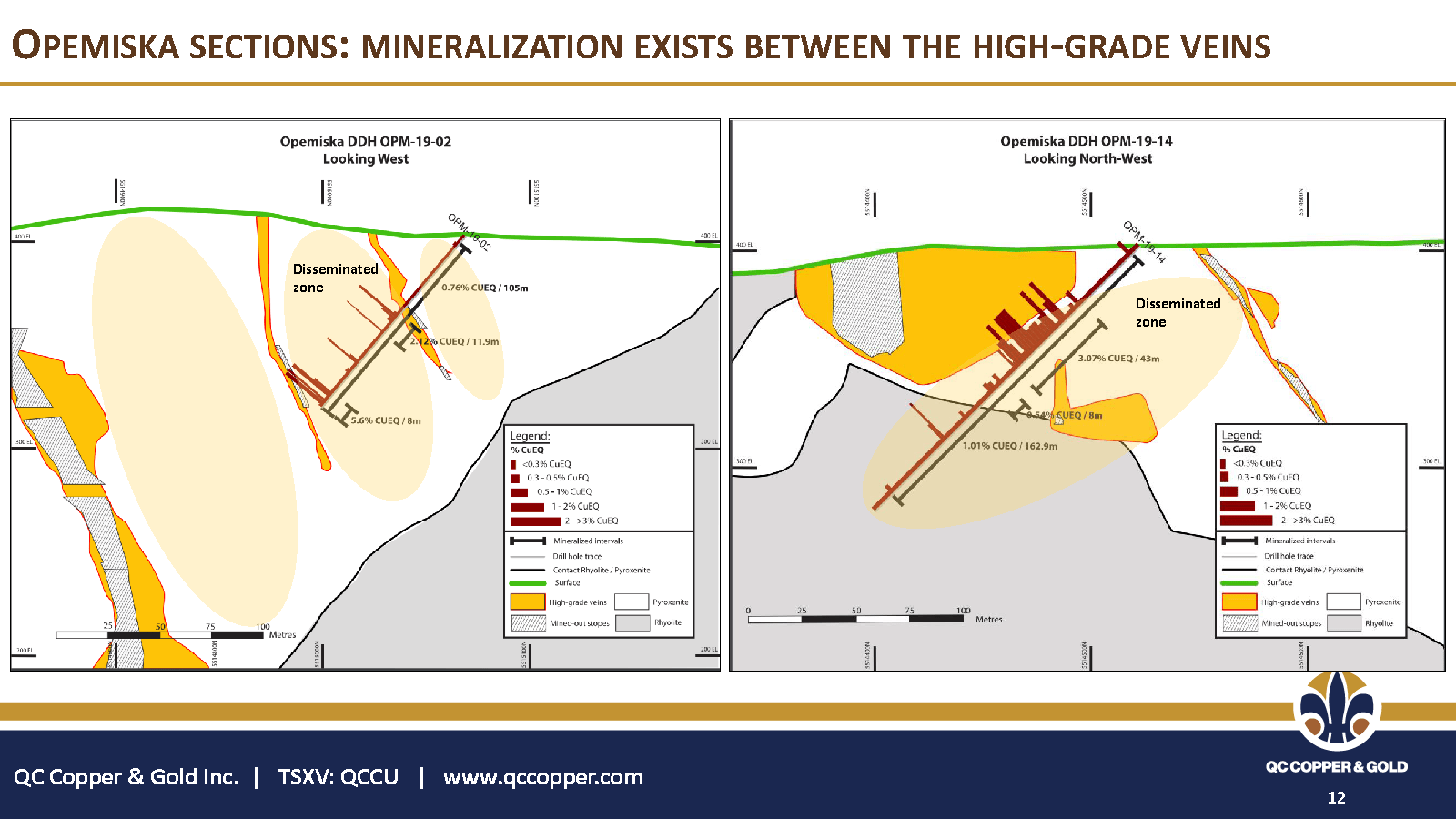

Stephen: Well, absolutely. Let me make a quick point. We’ve found this deposit. It’s right there. And in fact, before I get into our balance sheet, which I think your listeners are going to be excited to hear about, this deposit used to be a high-grade vein type deposit. Okay, so they were mining underground. And Falconbridge, who is now Glencore were producing out of there for 50 years and they had a phenomenal database which we acquired, digitized, and we saw something. We had a new idea and that was that the copper existed outside of these veins. So it’s what’s called a disseminated deposit. The real kicker was that this all happens close to surface. We had an idea that we could turn what was a high-grade underground mine into an open pit. This open pit is right on the rail, right on the road, access to power.

And so, we saw that in the data but the data isn’t always real. So back in 2019, we drill tested it. We put 3,500 meters into the ground. It returned 13 holes, over a hundred meters of ore-grade copper right near surface in an open pit. We had 2.5% percent copper over 75 meters. It was my personal favorite hole. My second favorite hole was 1% copper over 160 meters and that’s right at surface, literally that was three meters down in the hole so that means open pit. That all goes to say, we’ve already found this deposit.

Now, our next task is delineating it, so systematically drilling it out and proving to the market and to everybody that this is X tons at Y grade with Z strip ratio. That is our objective right now, and we are going to get to that in Q1. We’re just coming out with a 20,000 meter drill campaign that we’ll put on the first made in 43-101 resource. We’re obviously going to utilize the Falconbridge data and leverage that in this 20,000 meter program as well. And then, we’ll put economics on it.

Everybody wants to see how big is this, what’s the NPV, what’s the IRR, does this make sense? We think it does. Our goal, a forward-looking statement is we think we can take this to the hundred million ton range at one percent copper. If we do that, you do the math, that’s a million tons of copper. Copper’s trading right now at around 7,000 US dollars per ton. That’s $7 billion in gross metal. It doesn’t mean that’s what it’s worth. Obviously, you got to build, you got to extract, you have operating costs but that’s a great top line to aim for. That’s our objective. We’ll see if we get there.

To answer your question that you had, the other part of your question was of course, our cash and our balance sheet. What does that look like? First I’ll state that we are a $10 million market cap company. We barely exist, so the opportunity for investors to get at close to the ground floor is here, I would say. If you’re looking for a junior that has not run, take a look at QC Copper and Gold. That’s what I would say. In terms of where our capital situation is, we have approximately $1.8 million in cash so we’ve got cash. We’re not rich, but we’ve got cash to operate. And what we do have, what I think is unique is that we have about almost $8 million in shares of another company called Baselode Energy.

You mentioned you talked to Baselode CEO, James Sykes, QC Copper vented off about six, seven months ago, vendor a non-core asset. Okay. So this has nothing to do with our Opemiska project. It wasn’t our focus. We were paying no attention to it. We sold it to Baselode for what was about a million dollar valuation. We’ve turned that into about $8 million in Baselode shares. That speaks to the corporate level transaction that our group has become quite well known for. And so, that is not cash of course, but those are real shares. Baselode is led by a fantastic guy. And if he’s successful in his thesis, and Baselode has got about three and a half million dollars of cash, and it’s going to be drilling in December. If that’s successful, well that 8 million dollars could turn into who knows. I won’t make any prognostications, but we’re going to sit tight and see what happens with James.

So if you add those two figures together, basically our working capital brings our EV to zero. So that means you’re getting this project for nothing, what I think is perhaps one of the most interesting copper and gold exploration plays in a mature district like Chibougamau, Quebec. You can invest at a virtual zero enterprise value with QC Copper and Gold today.

Bill: At $1.8 million Canadian, how far will that take you with the plans of drilling in the economic study?

Stephen: Well, if you drill with the … Hundred dollars a meter is really the sort of back of the envelope there. That will not take us to the full 20,000 meters. So 20,000 meters at a hundred bucks, that’s 2 million bucks, so we’re a little bit shortfall there. So investors can expect us to take in capital at some point in the future. We raised a million dollars about five, six months ago. The whole purpose of that was to give me patience. I believe in timing and timing is so important in the juniors. We don’t like to force anything. In the last year, we haven’t been drilling because copper has been out of vogue. Okay, so I want to be drilling when copper is in vogue and we’re just at the cusp.

Our share price is getting up. I’m sensitive to our cost of capital. When it’s appropriate, investors can expect us to go and dip a toe into the market. Finance us completely up to the level that we can execute our 20,000 meter drill program. And then of course, we have all sorts of other optionality plays including things like Baselode that may or may not come into play but I think that it’s important to note that our group, you mentioned the Ore group, we’ve raised close to $20 million over the last six or seven months. Clearly, we have access to capital. There’s a ton of interest in QC. So the money is there when we want it. It’s just a question of timing and at what cost?

Bill: Stephen, this isn’t a massive porphyry deposit in Chile or Peru but a hundred million tons at 1% copper is nothing to sneeze at. Talk to us about what type of company would buy such a project, because that’s your exit strategy is ultimately to sell this project.

Stephen: That’s the best way for any junior company and its investors to make money, if you want my opinion is to sell. Guys such as myself and many of my contemporaries, although there are exceptions, never built a mine. And so, I think that’s the best way to execute. So ultimately, that is my goal is to delineate and de-risk something that it becomes attractive to probably a mid-tier producer. I never like to shut any doors, but you’re right. It’s not a porphyry deposit which would be attractive to a mega major like a Rio Tinto or a BHP. But you know what? I don’t want to be a porphyry deposit. Maybe you can get a billion tons of ore in a copper deposit, which is nice, but their grades are 0.3%. And then they come along and they take forever to drill out. They’re super high risk. The capital required to drill at a porphyry is just so high.

And then when it comes time to build it, you’re looking at 1, 2, 3, $5 billion. That’s not what we are. That’s not what we want to be. Where a nice, small … Small is not the right word, but we’re a nice tight package. We’ve got high grades. Okay, so grade is King. We think that our grades stand up to nearly anybody in the copper space. And then of course, I think the bonus is when we have delineated or open pit and define our tons and grade, we’ve got the infrastructure there. Literally, the Canadian, the CN Railway comes right to our property. There’s a hundred, if not a billion dollar line item that is not required to be built. We’ve got a paid highway running through the property. We’ve got an airport 15 minutes away, power to site. We’ve got a very sophisticated mining community labor. That’s very important when we’re drilling this.

And before we start building anything, when we drill it, our drillers go home at night. There’s no camps. When I quoted a hundred dollars per meter to drill, that’s where we are. If we didn’t have these infrastructure advantages, you can be 2, 3, $500 a meter. This project, given it’s in a mature area of Chibougamau has so many advantages and that’s what initially attracted us to this project. And I’ll mention that above and beyond the Chibougamau district or our Opemiska project, which is really the anchor in the district, there are other deposits there. So that, potentially, if we and I believe in consolidation, bigger is usually better in the mining industry.

And so, if a larger company, even somebody like a Rio or a BHP wanted to come in there with an eye to consolidate, okay, so you could really pick up all sorts of deposits in and around what’s called the Gwillim fault, which is the regional controlling mineralized structure. That’s how I see it, so I never like to count anybody out who could acquire us. I think all sorts of producers, small, big, and super big will be interested in domestically produced copper, especially in light of what we’ve seen in the policy responses to COVID. I think everything’s, and particularly the supply chain, is going to come a lot closer to home.

Bill: Stephen, one question about your involvement in QC. You’re the CEO but you’re also involved in all of the other Ore group companies as well as Orefinders. I’m very impressed with your entrepreneurial ambition, but then the question also comes up as an investor, is he spreading himself too thin? Could you please speak to this?

Stephen: Sure. Well, no. I don’t think I am. I think I give equal attention to all my children, so to speak. The most important thing is the team. It’s not just me running this. The other companies all have a technical team behind it. Orefinders and Mistango, those are operating right now. I’ve largely handed the keys over to our technical team, Keith Benn, who’s focused on executing our drill program. They want me nowhere near that drill program at this point in time. Trust me, I’m not a geologist. Same thing for QC Copper and Gold. The keys are in the hands of Charles Beaudry who just put out a really great webinar yesterday detailing the technical plan. Charles is the mastermind behind the geology. The Ore group really does have a team that I rely so heavily on, the primary tasks.

What I bring to the table are my ability, my network. Okay, so I raise the money. That is my primary responsibility so that my team can go out and execute. That’s what Charles is going to do. He has his vision. Charles is the one that deserves the credit for identifying this disseminated feature that this deposit has. Very few deposits are actually disseminated, but it’s not … We didn’t invent the wheel either. This model has been very successfully executed most famously with Osisko and their Malarctic deposit, the exact same principle and not too far away. So Charles saw that same sort of potential and then came to me. We raised the money. I raised the money with him behind me to go and execute his thesis. We did that with our drill program to prove it’s disseminated. Now, we got to go finish the job.

Bill: Stephen, one year from now a forward looking statement, if you’re successful with these plans you’ve laid out, what’s the market cap going to be?

Stephen: Well, I look at some of our peers who are 50, 100 million dollar market cap. We’re a 10 million dollar market cap. Okay, so I see companies that are trading 5 to 10 times us with a lesser asset, certainly lesser than the targets that I’ve mentioned before. We certainly hope to meet those. If you go to our presentation, I think it’s on slide 18, we list a lot of the comparables there. We’re at the bottom of the list. We’re sub $10 million market cap. And then we list a whole slew of companies going up to 50 million tons, and some of them are $500 million. Now, that is a forward-looking statement. I’m not saying we’re going to be a $500 million market gap but maybe we are, maybe we won’t, but there’s quite a ladder for us to climb in terms of creating value for shareholders.

Bill: One follow-up question on Baselode. I am a Baselode shareholder which I didn’t disclose in my last interview with James. Because after I produced the interview, I said, “I need a piece of this.” So I did invest in the private placement. So as a Baselode shareholder, should I have any concern that you own 44% of the company and how would you possibly unload those shares?

Stephen: Well, no. I wouldn’t be concerned at all. I wear two hats in the sense that I’m not looking to rob Peter to pay Paul, so to speak. QC is a long-term shareholder. We’re not interested in liquidating $8 million worth of shares if we could. That’s not all that liquid. That company is not all that liquid certainly to do that. We’re in this for the big score. We take risk adjusted bets. We bet on people. We bet on theses, on the commodity, and then we bet on a plan. I am not selling any shares. My personal shares in Baselode nor is QC Copper for the foreseeable future. I want to see … I mean, James has discovered, been a key member of three uranium deposits. He’s 40 years old. I am betting that he’s going to find a fourth, fifth, and sixth, and I’m going to hitch my wagon to him when he does and benefit financially. And I expect QC will do the same.

Bill: So the name is QC Copper and Gold, but almost could be as we speak, QC Copper, Gold, and Uranium couldn’t it?

Stephen: With a uranium kicker, sure. Why not?

Bill: There you go. So you’re getting exposure to, of course, copper and uranium. The website again is qccopper.com. For Canadian investors or those that can invest internationally on the Venture Exchange in Toronto, you can find it under the ticker QCCU. And for US investors, in the works is that OTC listing that you’ll find very shortly. Stephen, as always, a great presentation. Orefinders owns 9% of QC Copper, we should mention, so I do have exposure to QC Copper and Gold via my Orefinders shares, but thank you for this overview.