by Rick Ackerman

RickAckerman.com

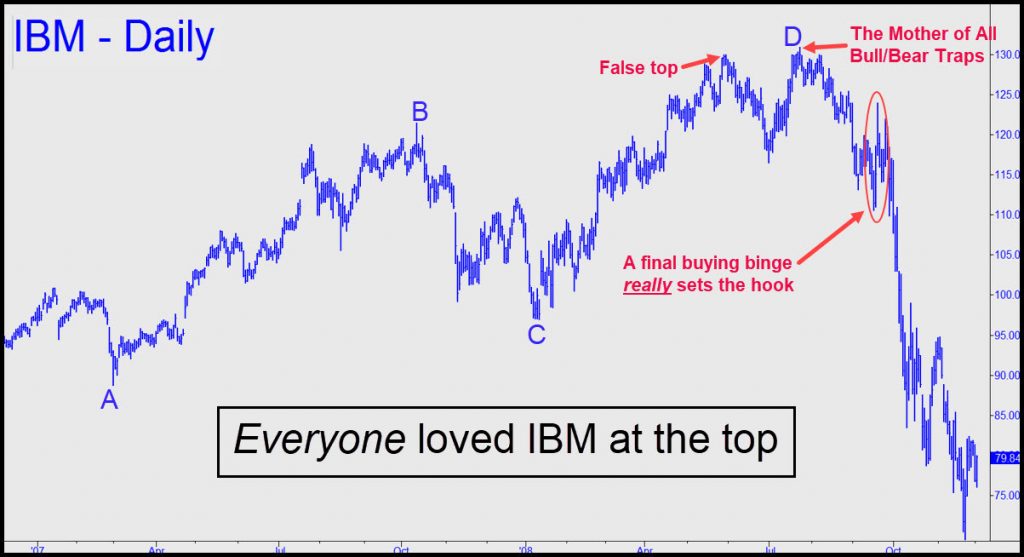

AAPL topped last week within a hair of an important rally target at 135.98, prompting this headline atop last Thursday’s commentary: “Is This the Start of the Big One?” If so, it is long overdue. Valuations are worse, even, than at the height of dot-com mania, led by vertical spikes not only in AAPL, but in the shares of Tesla, Amazon, Chipotle, Google, Facebook and a few other world-beaters. Portfolio managers have thrown a mountain of Other People’s Money at a relative handful of stocks that are deemed likely to flourish in these economically challenging times. The geniuses keep dumping more and more money into the same few stocks because they evidently are clueless about what to do next. This has caused the value of some big companies still doing brisk business during the pandemic to soar into the hundreds of billions of dollars, or even into the trillions. Crazy.

AAPL topped last week within a hair of an important rally target at 135.98, prompting this headline atop last Thursday’s commentary: “Is This the Start of the Big One?” If so, it is long overdue. Valuations are worse, even, than at the height of dot-com mania, led by vertical spikes not only in AAPL, but in the shares of Tesla, Amazon, Chipotle, Google, Facebook and a few other world-beaters. Portfolio managers have thrown a mountain of Other People’s Money at a relative handful of stocks that are deemed likely to flourish in these economically challenging times. The geniuses keep dumping more and more money into the same few stocks because they evidently are clueless about what to do next. This has caused the value of some big companies still doing brisk business during the pandemic to soar into the hundreds of billions of dollars, or even into the trillions. Crazy.

Throughout the mania, we’ve focused more on AAPL than on any other stock simply because it is the one stock that no portfolio manager can be without. Under the circumstances, if a forecaster gets AAPL right, he invariably gets the stock market right. Rick’s Picks has succeeded well at this, remaining foolishly bullish against all common sense and wisdom. But last week’s sharp selloff, coming at a time when most investors were already getting antsy about valuations, has many wondering whether it will mark the end of the party or just a healthy correction.