by Steve St. Angelo

SRSRocco Report

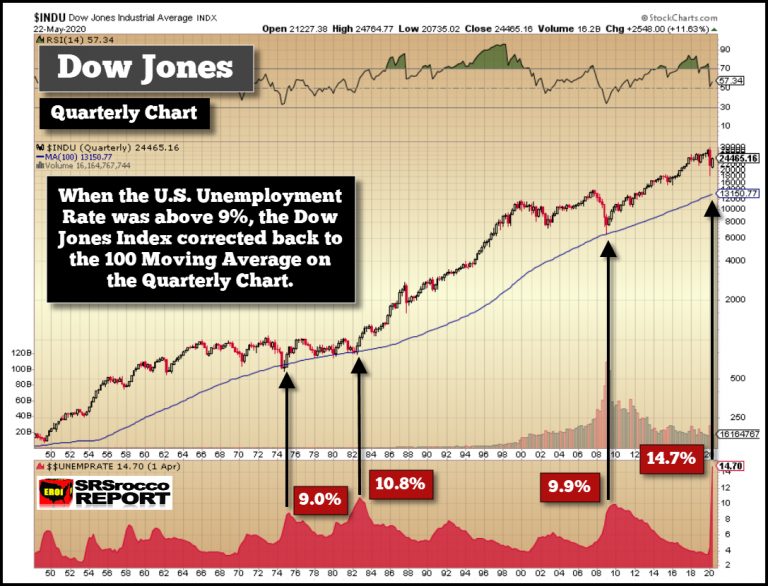

Even with the highest unemployment rate in more than 80 years, the U.S. Stock Market continues higher regardless of the lousy economic data and fundamentals. However, without the massive money printing and liquidity injections by the Federal Reserve, the stock market indexes would be substantially lower.

Even with the highest unemployment rate in more than 80 years, the U.S. Stock Market continues higher regardless of the lousy economic data and fundamentals. However, without the massive money printing and liquidity injections by the Federal Reserve, the stock market indexes would be substantially lower.

Unfortunately, the Fed is now forced to prop up the markets because stock markets have now become the economy, instead of the other way around. With the total U.S. Equity Market Cap to GDP Ratio now nearly 140%, it is more than double the 68% mean average for the past 70 years. And, if we look at the markets back in the 1950s, it took 24 years for the Dow Jones Index to double from 500 to 1,000.