by Robert Hughes

The American Institute for Economic Research

Fallout from Covid-19 and government policies of lockdowns and restrictions continue to wreak havoc on the economy. While much attention is focused on measures of activity and labor market conditions, new data from the Federal Reserve highlight critical developments for the financial side of the economy.

Fallout from Covid-19 and government policies of lockdowns and restrictions continue to wreak havoc on the economy. While much attention is focused on measures of activity and labor market conditions, new data from the Federal Reserve highlight critical developments for the financial side of the economy.

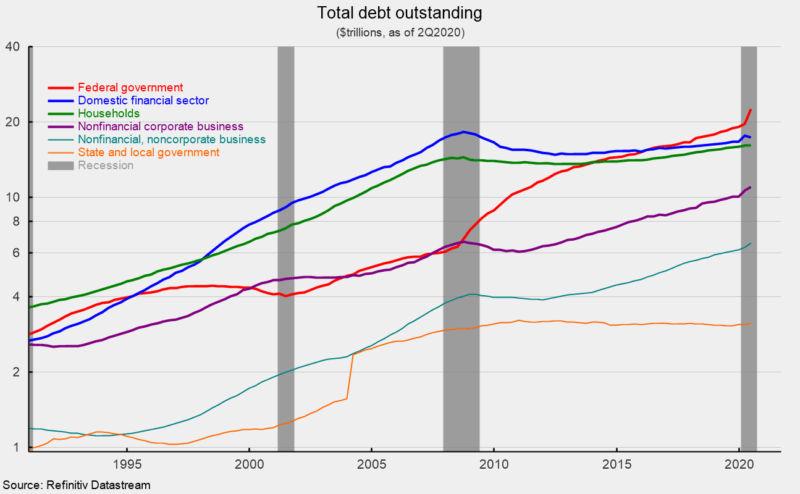

The two most striking points from the second quarter Flow of Funds data are the surge in debt growth for the federal government and nonfinancial corporate sectors and the rebound in household net worth. Total debt across the entire economy rose to $59.3 trillion as of the second quarter. The increase was led by the federal government which saw a jump to $22.5 trillion from $19.6 trillion at the end of the first quarter, a rise of almost $3 trillion or about 15 percent (see first chart). That follows a 2.8 percent gain in the first quarter. From a year ago, federal government debt is up 21.9 percent and since the end of 2015, debt has surged 48 percent. The federal government now accounts for 37.9 percent of all domestic debt outstanding, a record high.