by Norman Mogil

Sober Look

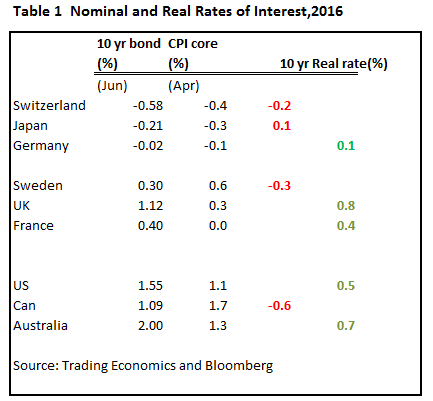

Over the past month, the global bond markets have been sending out signals that all is not well with the global economies. Initially, the surge in negative nominal rates in Europe and Japan rattled many investors in both the fixed income and equities markets. This historic development suggests that large-scale investors are anticipating low growth and disinflation for many more years. Simultaneously, the yield curve, especially in the US, has been flattening, again signalling that growth is slowing, giving the policy makers considerable pause in their deliberations on the course of future interest rates. This blog examines both these developments to help the reader understand the signals coming out of the bond markets around the world.

Over the past month, the global bond markets have been sending out signals that all is not well with the global economies. Initially, the surge in negative nominal rates in Europe and Japan rattled many investors in both the fixed income and equities markets. This historic development suggests that large-scale investors are anticipating low growth and disinflation for many more years. Simultaneously, the yield curve, especially in the US, has been flattening, again signalling that growth is slowing, giving the policy makers considerable pause in their deliberations on the course of future interest rates. This blog examines both these developments to help the reader understand the signals coming out of the bond markets around the world.