by Michael J. Ballanger

The Gold Report

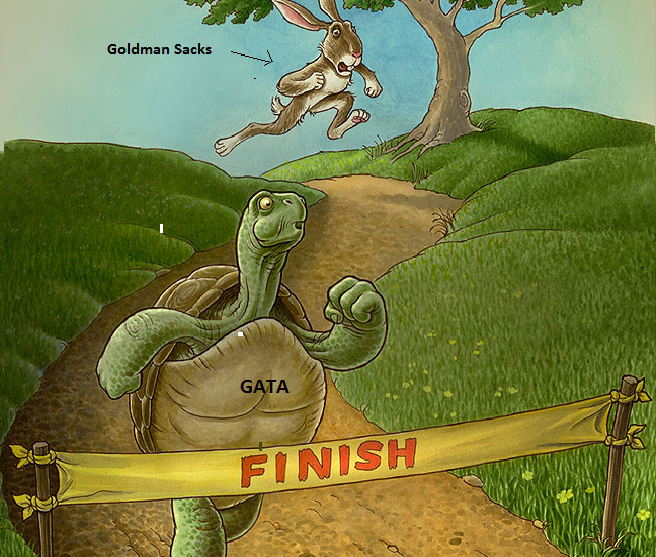

Precious metals expert Michael Ballanger believes we are in the very early stages of an absolutely breath-taking bull market in mining stocks and the precious metals, but like the famous Aesopian fable, sometimes it’s the tortoise that wins the race by simply plodding along and exercising patience and a tad of caution.

Over the weekend, I wrote an essay entitled “Patiently Climbing Aboard the New Golden Bull,” in which I stated that not only are we in a new bull market in precious metals, but also I pegged my long-term target price for gold at US$7,189/oz, which, at a gold-to-silver ration (GTSR) of 50, implies a longer-term silver price of $143/oz.

Over the intermediate term, I see a move up to the $1,450/oz range, albeit not without a great deal of backing and filling and accelerated volatility. That sounds wonderful, doesn’t it? You can just back up your Ford 150 and load it to the brim with gold coins and wafers and senior mining shares and why not buy a few million shares of a 5-cent penny dreadful because, after all, don’t we all agree that “there’s no fever like gold fever,” and fifty-baggers are a walk in the park. Right?