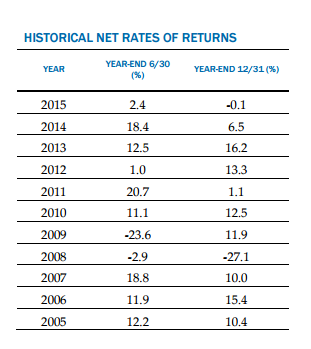

Weakest return since 2008-09 financial crisis.

from My Budget 360

The two largest public pensions in the U.S. are Calstrs and Calpers and collectively they oversea $484 billion for public workers in California. Pensions have a hard time surviving in a low return world. For example, these pensions seek out a 7.5% annual return which is simply unrealistic to do in a market that is volatile (by definition, markets are meant to be unpredictable). Not only is the market volatile but we find ourselves in a low return environment. Pensions trying to seek out guaranteed returns are going to have a tough time finding a sure bet when bonds are producing such a low return. Unfortunately these guarantees become contractual and the shortfall needs to be closed by the taxpayer. It is no surprise that pensions have become a rarity in this market. The 401k model of investing was supposed to help workers transition from this guaranteed return to a more market based approach. The only issue with that is most people never save on their own and make bad investment moves. When you are dealing with high frequency traders and other advanced investment techniques, the regular family stands no chance. Recently Calpers posted a dismal return, the worst since the 2008-09 financial crisis.

The two largest public pensions in the U.S. are Calstrs and Calpers and collectively they oversea $484 billion for public workers in California. Pensions have a hard time surviving in a low return world. For example, these pensions seek out a 7.5% annual return which is simply unrealistic to do in a market that is volatile (by definition, markets are meant to be unpredictable). Not only is the market volatile but we find ourselves in a low return environment. Pensions trying to seek out guaranteed returns are going to have a tough time finding a sure bet when bonds are producing such a low return. Unfortunately these guarantees become contractual and the shortfall needs to be closed by the taxpayer. It is no surprise that pensions have become a rarity in this market. The 401k model of investing was supposed to help workers transition from this guaranteed return to a more market based approach. The only issue with that is most people never save on their own and make bad investment moves. When you are dealing with high frequency traders and other advanced investment techniques, the regular family stands no chance. Recently Calpers posted a dismal return, the worst since the 2008-09 financial crisis.